KOA’s Toby O’Rourke: ‘More People Camping than Ever Before’

Toby O’Rourke

Toby O’Rourke, CEO and president of Kampgrounds of America Inc. (KOA), kicked off the Canadian Camping & RV Council‘s (CCRVC) Canadian Outdoor Hospitality Conference & Expo Feb. 15 with a keynote that focused on different tailwinds and headwinds impacting the outdoor hospitality industry.

Click here for more coverage of CCRVC’s Canadian Outdoor Hospitality Conference & Expo.

The data O’Rourke shared gave a sneak peek into the 2023 North American Camping Report, which is commissioned by KOA and has quickly become a go-to resource for industry data.

She started her keynote by lauding the growth of camping over the past few years.

“There are more people interested in camping than ever before,” O’Rouke said. “Campgrounds are having strong years, even record-setting years. Even with all that is going on in the economy, KOA has seen strong year-over-year growth the past 10-12 years.”

O’Rourke pointed to KOA’s registration revenue since 2011 as an indication of how the industry as a whole is performing.

“I share our numbers, because I have access to that data, obviously, but I think it’s pretty reflective of how the whole industry is doing,” she said. “Our Canadian portfolio had a huge year in 2022. It’s kind of a year behind what we saw in the U.S., because in Canada, as you know, you had two years of restrictions, particularly in the spring, which impacted business. As you look at what happened last year, in our Canadian KOA portfolio, our occupancy and our nights were up 7%, which drove our registration revenue up 14.5%.”

O’Rourke introduced the idea of tailwinds (positive trends) and headwinds (negative trends) that impacted the industry.

“What factors or conditions are going to slow our growth this year, and cause negative effects?” she asked. “Or what is going to push us forward, and accelerate where we can go? In some cases what might seem like a headwind can switch very suddenly and definitely turn into a powerful tailwind. I think we have a few of those to consider, as well.”

She noted that the economy is the most talked about headwind, noting that the Canadian economy did see slowing growth, and some economists are wondering if the country might experience a mild recession.

“I am definitely not an economist or an expert on the economy, but I think it is important that we consider the impact that increasing inflation or rising interest rates could have on leisure spending,” O’Rourke explained. “According to our research from just a few weeks ago, 66% of Canadian campers said inflation had an impact on their camping and travel plans last year.

“That’s not surprising, because in the heart of the summer season, inflation was at its highest point in 40 years, at 8%,” she added. “Now when all these prices are increased across the board, that really impacts discretionary spending. Even if you take into account things like food, we’ve seen large increases in food costs, up 11% at the end of last year. That impacts what people can spend on things like travel or on purchasing RVs.”

Pivoting to the RV industry, O’Rouke told attendees that she thought the economy presents a formidable challenge for the RV industry as shipments declined 15% in 2022.

“That decline is expected to continue this year,” she said. “They are expecting shipments to be down 21% this year versus last year.

“That all being said, there is some normalization that is happening here,” O’Rourke added. “We had some big year where a lot of people were camping or buying RVs for the first time, so this normalization is expected to some degree, but headwinds from the economy can still impact discretionary spending.”

O’Rourke highlighted that she also thought the economic issues presented some tailwinds as well, noting that people who own RVs are going to want to use their investment and that more may use their RVs during an economic downturn.

“Forty-four percent of Canadian RV owners said they will take the same number of trips or more, instead of others, during an economic downturn,” she said. “Forty-seven percent of Canadian campers believe camping offers a more cost-friendly way to travel.

Toby O’Rourke noted KOA registration data during her presentation.

“People are going back to airlines and prices are starting to come down, but they’re still significantly higher than they were at this time last year,” O’Rourke continued. “In December, airfare was 28.5% percent of where it was in December 2021, so it’s very expensive to take air travel. We do see those people, particularly those that own RVs, opting for a driving vacation instead. And in fact, we asked Canadian campers, and 24% said they would cancel other trips that they have planned, and replace it with camping if the economy continues to lag.”

O’Rourke also highlighted the stress relief benefits of camping and the sense of normalcy it provides during tough times.

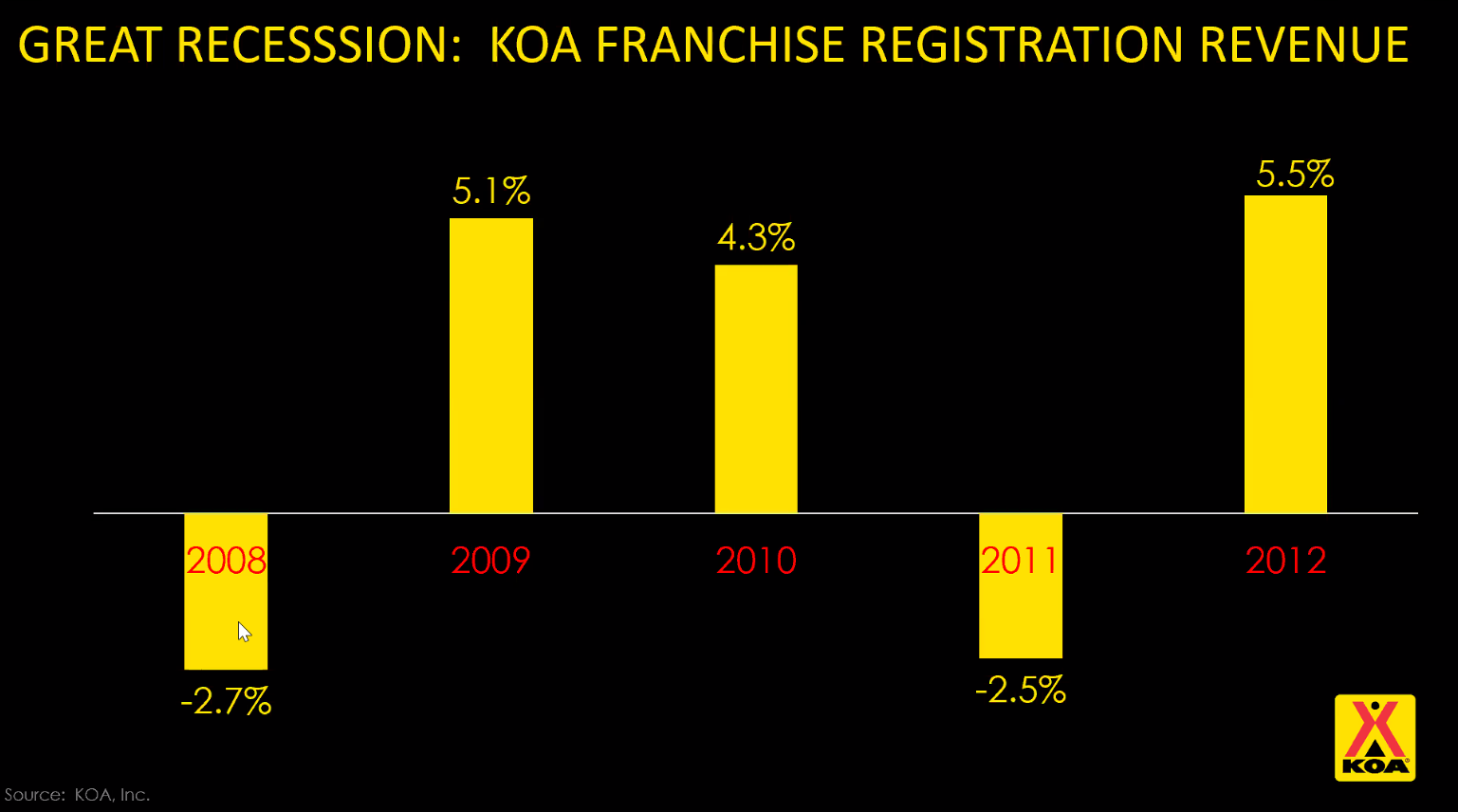

She also noted how KOA fared during the Great Recession in 2008, which lasted 18 months. She pointed out that the KOA system was down slightly (2.7%) in 2008 when compared to 2007, but that there was a strong rebound in 2009 (up 5%) that continued into 2010 (up 4.3%). There was a small dip in 2011, but things came back strong again in 2012.

“Over the course of that five years, the business actually grew 9.7%, and that was right at the tail end of that recession,” O’Rourke explained.

Other key points that O’Rourke highlighted:

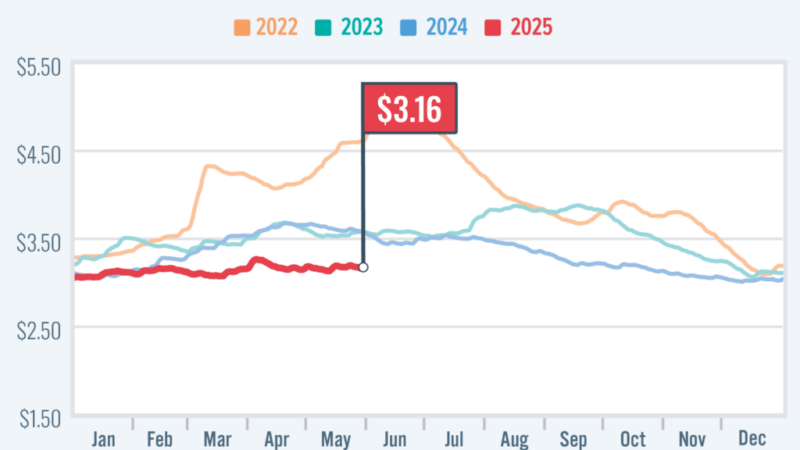

- Gas Prices: “When gas was at really high record levels, only 6% of cancellations for KOA business was cited as due to gas. We didn’t see the big impact on business that we expected as those prices continued to rise.”

- COVID Impact: “I think it’s important we do think about what sort of lasting effects we might have from COVID that’s still impacting our business. 13% of our Canadian business in 2019 was from the U.S. and last year it was 9%. There still might be some hesitation and confusion about crossing the border. 29% of American campers said they had concerns about crossing the border, because of COVID, specifically, or didn’t know enough about the rules and regulations.

- Nabbing Workers: “A study that was done by the Angus Reid Institute, showed that there has been an 18% decline in the number of workers in the Canadian service sector over the past two and a half years. That includes a 22% decline among 18- to 24-year-olds, which is a sweet spot for workers at campgrounds. People are shifting and reassessing where they work, or how they want to work. And that could be that they want to work remotely, they want to be closer to family, they want a job with more flexibility, and we’ve seen workers starting to look at other opportunities. We can appeal to those who already have experience in hospitality, that are reassessing right now, and who have a service mindset. We can offer them the outdoors, and that’s a really big thing that we can sell. We’re giving fresh air, campfires, and more unique ways and magical ways to engage with guests. I think that that really does appeal to people that are wanting to leave the traditional hospitality segment.”

- Site Availability: “Campgrounds have been full, occupancy is high and availability is definitely becoming an issue for campers. There’s also a solid case to be made right now for building more campgrounds and adding sites, and as you do this you need to sell the economic impact of camping. Our research showed that last year, Canadians spent, on average, $131 a day in their local communities when they camped. That was a 30% increase over the previous year. Overall, we’re showing that the total amount spent in local economies was $7.6 billion last year by campers, and that was a huge increase over the year before.”

- Camper Expectations: “This can be challenging, particularly in the business we’re in, and you have to continue to keep up. We’re an ageless, timeless activity that has a newer, younger tech-savvy generation, and we’re trying to keep up with their expectations. “If we can effectively meet camper expectations, I think that this can be a really big tailwind to keep this momentum going in the industry, and keep bringing all these new campers back to camp, and encouraging future generations to camp. 64% of Canadian campers are Gen Z or Millennials. That boomer generation is now just 11%, it came down 16 points, and this is a snapshot of what the Canadian camper looked like last year across the board.”

- COVID campers: “15 million households consider themselves campers in Canada, 66% of the total population, and 31% of households that camped in the past couple of years just started and most of them cited what was occurring around COVID as why they began camping. 16% of Canadians said that camping became their go-to choice for travel last year and 40% said it has always been.”

O’Rourke also spoke on the need for park owners to do better at rate management, the importance of marketing parks to highlight the benefits of camping, the importance of technology like Wi-Fi and EVs, and more.

Source: https://rvbusiness.com/koas-toby-orourke-more-people-camping-than-ever-before/