WSJ: Boom is Over, But RV Stocks Promise a Sweet Ride

Here’s a sweet deal: a vehicle big enough for your whole family to live in on “clearance” at 30% off the manufacturer’s suggested retail price!

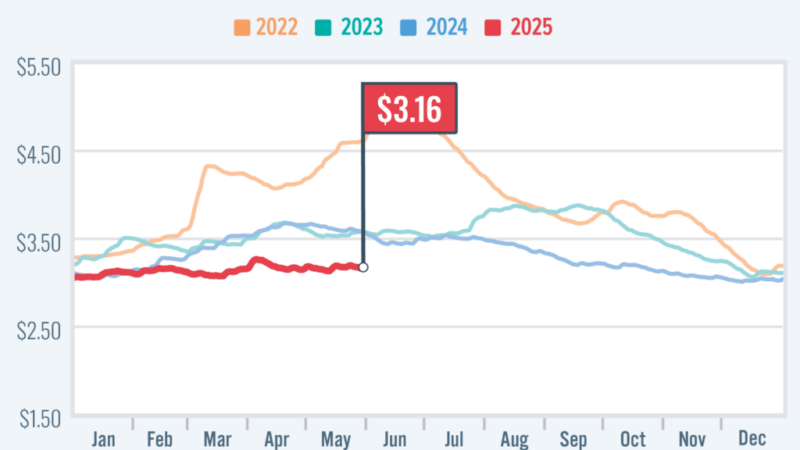

Unfortunately, that 39-foot long Thor Challenger 37FH motor home still will set you back $188,895. Even with a 240 month loan—much longer than those available to car buyers—your monthly payment would come to $1,221. Inflation means parking that recreational vehicle at a campground will cost about 30% more than it would have just a few years ago and, while pump prices are down from their peak, a behemoth that gets about 8 miles a gallon makes dealer Camping World Holdings CWH -1.22%decrease; red down pointing triangle’ “See America for Less” promotion something of a relative statement.

The RV market was already experiencing near record sales in the years before Covid-19 hit, with baby boomers retiring in droves and a younger, more diverse group of buyers embracing the seminomadic lifestyle dubbed #vanlife. Then the pandemic made living and even working on the road more appealing. Sales of new RVs almost certainly would have set records in 2020 had factory shutdowns and supply-chain constraints not been an issue.

“It was build it and they were already sold,” says Monika Geraci, a spokeswoman for the RV Industry Association.

The pent-up demand supercharged RV sales to their best year ever in 2021, with more than 600,000 new units shipped in North America. As soon as the Federal Reserve began raising interest rates last year, though, the wheels came off. Through April of this year, shipments of RVs have collapsed by more than half compared with the same period of 2022.

People who leapt into the RV lifestyle and are now making monthly payments on a depreciating asset mostly parked in their driveways aren’t the only ones with buyers’ remorse: Investors are nursing paper losses too. Shares of Thor Industries, the world’s largest RV manufacturer, are down by half from their boom-era peak. Those of top dealership Camping World Holdings are off by 45% from their all-time high. And units of real-estate investment trust Sun Communities, which owns more than 180 RV parks, are down by 40%.

While swooping in to buy a discounted RV may or may not be a savvy financial move, RV-related stocks could present a golden opportunity for investors willing to look past those ugly shipment numbers. Most RV owners don’t drive 12-ton giants with marble countertops, or even smaller motor homes—towables are about 90% of the market and were the gateway drug for pandemic newbies. Shipments for that cheaper variety are down far more sharply than for motor homes. Thor’s projected revenue this fiscal year will be well off its 2021 peak but would be a blowout record number for any period before the pandemic.

Source: https://rvbusiness.com/wsj-boom-is-over-but-rv-stocks-promise-a-sweet-ride/