Winnebago Q2: Towable Revenue Shows Modest Increase – RVBusiness – Breaking RV Industry News

EDEN PRAIRIE, Minn. – Winnebago Industries Inc. (NYSE: WGO), a leading outdoor lifestyle product manufacturer, today reported financial results for the fiscal 2025 second quarter ended March 1.

Highlights included:

- Improves Sequential Profitability, Driven by Margin Growth in All Segments

- Completes $100 Million High Yield Debt Tender, Enhancing Capital Efficiency Through Strategic Debt Reduction

- Barletta’s Share of U.S. Aluminum Pontoon Market Increases to 9.5%(1), up 140 Basis Points YoY

- Newmar Delivers its Fourth Straight Year of Increasing Market Share in Class A Diesel Segment(2)

Second Quarter Fiscal 2025 Financial Summary

- Net revenues of $620.2 million

- Gross profit of $83.1 million, representing 13.4% gross margin

- Net loss of $0.4 million, or $0.02 per diluted share; adjusted earnings per diluted share of $0.19

- Adjusted EBITDA of $22.8 million, representing 3.7% adjusted EBITDA margin

CEO Commentary

“Winnebago Industries continues to demonstrate solid performance in our strategic markets, leveraging product differentiation and sharper affordability options to maintain healthy market share in our core premium and mid-range RV segments,” said President and Chief Executive Officer Michael Happe. “We’re expanding our RV brand portfolio with new products across diverse price points, while maintaining our commitment to profitability. This strategic approach allows us to capitalize on market opportunities and positions us for sustainable financial performance as the market recovers. Our most recent example of this is the introduction of Grand Design’s Class C Lineage Series M, which has been enthusiastically received in the marketplace and highlights the demand for the brand’s innovative motorized RVs. With the latest launch of our new Lineage Class Super C motorhome, the Lineage brand is on a trajectory to achieve its $100 million-plus revenue target in fiscal 2025.”

“In our Marine segment, Barletta continues to grow its share of the U.S. aluminum pontoon market and outperform the category.” Happe said. “For the 12-month period ended February 28, 2025, Barletta achieved a market share of 9.5%, an improvement of 140 basis points over the prior-year period and placing Barletta as the number three player in aluminum pontoons.”

“Our strong financial position provides flexibility to invest in growth opportunities while maintaining disciplined fiscal management,” Happe said. “During the second quarter, we completed a cash tender offer to repurchase $100 million of our 6.25% Senior Secured Notes due 2028, and we also repurchased $20 million of our stock. Reducing our higher-cost debt and returning value to shareholders, while continuing to focus on internal investments, underscores our commitment to executing a diverse capital allocation strategy and deliver resiliency through the cycle.”

Second Quarter Fiscal 2025 Results

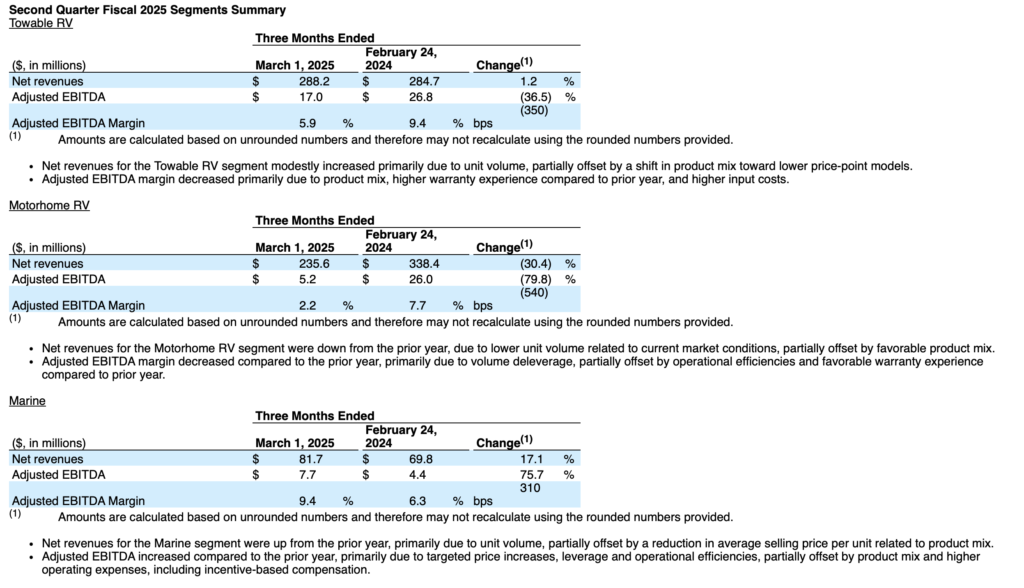

Net revenues were $620.2 million, a decrease of 11.8% compared to $703.6 million in the second quarter of last year, driven by a reduction in average selling price per unit related to product mix, partially offset by targeted price increases. Volume growth in the Towable RV and Marine segments was offset by volume reductions in the Motorhome RV segment, as dealers continue their efforts to reduce field inventories in this segment in an effort to combat higher interest rates.

Gross profit was $83.1 million, a decrease of 21.1% compared to $105.3 million in the second quarter of last year. Gross profit margin decreased 160 basis points in the quarter to 13.4% as a result of deleverage associated with product mix, partially offset by operational efficiencies.

Selling, general and administrative expenses were $69.7 million, an increase of 8.6% compared to $64.2 million in the second quarter of last year, primarily due to the mix of incentive-based compensation plans relative to performance across our businesses, and investments to support Grand Design motorized growth and also growth in Barletta.

Operating income was $7.8 million, a decrease of 78.0% compared to $35.4 million in the second quarter of last year.

Net loss was $0.4 million, compared to net loss of $12.7 million in the second quarter of last year. Reported net loss per diluted share was $0.02, compared to reported net loss per share of $0.43 in the second quarter of last year. Results for the second quarter of fiscal 2024 include a charge of $32.7 million, or $1.12 per share, attributable to the loss on repurchase of a significant portion of the Company’s 2025 convertible senior notes. Adjusted earnings per diluted share was $0.19(3), a decrease of 79.6% compared to adjusted earnings per diluted share of $0.93(3) in the second quarter of last year.

Consolidated Adjusted EBITDA was $22.8 million, a decrease of 54.2%, compared to $49.8 million in the second quarter of last year.

Balance Sheet and Cash Flow

As of March 1, 2025, the Company had total outstanding debt of $598.7 million ($609.3 million of debt, net of debt issuance costs of $10.6 million) and working capital of $438.4 million. Cash flow used in operations was $27.2 million in the fiscal 2025 second quarter. During the second quarter of fiscal 2025, the Company successfully completed its previously announced cash tender offer to purchase $100 million of its 6.250% Senior Secured Notes due 2028.

Outlook

Based on its second quarter 2025 results, and its outlook for the balance of the year, the Company is updating its fiscal 2025 outlook for sales of $2.8 billion to $3.0 billion, and for reported earnings per diluted share of $2.10 to $3.10 and adjusted earnings per share of $2.75 to $3.75(4). The Company’s outlook takes into account prevailing trends in the RV and marine sectors, including competitive dynamics, shifts in consumer preferences, dealer ordering patterns, and key macroeconomic factors, including changes to trade practices and other policies, that may influence overall demand.

“Our full-year financial outlook for fiscal 2025 is updated to take into consideration the very dynamic environment and the macro economic and sector challenges that our industry has been presented. Among these are stubborn interest rates, inconsistent consumer sentiment, and dealers that continue to push inventory levels lower, particularly in the Motorhome RV and Marine segments”, Happe said. “As we have in the past, we will continue to take a prudent approach to pacing our production and output with dealer demand. While these near-term challenges exist, we remain confident in the long-term demand landscape and the strong interest in the outdoor lifestyle that our consumers demonstrate. Our long-term ambitions and investment theses reflect confidence in the RV and marine markets’ underlying resilience as a growing number of consumers embrace the benefits of outdoor recreation. Our strong balance sheet and robust cash flows afford us the flexibility to continue investing in product innovation to drive organic growth while maintaining our commitment to direct shareholder returns through dividends and share repurchases.”

Happe continued, “While the impact of tariffs remains an active conversation with our vendors, including collaborative discussions on how best to mitigate their impact, we have included our current estimate of the net impact of tariffs in the range provided for our fiscal year 2025 outlook. This net impact includes anticipated pricing actions that may be required to offset the estimated inflationary pressures on our input costs.”

Q2 FY 2025 Conference Call

Winnebago Industries, Inc. will discuss second quarter fiscal 2025 earnings results during a conference call scheduled for 9:00 a.m. Central Time today. Members of the news media, investors and the general public are invited to access a live broadcast of the conference call and view the accompanying presentation slides via the Investor Relations page of the Company’s website at http://investor.wgo.net. The event will be archived and available for replay for the next 90 days.