Winnebago Industries Inc. Announces Cash Tender Offer – RVBusiness – Breaking RV Industry News

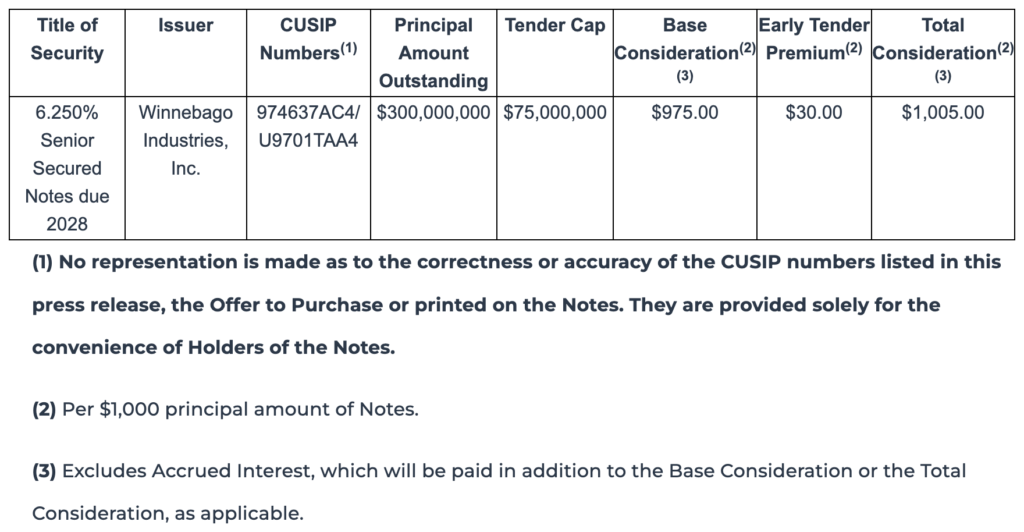

EDEN PRAIRIE, Minn. – Winnebago Industries, Inc. (NYSE: WGO), a leading manufacturer of outdoor recreation products, on Feb. 3 announced that it commenced a cash tender offer (the “Tender Offer”) to purchase its 6.250% Senior Secured Notes due 2028 (CUSIP No. 974637AC4 / U9701TAA4) in a principal amount of up to $75,000,000, exclusive of any applicable premiums paid in connection with the Tender Offer and accrued and unpaid interest. The terms and conditions of the Tender Offer are set forth in an Offer to Purchase dated Feb. 3, 2025, which is being sent to all registered holders (collectively, the “Holders”) of Notes.

“This tender offer reflects our commitment to enhancing long-term shareholder value through a disciplined capital allocation strategy,” said Michael Happe, President and Chief Executive Officer of Winnebago Industries. “By leveraging our strong liquidity position, we can optimize our capital structure while continuing to drive innovation through strategic organic and inorganic investments.”

Bryan Hughes, the Company’s Chief Financial Officer, added, “This tender offer exemplifies our proactive strategy to effectively manage leverage through the cycle via our strong cash flow generation and accumulation. We have generated strong free cash flow over time enabling us to fund organic and inorganic investments, while also returning cash to shareholders. This tender reduces our higher-cost debt and reaffirms our commitment to executing on our capital priorities in a balanced manner.”

Holders of Notes must validly tender and not validly withdraw their Notes on or before 5:00 p.m., New York City time, on February 14, 2025, unless extended (such date and time, as the same may be extended, the “Early Tender Date”) in order to be eligible to receive the Total Consideration. Holders of Notes who validly tender their Notes after the Early Tender Date and on or before the Expiration Date (as defined below) will be eligible to receive only the applicable Base Consideration, which is equal to the Total Consideration minus the Early Tender Premium, as set forth in the table above. In addition to the applicable consideration, Holders whose Notes are accepted for purchase in the Tender Offer will receive accrued and unpaid interest to, but excluding, the date on which the Tender Offer is settled. The settlement date for Notes validly tendered and accepted for purchase before the Early Tender Date (if the Company elects to do so) is currently expected to be on or about February 20, 2025, and the final settlement date, if any, is expected to be March 7, 2025.

The Tender Offer will expire at 5:00 p.m., New York City time, on March 4, 2025, unless extended (such date and time, as the same may be extended, the “Expiration Date”). As set forth in the Offer to Purchase, validly tendered Notes may be validly withdrawn at any time on or before 5:00 p.m., New York City time, on February 14, 2025, unless extended (the “Withdrawal Deadline”).

The consummation of the Tender Offer is subject to the satisfaction of certain conditions as set forth in the Offer to Purchase. The Company reserves the right, in its sole discretion, to waive any and all conditions to the Tender Offer with respect to the Notes.

If any Notes are validly tendered and the principal amount of such tendered Notes exceeds the Tender Cap as set forth in the table above, any principal amount of the Notes accepted for payment and purchased, on the terms and subject to the conditions of the Tender Offer, will be prorated based on the principal amount of validly tendered Notes, subject to the Tender Cap and any prior purchase of Notes on any day following the Early Tender Date and prior to the Expiration Date.

Any Notes that are validly tendered at or prior to the Early Tender Date (and not validly withdrawn at or prior to the Withdrawal Deadline) will have priority over any Notes that are validly tendered after the Early Tender Date. Accordingly, if the principal amount of any Notes validly tendered at or prior to the Early Tender Date (and not validly withdrawn at or prior to the Withdrawal Deadline) and accepted for purchase equals or exceeds the Tender Cap, no Notes validly tendered after the Early Tender Date will be accepted for purchase.

The Company’s obligations to accept any Notes tendered and to pay the applicable consideration for them are set forth solely in the Offer to Purchase. This press release is neither an offer to purchase nor a solicitation of an offer to sell any Notes. The Tender Offer is made only by, and pursuant to the terms of, the Offer to Purchase, and the information in this press release is qualified by reference to the Offer to Purchase. Subject to applicable law, the Company may amend, extend, waive conditions to or terminate the Tender Offer.

J.P. Morgan Securities LLC is the Dealer Manager for the Tender Offer. Persons with questions regarding the Tender Offer should contact J.P. Morgan Securities LLC at (866) 834-4666 (toll-free) or (212) 834-4818 (collect). Requests for copies of the Offer to Purchase should be directed to D.F. King & Co., Inc., the Tender and Information Agent for the Tender Offer, at (212) 269-5550 (banks and brokers), (800) 848-2998 (toll-free) or email at [email protected].