Winnebago Financial Results Reflect ‘Challenging’ Environment – RVBusiness – Breaking RV Industry News

EDEN PRAIRIE, Minn – Winnebago Industries, Inc. (NYSE: WGO), a leading outdoor lifestyle product manufacturer, today reported financial results for the company’s first quarter fiscal 2025.

Highlights:

- Overall Performance Reflects Challenging Outdoor Recreation Market Environment

- Barletta Continues to Expand U.S. Aluminum Pontoon Market Share, Driving Growth of Marine Segment

- Company Repurchases $30 Million of Shares During First Quarter

- Fiscal Year 2025 EPS Guidance Range Narrowed; Midpoint Maintained

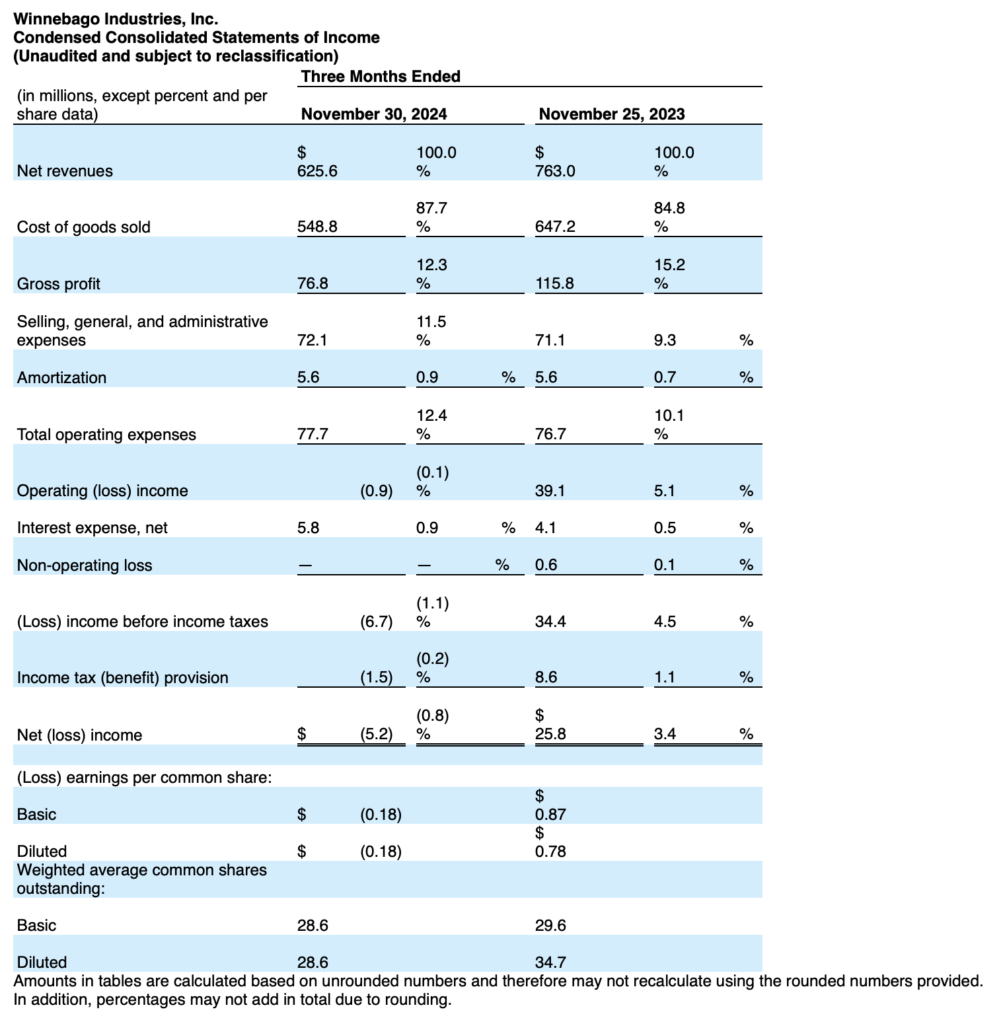

First Quarter Fiscal 2025 Financial Summary

- Revenues of $625.6 million

- Gross profit of $76.8 million, representing 12.3% gross margin

- Net loss per diluted share of $0.18

- Adjusted net loss per diluted share of $0.03(1)

CEO Commentary

“As expected, the RV and marine operating environment remained challenging in the first quarter, marked by subdued consumer demand and a cautious dealer network reluctant to make significant commitments on new orders ahead of the historically slow winter season,” said Michael Happe, President and Chief Executive Officer of Winnebago Industries. “These industry challenges highlight the critical importance of our strategic focus on disciplined production, effective cost management and targeted investments in new products and technologies. These strategies, complemented by our healthy balance sheet, prudent capital spending and robust liquidity, enhance our competitive position for an anticipated market recovery in the second half of fiscal 2025.”

“Our first-quarter results reflected lower unit volumes in our RV segments, start-up costs associated with the Grand Design motorized RV rollout and ongoing product development, and a shift in product mix as we continue to introduce new products that meet the growing consumer preference for lower price-point models,” Happe said. “We continue to transform our product portfolio across brands and segments, refining product content and features to focus on delivering what consumers truly value, without compromising quality or functionality. While revenue and margins in our RV segments were down year over year, we were pleased with the performance of our Marine segment, which delivered top-line and margin growth sequentially and year-over-year. Our Barletta and Chris-Craft brands each generated retail market share growth through October, outperforming the industry in their respective categories.”

“From an industry perspective, encouraging retail trends in October and increasing consumer confidence, combined with ongoing inventory management efforts at the dealer level, are positive indicators of strengthening demand and a more balanced market environment,” Happe said. “While the second quarter of fiscal 2025 is likely to remain challenged, we remain confident in our strong positioning and long-term growth potential. That confidence is reflected in our balanced capital allocation strategy, highlighted by the $30 million in share repurchases executed in the first quarter as part of our ongoing commitment to delivering value to our shareholders.”

First Quarter Fiscal 2025 Results

Revenues were $625.6 million, a decrease of 18.0% compared to $763.0 million in the first quarter of last year, driven primarily by lower unit volume and a reduction in average selling price per unit related to product mix.

Gross profit was $76.8 million, a decrease of 33.7% compared to $115.8 million in the first quarter of last year. Gross profit margin decreased 290 basis points in the quarter to 12.3%, reflecting deleverage, higher warranty experience compared to the prior year and product mix, partially offset by operational efficiencies.

Operating expenses were $77.7 million, an increase of 1.3% compared to $76.7 million in the first quarter of last year. This increase was primarily driven by strategic investments, partially offset by cost containment efforts.

Operating loss was $0.9 million, compared to operating income of $39.1 million in the first quarter of last year.

Net loss was $5.2 million, compared to net income of $25.8 million in the first quarter of last year. Reported net loss per diluted share was $0.18, compared to reported net earnings per diluted share of $0.78 in the first quarter of last year. Adjusted loss per diluted share was $0.03(1), compared to adjusted earnings per diluted share of $0.95(1) in the first quarter of last year.

Consolidated Adjusted EBITDA was $14.4 million, a decrease of 73.4%, compared to $54.1 million in the first quarter of last year.

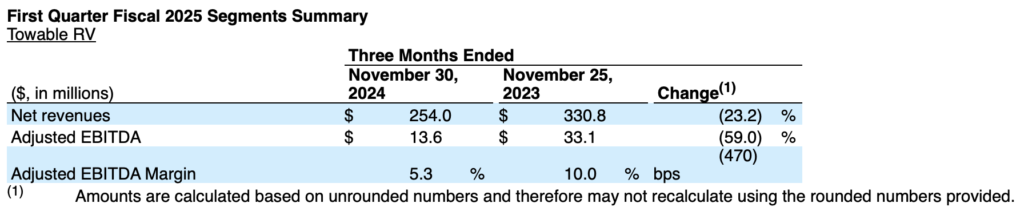

- Revenues for the Towable RV segment were down compared to the prior year, primarily driven by lower unit volume and a shift in product mix toward lower price-point models.

- Segment Adjusted EBITDA margin decreased compared to the prior year, primarily driven by volume deleverage and product mix, partially offset by cost containment efforts.

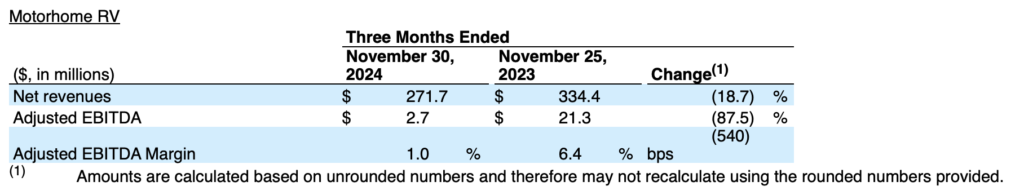

- Revenues for the Motorhome RV segment were down from the prior year, primarily due to lower unit volume related to market conditions.

- Segment Adjusted EBITDA margin decreased compared to the prior year, primarily driven by volume deleverage, higher discounts and allowances, and higher warranty experience compared to the prior year, partially offset by operational efficiencies.

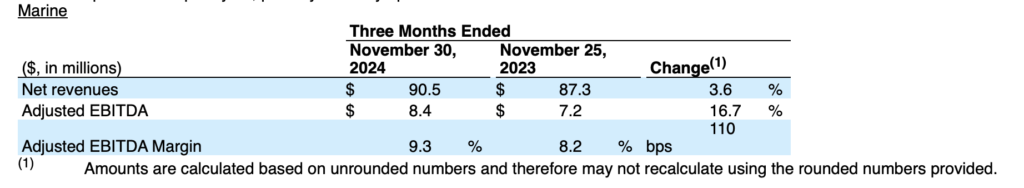

- Revenues for the Marine segment were up from the prior year, primarily due to targeted price increases and higher unit volume, partially offset by a reduction in average selling price per unit related to product mix.

- Segment Adjusted EBITDA margin increased compared to the prior year, primarily driven by targeted price increases, partially offset by product mix and higher warranty expense.

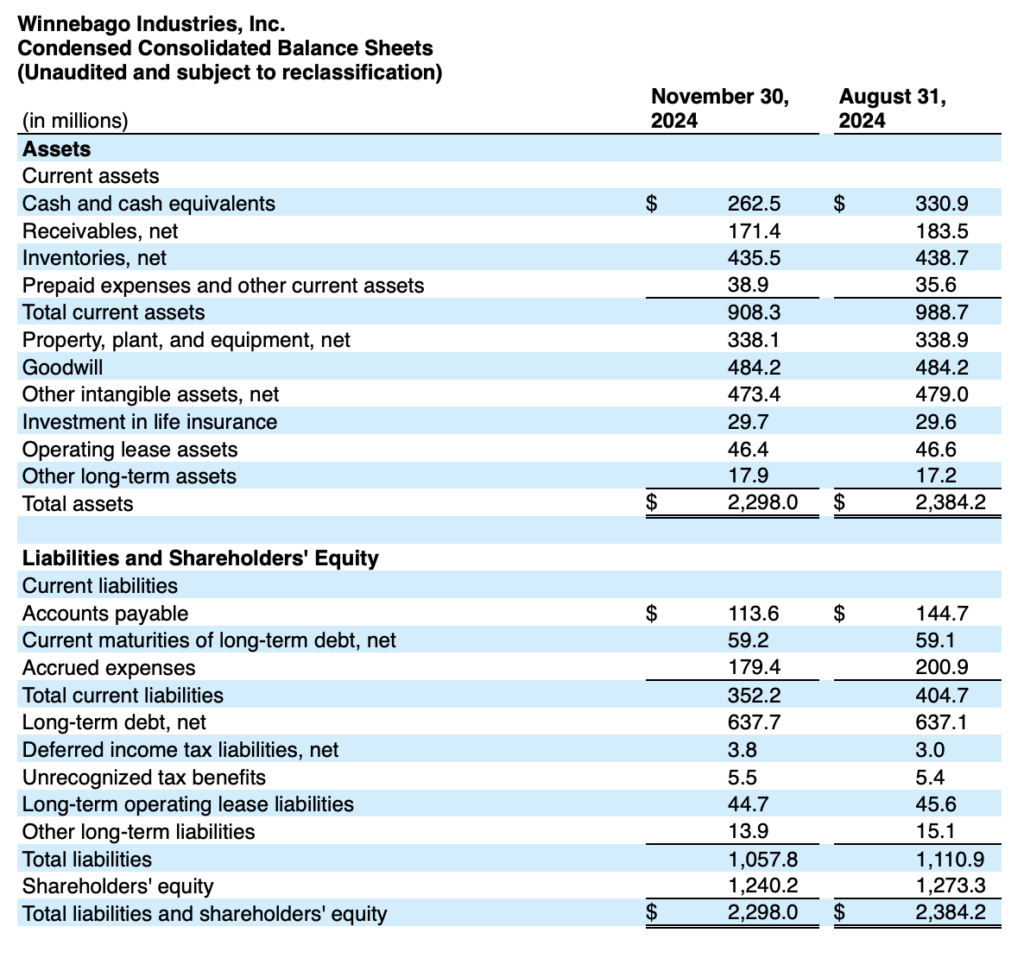

Balance Sheet and Cash Flow

As of November 30, 2024, the Company had total outstanding debt of $696.9 million ($709.3 million of debt, net of debt issuance costs of $12.4 million) and working capital of $556.1 million. Cash flow used in operations was $16.7 million in the Fiscal 2025 first quarter.

Quarterly Cash Dividend and Share Repurchases

On December 18, 2024, the Company’s Board of Directors approved a quarterly cash dividend of $0.34 per share payable on January 29, 2025, to common stockholders of record at the close of business on January 15, 2025. Winnebago Industries executed share repurchases of $30.0 million during the first quarter.

Outlook

For fiscal 2025, Winnebago Industries is reaffirming its expectation for consolidated revenues in the range of $2.9 billion to $3.2 billion. Based on its first-quarter 2025 results, and its outlook for the balance of the year, the Company is narrowing its fiscal 2025 reported EPS and adjusted EPS outlook while leaving the midpoints unchanged. The Company now expects reported earnings per diluted share of $2.50 to $3.80, compared with the prior range of $2.40 to $3.90 per diluted share, and adjusted earnings per share of $3.10 to $4.40(2), compared with a prior range of $3.00 to $4.50 per diluted share. The Company’s outlook takes into account prevailing trends in the RV sector, including competitive dynamics, shifts in consumer preferences, and key macroeconomic factors that may influence overall demand.

“We remain confident in our fiscal 2025 guidance,” said Happe. “Although the first half of the fiscal year comes with its typical seasonality and challenging market conditions, we are prepared to capitalize on the anticipated rise in demand as the RV and marine markets enter the spring selling season. This confidence comes from our robust lineup of new products, healthy channel relationships and strong financial foundation, all of which equip us to effectively serve our customers and navigate the current market landscape.”

Q1 FY 2025 Conference Call

Winnebago Industries, Inc. will discuss first quarter fiscal 2025 earnings results during a conference call scheduled for 9:00 a.m. Central Time today. Members of the news media, investors and the general public are invited to access a live broadcast of the conference call and view the accompanying presentation slides via the Investor Relations page of the Company’s website at http://investor.wgo.net. The event will be archived and available for replay for the next 90 days.

Footnotes to News Release

Footnotes:

(1) Beginning in the fourth quarter of Fiscal 2024, the Company updated its definition of Adjusted EPS to no longer adjust for the impact of a call spread overlay that was put in place upon the issuance of convertible notes, and which economically offsets dilution risk. Prior period amounts have been revised to conform to current year presentation.

(2) Fiscal 2025 adjusted EPS guidance excludes the pretax impact of intangible amortization of approximately $22 million.