Why Does Ammo Keep Getting More Expensive?

We may earn revenue from the products available on this page and participate in affiliate programs. Learn More ›

The sky-high cost of ammunition during the Covid pandemic shortages have mercifully declined. While ammunition probably feels a lot more expensive than it used to, many prices really have dropped from the all-time, eye-popping peak during the ammo shortage in 2021 and 2022.

That’s the good news. The bad news, as most hunters and shooters have already noticed, is that ammo remains pricier than we’re used to paying. That’s for a few reasons. First, the price of raw materials to make ammunition have generally increased. We’re also several years into a global propellant shortage. While tariffs haven’t yet contributed to high prices for most American-made ammo, they’ve caused price spikes in some segments of the market.

Despite these challenges, industry insiders say, ammo is widely available and prices have been lower for cheap, bulk ammunition. There’s no shortage expected anytime soon. And — as tough as it is to stomach — the price is likely going to increase in the near future. Here’s why.

Ammo Prices Have Come Down Since the Pandemic Price Spikes

There were plenty of factors that created a perfect storm of ammo scarcity — like minimal supply and panic buying — and correspondingly astronomical costs.

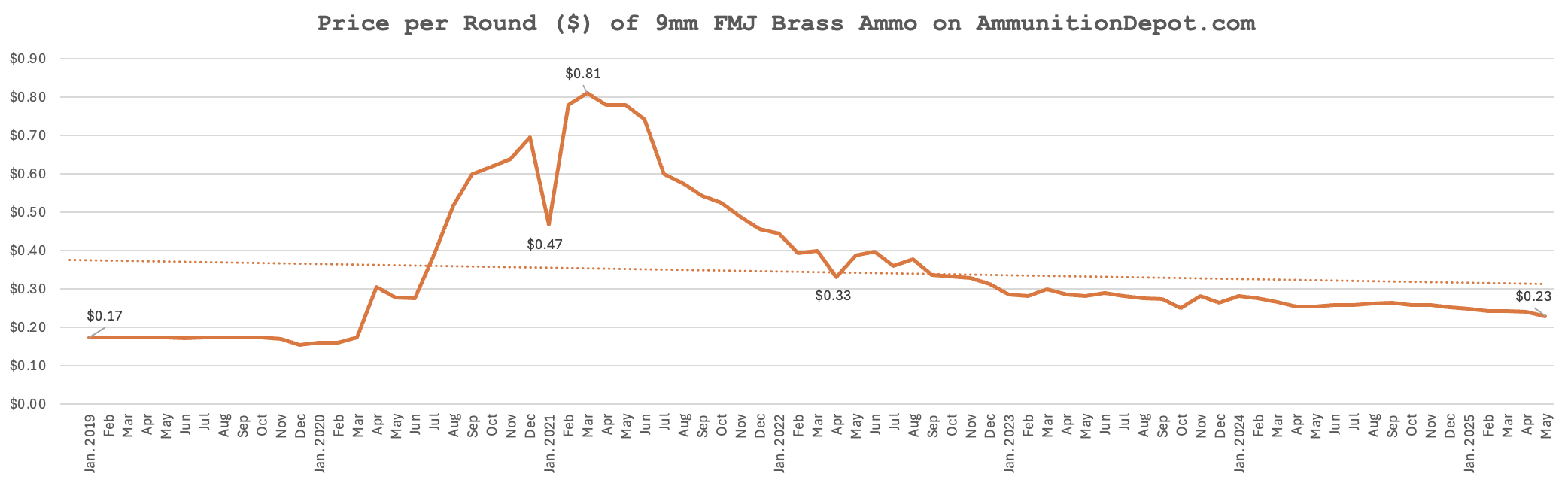

“You have short term price spikes that come from a significant increase in buying intent and buying demand coming from fear, uncertainty, and doubt,” says AmmunitionDepot.com CEO Dan Wolgin, in reference to the pandemic-era ammunition shortages. “After that, eventually things kind of normalize and that price coasts back down to the long-term trend line. Or usually below it, and then has to come back up. Right now, we are in that below-the-long-term-trend-line pricing.”

One clear example is in pricing data from one of Ammunition Depot’s most popular products: 9mm FMJ brass. As you can see in the line graf below, the price of that round spiked in March 2021 — exactly year after the pandemic set in — at .81 cents per round. The price has gradually declined to about .23 cents per round as of this month.

While this is just one example of one load (albeit a popular cartridge) this trend of lower-than-pandemic ammo prices is generally true for a lot of popular loads.

Nosler, for instance, lowered many of its prices at the beginning of 2025, so that ammo cost the same or slightly less than in 2022. Note, too, that the prices listed below are MSRPs, or “manufacturer’s suggested retail prices,” and the retail price of that ammo is usually lower online or in a shop.

Nosler provided OL with pricing data for three popular and commonly stocked loads. Many figures are rounded estimates based on price margins, since Nosler did not implement MSRPs until recently.

| Caliber / Nosler Load | 2015 MSRP | 2020 | 2021 | 2022 | 2025 |

| 9mm 115-gr. JHP ASP (previously Sporting Handgun) | ~$37.00 | ~$27.00 | ~$34.95 | ~$37.95 | $37.95 |

| .223 Rem. / 55-gr. Varmageddon | ~$22.95 | ~$34.95 | ~$31.95 | ~$33.95 | $32.95 |

| 6.5 Creedmoor / 140-gr. Match | ~$45.00 | ~$37.00 | ~$49.95 | ~$54.95 | $53.95 |

“You will note that both the 6.5 Creed and 9mm had a lower price in 2020 than 2015 — those are accurate,” says Pat Mundy, Nosler’s vice president of sales, marketing, and innovation. “We had a price reduction just before Covid [and resultant inflation and shortages] hit.”

Meanwhile, other companies have increased prices. That’s for a few reasons, says Hornady communications manager Seth Swerczek — including because manufacturers like Hornady don’t adjust their prices as often as some other companies.

“At Hornady we will eat price increases throughout the year and sometimes several years in a row before we do a pricing change,” says Swerczek. “[We don’t like to] raise the price of the ammo throughout the year and then lower it other times throughout the year because it can create a yo-yo effect in the supply and demand chain, though there are other ammo companies that do.”

When I asked Hornady for pricing data in the same three cartridges, the company selected its top-selling load in each. Note that Hornady’s MSRPs are also listed much higher than what you can actually buy their ammo for. For instance, their 6.5 Creed has a current MSRP of $56 and is selling for $39.99 on MidwayUSA right now. The important thing to pay attention to is the relative price of each load to past years.

| Caliber / Hornady Load | 2015 MSRP | 2020 MSRP | 2025 MSRP |

| 9mm / Critical Defense | $28.12 | $30.65 | $38.80 |

| 223. Rem. / 55-gr. V-Max | $26.41 | $28.97 | $37.88 |

| 6.5 Creedmoor / 140-gr. Match | $36.57 | $45.52 | $56.19 |

This bucks the trend above highlighted by Ammunition Depot, in which the price of bulk 9mm has steadily decreased. That’s partly due to different manufacturing standards, says Swerczek. Hornady does not mass-produce bulk ammo, and instead specializes in premium loads with strict quality control and accuracy protocols.

“The bulk ammo you can get away with letting dimensional tolerances be a little freer,” he says. “The accuracy spec is either much looser or non-existent. There is no terminal performance expectation. You could use cheaper, thinner brass that might not have as much strength as a thicker, more premium cartridge case. You could use the cheaper primers, the cheapest propellant that’s gonna burn really dirty. You can get away with doing all that stuff in the commodity ammo market. And that will definitely affect the cost, especially when you’re making things in huge volumes.”

So if you’re a hunter or competition shooter, you’re feeling the rising costs of goods (more on this in a minute) more than ever before.

“You’re at a point where [premium] ammo is just unfortunately more expensive than it’s ever been,” says Swerczek. “We’re making top quality ammo like we always do, but the end user is paying more for it and not necessarily getting any better ammo than they did two years ago. It’s just simply that the input costs have increased significantly.”

The Factors That Affect Ammo Prices

There’s a whole host of factors that contribute to the final cost of a box of ammo in your physical or digital shopping cart, so it’s tough to identify a single culprit behind a price increase. With the exception of pandemic-era panic-buying and price gouging by online scalpers, ammo industry folks discussed a couple key factors.

Supply Chain and Manufacturing Disruptions

On the whole, none of the ammo-price spike indicators characteristic of the ammo shortage of a few years ago are present right now. That includes halted production and material scarcity.

Mark Oliva, the managing director of public affairs for the National Shooting Sports Foundation, notes that manufacturers have only ramped up production since the pandemic, with ammo makers like Remington coming back on line and other companies working to expand their facilities. That’s good news for steady ammo prices.

“All the component parts are available. There’s plenty of brass being made. There’s plenty of projectiles being made,” Oliva says. “Copper’s still available. Lead is still available. Even looking at the labor costs and the market fluctuations, all that stuff is fairly stable. There’s plenty of production happening in the companies.”

Gun Purchases

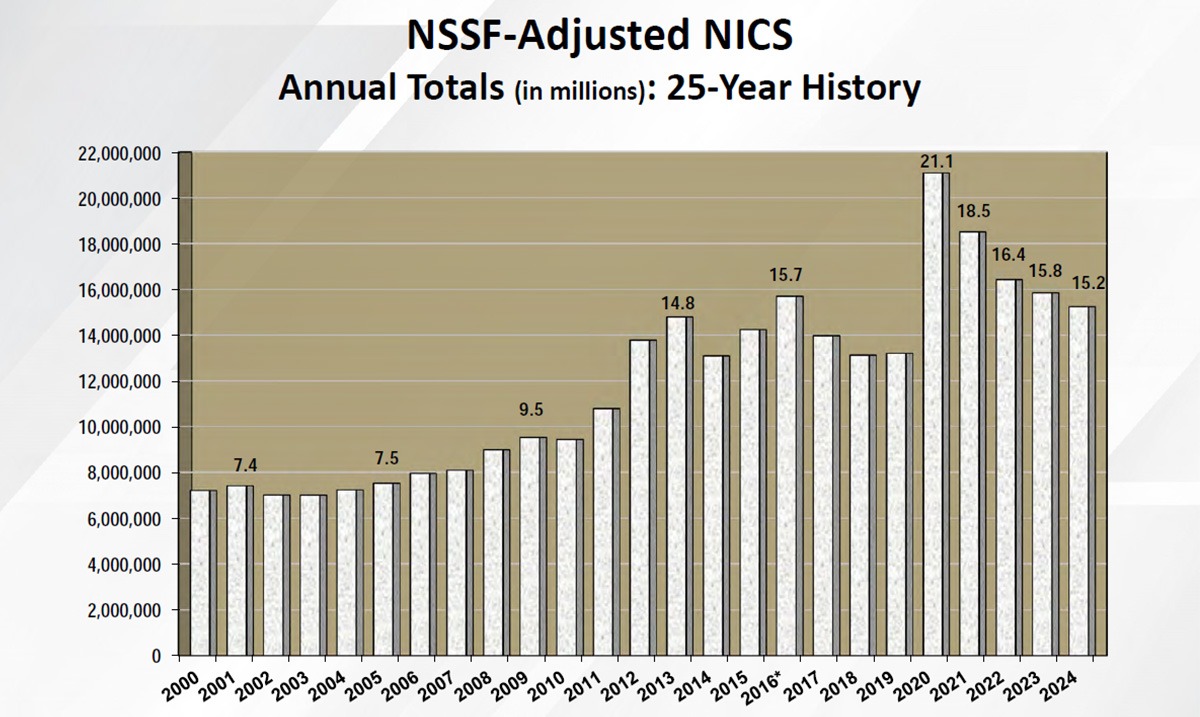

Another reliable indicator of ammo price increases — gun purchases, as determined by the FBI’s National Instant Criminal Background Check system — remains stable.

“The big hit to the [ammo] market on availability also happened to coincide with a huge spike in demand as we saw the NICS numbers rise up” during the shortage, Oliva adds. “We saw more people buying guns. And of course, when you buy a gun, you’re gonna need ammo to go with it. … NICS numbers are still feathering off the highs that we saw in 2020 and 2021. We’re still above where we were in 2019, but we certainly aren’t at [pandemic levels], when we saw 21 million background checks for the sale of a gun.”

Raw Material Prices

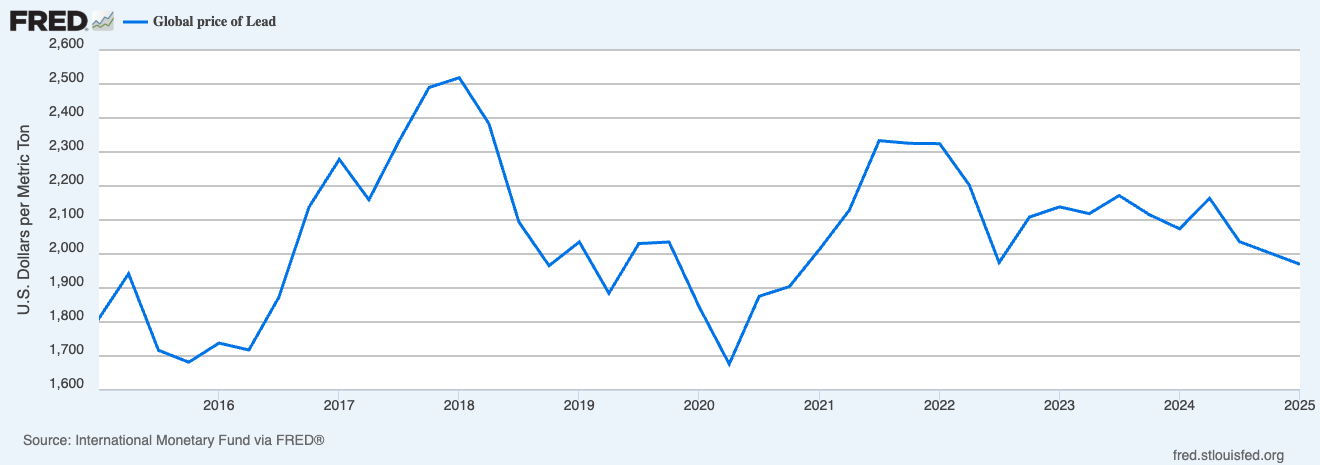

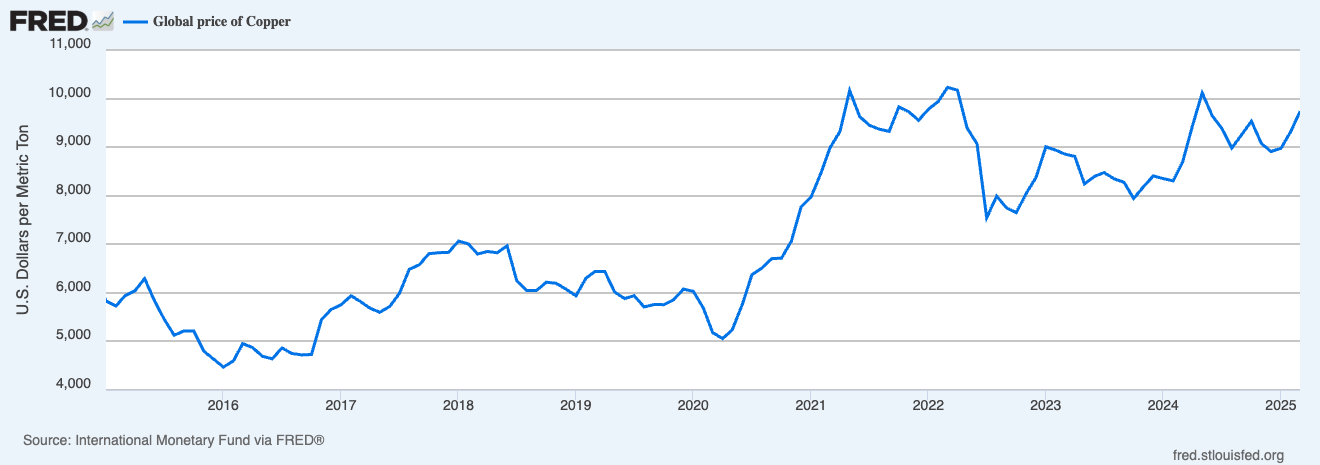

Ammunition is not immune from the effects of inflation. As inflation increases over time, so too does the price of everyday items like groceries and big-ticket purchases like pickup trucks. This includes, of course, raw materials that make ammunition manufacturing possible. While the price of metals like copper and lead certainly fluctuate, they are more expensive than they were 10 years ago.

The global price of copper (which is used to make brass) has increased 63.9 percent from March 2015 to March 2025. Similarly, the global price of lead has increased about 13.3 percent in that same time frame. But those prices fluctuate month to month, and when you step back and look at the big picture, lead is actually cheaper than it was during the height of the pandemic and even back in 2018. Copper remains pricy.

“A significant amount of a cartridge bullet and cartridge case is copper,” says Swerczek. “Then there’s lead …. There is no new lead mining going on. So we are on a fixed and recycled inventory of lead [like from car batteries]. And although getting lead hasn’t necessarily been a problem, the price of it definitely has been. And so you see those two drivers dramatically impact the cost of loaded ammo.”

In addition to that rising cost of copper and lead, Swerczek lists the increased cost of plastic and cardboard packaging and freight. Primer prices have also tripled.

“A decade ago primers were one to two cents apiece, maybe three cents a piece for a match primer. Today it’s very common to see 10 cents per primer. Now, we’re talking in cents. But when you make millions of rounds of ammunition, it becomes pretty significant. And that has all come together to create a perfect storm where you have to increase the cost of the ammo.”

The Global Powder Shortage

While production of projectiles, primers, and cases are humming along, there is one supply-chain bottleneck for a key cartridge ingredient: powder. One key stat that’s been floating around the industry is that powder prices have increased by about 15 percent this year, with many manufacturers scrambling to source powder however they can.

This is for a few reasons, including that there are just two primary powder plants in the country: the Radford Army Ammunition Plant in Virginia and St. Mark’s Powder in Crawfordville, Florida.

“The industry leans really heavily on the St. Mark’s powder company out of Florida [for spherical powders]. We certainly do,” says Swerczek. “They’re a great partner [and] they do a phenomenal job. But there are certain propellants that do certain jobs better, so we definitely lean on the propellants that are imported as well.”

Those single-based extruded propellants appear in products like the Hodgon Extreme Powder line and are sourced overseas from countries like Australia, Sweden, Switzerland, Denmark, and Norway. And ever since Russia invaded Ukraine in early 2022, propellants have been particularly challenging to source from those European companies. Reloaders have already felt the increase in the cost of their powder since the pandemic.

“Not only are those propellants more difficult to get in the volumes that we require,” says Swerczek, “but the cost to get them has gone up significantly as well.”

Steve Barzee, a veteran gun-counter salesman who has worked at mom-and-pop outdoor shops in the St. Louis area for decades, says the cost of his personal reloading powder has tripled from $20 before the pandemic to a new normal of about $60.

Inflation

One quirk of ammunition prices is that, in many cases, they actually haven’t kept pace with inflation.

As the price of some materials have increased, manufacturers have actually absorbed some production costs instead of passing that price onto consumers. That’s due, in part, to the fact that customers haven’t been willing to pay exorbitant prices for ammunition now that ammo is more widely available.

“What we’ve been able to do is absorb a fair amount of the [price] increases over the last year with internal efficiencies like driving down costs of shipping by selling more ammunition,” Boss Shotshells owner Brandon Cerecke told OL in February. “We’re also streamlining our production where we can to be a bit leaner, so we don’t have to carry as much inventory.”

Here’s an example based on Nosler’s pricing data above. The MSRP on a box of Nosler 6.5 Creedmoor 140-grain Match ammo was about $45 in 2015. It’s about $54 right now. If you adjust for inflation, that box of ammo should actually cost almost $62. (Remember that MSRPs are higher than the retail price of ammo; this load costs $45 a box on AmmunitionDepot.com right now.)

So yes, the price tag on some of your favorite loads right now are absolutely higher than in 2015 — but so is the price of everything else.

Tariffs and Ammo Prices

The concern about the impact of tariffs on ammunition prices varies depending who you talk to. Wolgin, the CEO of Ammunition Depot, is largely unconcerned about tariffs impacting ammo prices. Instead, he says the biggest risk might be panic buying.

“What bugs me is fear mongering, like when I see people in the industry trying to stoke fear in people, especially when they don’t need to be afraid,” says Wolgin. “I saw a lot of messaging like, ‘Come buy ammo now before the prices go up because of tariffs.’ Which is a really convenient marketing tactic, but it’s also not true.”

That’s for a few reasons, says Wolgin.

“The ammunition market in the United States is mostly a self-contained one. So there certainly are international brands, and we import some of them. But the vast majority of the ammunition produced, sold, and used in the country is made almost from soup to nuts in the United States. In general we shouldn’t see any impact specifically from tariffs. We may see other impacts. There’s lots of things that can make the price of ammo go up [like inflation and panic buying]. But tariffs are probably not among the primary drivers of changes in the ammunition pricing market.”

Other industry folks are cautiously optimistic about ammo prices even amid ever-changing tariff news. While Oliva of the NSSF notes that tariffs are an “unknown factor,” most ammo price-spike speculation is just that — speculation.

“There’s a lot of rumors out there,” says Oliva, “but I’m not finding a lot of fact behind that to show that ammo prices are headed for a spike or that we’re looking at any kind of crunch for ammo like we saw back in 2021 and 2022.”

The U.S. Imports Bismuth and Tungsten

An important exception here is nontoxic ammunition. While Oliva notes that this “alternative ammunition” makes up just 1 percent of all the ammunition manufactured in America, it’s a crucial market for hunters.

Just as the price of copper and lead affects most popular ammo prices, the production and price of bismuth, tungsten, and steel impacts the cost of your duck loads. Roughly a quarter of U.S. steel is imported, making it less subject to tariff-related price hikes and, overall, steel prices have dropped since the pandemic spike. Bismuth is more of a sore spot.

BOSS’ bread-and-butter, for instance, has been copper-plated bismuth loads. In Sept. 2021, during the height of national ammo shortages and price spikes, a case of 200 of those 12-gauge 2 ¾ inch No. 5s cost customers $300. Today, that price is $425. This is an instance where the ammunition price has far outpaced inflation.

So while BOSS was able to keep some prices stable earlier this year, the company also had to prepare to adjust other prices this year by about 40 percent “in anticipation of Trump’s tariffs,” says Cerecke.

That’s due in part because the U.S. stopped producing and refining bismuth in 1997, becoming “highly import reliant” on the metal, according to the federal government. As of 2023, China was responsible for 80 percent of bismuth production.

Worse, as China curbed its exports earlier this year, causing the price of bismuth to skyrocket from $6.50 to $7 per pound to $55 a pound in the U.S. A similar story is true for tungsten, which is used for TSS pellets. The price of tungsten in February 2025 was 15 percent higher than it was in February 2024.

These commodity costs will likely lead to more price increases down the line as companies sell through their current inventory and begin making more nontoxic shot.

Ammo Is Only Going to Get More Expensive

There are a few key takeaways for ammo customers. First, there are no red flags that point to a coming ammunition shortage. If anything, says Wolgin, customers are cutting back on ammunition purchases right now.

“What we’re seeing is the impact of falling consumer confidence. So as the consumer gets less and less confident, they spend less and less. And we’re definitely noticing that [on AmmunitionDepot.com],” says Wolgin. “So it’s been a more difficult time, I think for all retailers lately than it was for the last couple of years.”

While Hornady is experiencing a similar dip in customer purchases, Swerczek thinks that’s actually because ammo buyers feel relatively secure right now.

“I’m guessing it’s that Trump’s in office, everybody’s comfortable, they’re not panic-buying anymore, and therefore sales are certainly softer than they had been, say, through the election cycle. Plus, I don’t think the rate of sales today is the new normal because people have stockpiled ammo [during Covid]. I think in the next couple years or next year, people will shoot that ammo and then we will establish what the new normal is. The prices have gone up and there’s not a whole lot anyone can do about that, but I do think that they’re confident that the ammo will be there when they need it.”

If there’s a significant decline in the cost of raw materials like copper and lead, says Swerczek, he does think there could be a modest dip in ammo prices down the line. But, everyone agrees, we’re not going to see any significant drop in price — and we’re never going back to pre-pandemic prices.

“Nosler lowered our prices significantly to start 2025,” says Mundy. “So we hope to be able to hold these prices — or prices very close to these — for a while. As our costs came down, we felt it was the right thing to do to make our products more accessible, and to pass on some of the savings we have seen from increased efficiency and lower prices of some of the components.”

Read Next: Here’s What the Ammo Shortage Revealed About the Industry

Waterfowlers in particular should expect prices to remain high.

“If you have the money and you have the space and you have the desire, go buy ammo,” says Wolgin, who emphasizes that his advice isn’t rooted in fear-mongering, but simply in predictions for rising costs. “I don’t expect prices to go down from here. I think they’ll go up, but I don’t know when, I don’t know how fast. These are not things that my crystal ball has told me on this day.”

The post Why Does Ammo Keep Getting More Expensive? appeared first on Outdoor Life.

Source: https://www.outdoorlife.com/guns/why-is-ammo-expensive/