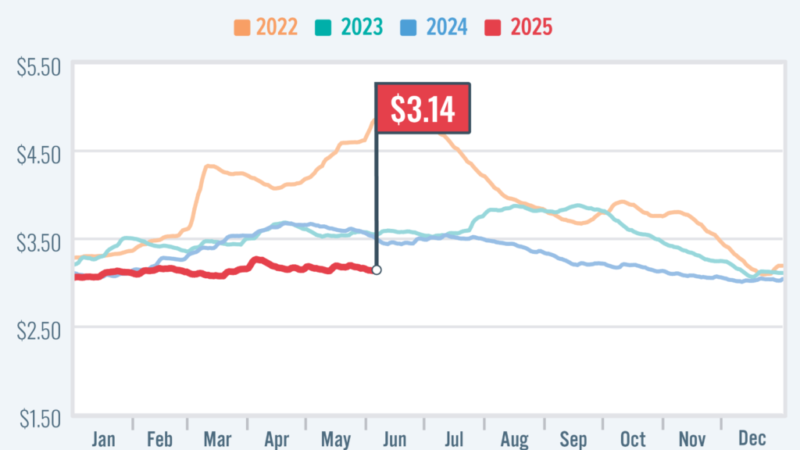

Wholesale Pressures Emerge Despite Long-Term Slowdown

WASHINGTON — Wholesale prices in the United States reaccelerated in January, indicating that inflation pressures continue to underlie the U.S. economy despite longer-term signs of improvement, according to an Associated Press report.

WASHINGTON — Wholesale prices in the United States reaccelerated in January, indicating that inflation pressures continue to underlie the U.S. economy despite longer-term signs of improvement, according to an Associated Press report.

From December to January, the government’s producer price index jumped 0.7%, driven up in part by a 5% surge in energy prices. That increase compared with a 0.2% drop from November to December, and it was nearly twice the rise that economists had been expecting.

The producer price data reflects prices charged by manufacturers, farmers and wholesalers, and it flows into an inflation gauge that the Federal Reserve closely tracks. It can provide an early sign of how fast consumer inflation will rise.

While the monthly inflation surge was worse than expected, price increases measured over the past year continued to show a slowdown: Wholesale prices in January were up 6% from 12 months earlier, compared with a 6.5% year-over-year rise in December and a recent peak of 11.7% in March. It was the seventh straight month of decelerating year-over-year wholesale inflation, though it still came in higher than forecasters had expected.

Read the full Associated Press report.

Source: https://rvbusiness.com/wholesale-pressures-emerge-despite-long-term-slowdown/