THOR Second Quarter Financials ‘in Line with Expectations’ – RVBusiness – Breaking RV Industry News

ELKHART, Ind. – THOR Industries Inc. (NYSE: THO) today announced financial results for its fiscal 2025 second quarter, ended Jan. 31.

“Our second quarter results were in line with our expectations going into the quarter, and we experienced mild, but encouraging, year-over-year improvement at recent retail shows,” noted Bob Martin president and CEO of THOR Industries. “As the challenging economic environment persists, our actions remain focused on what we can control: the products that we offer and the relationships that we foster with dealers and retail customers.

“Our strategic approach continues to emphasize a strong margin profile while focusing on alignment of our production to match the current retail environment. This approach will help us avoid growth of independent dealer inventory levels of our products until market conditions improve. Holding true to our strategy places our operating companies in an advantageous position to outperform the market when retail demand inevitably picks up. Despite the challenging market, we have generated strong cash flows through the execution of our proven operating model, favorably positioning THOR to seize upon growth opportunities in both North America and Europe,” Martin explained.

Key Takeaways from Fiscal 2025 Second Quarter

- Second quarter performance was aligned with expectations due to continued macroeconomic headwinds

- Margins remained resilient while contending with market challenges

- Robust cash generation as a result of management’s execution of our proven operating model

- Continued strategic actions to deepen dealer relationships and create competitive advantage so as to maximize performance upon the eventual return of a stronger market

- The Company narrowed and revised its full-year fiscal 2025 financial guidance

- Consolidated net sales in the range of $9.0 billion to $9.5 billion

- Consolidated gross profit margin in the range of 13.8% to 14.5%

- Diluted earnings per share in the range of $3.30 to $4.00

Second Quarter Financial Results

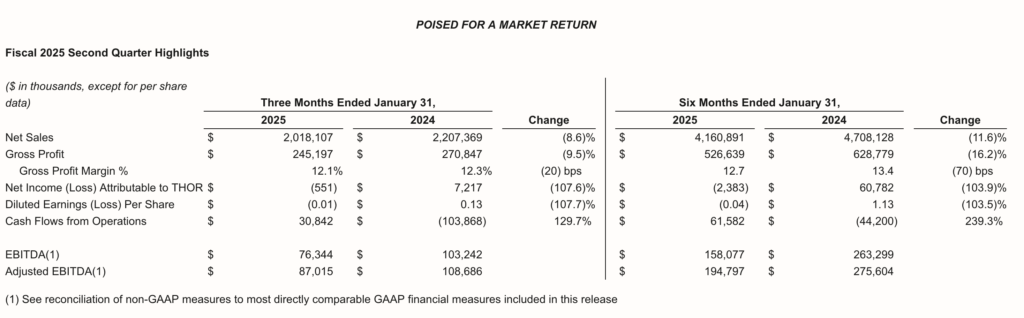

- Consolidated net sales were $2.02 billion in the second quarter of fiscal 2025, compared to $2.21 billion for the second quarter of fiscal 2024, a decrease of 8.6%.

- Consolidated gross profit margin for the second quarter of fiscal 2025 was 12.1%, a decrease of 20 basis points when compared to the second quarter of fiscal 2024.

- Net income (loss) attributable to THOR Industries, Inc. and diluted earnings (loss) per share for the second quarter of fiscal 2025 were $(0.6) million and $(0.01), respectively, compared to $7.2 million and $0.13, respectively, for the second quarter of fiscal 2024.

- EBITDA and Adjusted EBITDA for the second quarter of fiscal 2025 were $76,344 and $87,015, respectively, compared to $103,242 and $108,686, respectively, for the second quarter of fiscal 2024. See the reconciliation of non-GAAP measures to the most directly comparable GAAP financial measures included at the end of this release.

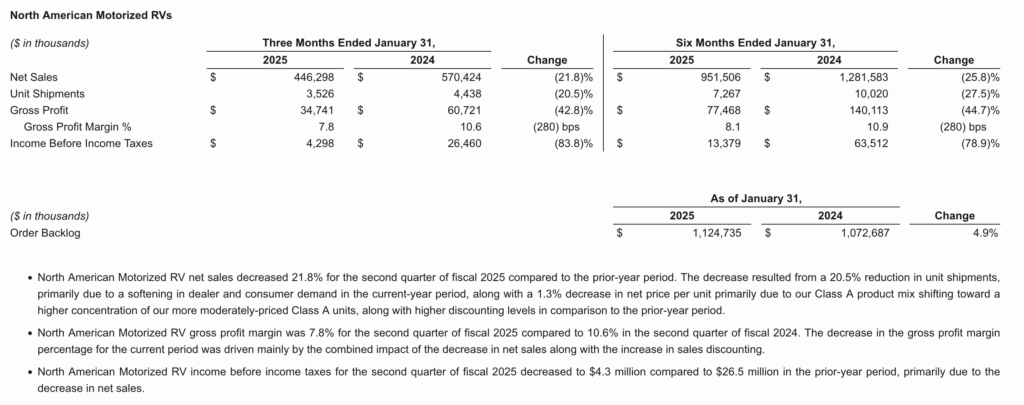

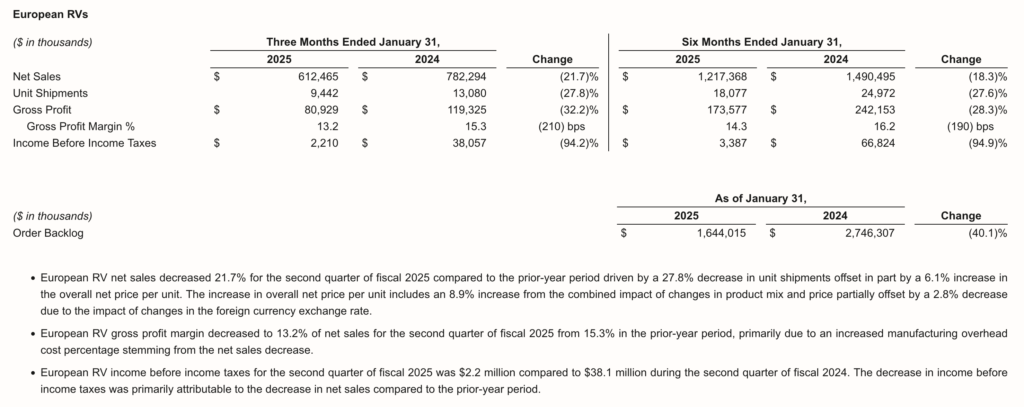

THOR’s consolidated results were primarily driven by the results of its individual reportable segments as noted below.

Management Commentary

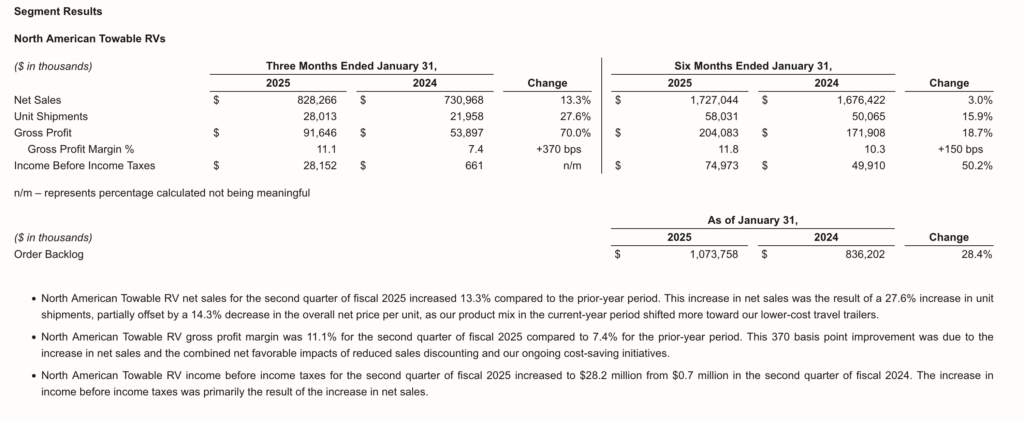

“At the beginning of fiscal 2025, we foresaw that the first half of our fiscal year would be challenging and that certainly has proven to be accurate. Our focus on maintaining a healthy balance between wholesale and retail activity enabled our segments to hold margins reasonably well with consolidated gross margins for the second quarter of fiscal 2025 at 12.1% compared to 12.3% for the prior-year period. As we anticipated and messaged at the beginning of our fiscal year, our North American Motorized and European segments have both seen a year-over-year decline in gross margins while our North American Towable segment has seen meaningful improvement on a year-over-year basis, with gross margins up 370 basis points over the same quarter last year. Our consolidated margin this quarter was also impacted by actions we took to deepen our partnerships with key dealers. Strategically, deepening these key relationships is important to our long-term market position. These strategic decisions position THOR well as we look ahead. The takeaway for this quarter and for the first half of our fiscal year is that we performed as we expected,” said Todd Woelfer, Senior Vice President and Chief Operating Officer.

“While the RV market has experienced an extended downturn, our focus has remained on prudently managing through the downturn by working with our vendor and dealer partners to improve what we build for retail customers. We proactively aligned production with retail demand to ensure a balanced inventory position and optimal channel pull-through in a highly dynamic market. At the same time, we continue to refine our brand portfolio to reflect evolving consumer trends and market dynamics. We have seen great success with some of our operating companies and challenges with others. As our fiscal year continues to unfold, we anticipate meaningful structural and brand rationalization announcements that will result in an improved profit profile for our operating segments. The net result will be a better, more profitable THOR aligned with the current and future needs of our dealers and retail consumers,” added Woelfer.

“Despite the challenging market and macroeconomic uncertainties, we remain focused on enhancing the fundamentals of our business and executing on our strategic plan as we progress through the second half of our fiscal year,” said Colleen Zuhl, Senior Vice President and Chief Financial Officer.

“On January 31, 2025, we had liquidity of approximately $1.23 billion, including approximately $373.8 million in cash on hand and approximately $855.0 million available under our asset-based revolving credit facility. In addition to the firm foundation provided by our total liquidity position and overall strong balance sheet, during the second quarter, we generated cash from operations of approximately $30.8 million, bringing our fiscal year-to-date total to $61.6 million. In the face of the difficulties of the first half of our fiscal year, we improved our cash flow from operating activities by over $100 million compared to the first half of last year by executing on our proven operating model as we significantly reduced our working capital through prudent management of inventories and other actions.

“True to our historical commitment of taking a measured and conservative approach to cash management and capital allocation during challenging economic periods, during the first half of fiscal 2025, we have made capital expenditures of approximately $51.5 million with a priority on time-sensitive investments into our facilities and machinery. We have also reduced our total indebtedness by approximately $90.5 million and returned capital to our shareholders primarily through the payment of $53.2 million in quarterly dividends.

“Based on the historical seasonality of our industry and our previously stated outlook on our full year fiscal 2025, we expect stronger generation of cash from operations during the second half of our fiscal year, further bolstering our ability to execute our strategic plan and enhance shareholder value,” added Zuhl.

Outlook

“Despite the RVIA recently revising its forecast upwards for calendar year 2025, now with total expected wholesale unit shipments exceeding 350,000 units, we remain more cautious in our preparation for the remainder of the calendar year. While we are resolute in our belief in the strength of the foundation and future of our industry, we are aware that the recent decline in consumer confidence and the impacts of a broad tariff policy create uncertainty in the market in the near term. We remain confident in our ability to navigate this uncertain market environment while continuing to position THOR for future success. By maintaining financial discipline and focusing on strategic growth initiatives, we are well-equipped to emerge stronger and more resilient,” concluded Martin.

Fiscal 2025 Guidance

“THOR’s consolidated net sales levels through the first half of our fiscal year have been very much in line with our initial expectations and financial guidance. Pressure on margins, however, has been higher than we anticipated primarily due to challenging North American Motorized and European market conditions and additional strategic actions that THOR has implemented with our dealer partners, resulting in softer margins than our original forecast. We still expect that the retail market will begin trending more positively as we progress through the remainder of our fiscal 2025, which will pave the way for a stronger year in our fiscal 2026 which begins in August. Taking into consideration results to date and our expectations for our North American and European operations for the upcoming fiscal quarters, the Company has narrowed and revised its financial guidance for fiscal 2025,” commented Woelfer.

For fiscal 2025, the Company’s updated full-year financial guidance now includes:

- Consolidated net sales in the range of $9.0 billion to $9.5 billion (narrowing the previous range of $9.0 billion to $9.8 billion)

- Consolidated gross profit margin in the range of 13.8% to 14.5% (previously in the range of 14.7% to 15.2%)

- Diluted earnings per share in the range of $3.30 to $4.00 (previously in the range of $4.00 to $5.00)

Supplemental Earnings Release Materials

THOR Industries has provided a comprehensive question and answer document, as well as a PowerPoint presentation, relating to its quarterly results and other topics.

To view these materials, go to http://ir.thorindustries.com.