THOR Industries Sees Gains in Q3 Financial Performance – RVBusiness – Breaking RV Industry News

ELKHART, Ind. – THOR Industries, Inc. (NYSE: THO) today announced financial results for its fiscal 2025 third quarter, ended April 30, 2025.

Key Takeaways from Fiscal 2025 Third Quarter

- Third quarter performance yielded strong results and exceeded expectations

- Delivered resilient margins while contending with shifting market and macroeconomic conditions

- Fiscal year-to-date generation of cash from operations surpassed the prior-year period as management continued to execute on our proven operating model

- Strategic organizational restructuring announced during the quarter continues to align the Company with current market conditions and positions THOR favorably to achieve additional operating efficiencies

- The company reaffirmed its revised full-year fiscal 2025 financial guidance

- Consolidated net sales in the range of $9.0 billion to $9.5 billion

- Consolidated gross profit margin in the range of 13.8% to 14.5%

- Diluted earnings per share in the range of $3.30 to $4.00

“Our third quarter results exceeded our expectations on both the top and bottom lines” stated Bob Martin, president and chief executive officer of THOR Industries. “The successful execution of key strategic initiatives, in particular placing further emphasis on driving down our cost profile, led to improved margins in an environment where we saw modest year-over-year top-line improvement. THOR’s operating model, particularly within North America, is designed to ramp upward and downward in an incredibly efficient manner, and our performance in the fiscal third quarter exhibited the strength and flexibility of this operating model.

“We are incredibly proud of our hard-working team members as they continue to execute to plan in the face of numerous challenging market conditions as we navigate through this prolonged industry downturn together,” he continued. “Our third quarter performance exemplifies what makes THOR the market leader. History has proven THOR’s ability to weather difficult macroeconomic circumstances and to come back stronger when market conditions improve. While the current level of uncertainty is unprecedented, and we believe the next two fiscal quarters will be challenging for the RV industry as a whole, we are very pleased that our efforts are starting to move the needle.”

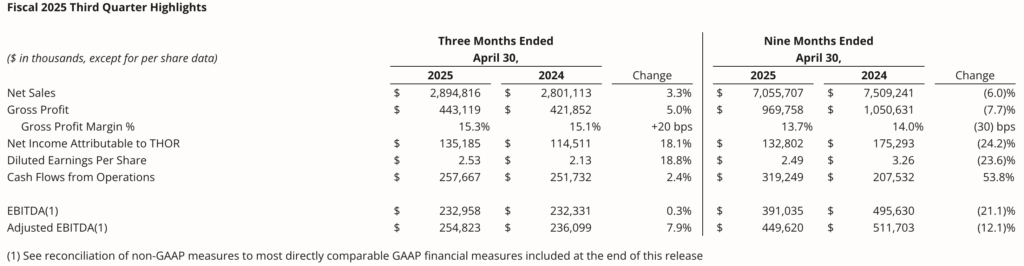

Third Quarter Financial Results

Consolidated net sales were $2.89 billion in the third quarter of fiscal 2025, compared to $2.80 billion for the third quarter of fiscal 2024, an increase of 3.3%.

Consolidated gross profit margin for the third quarter of fiscal 2025 was 15.3%, an increase of 20 basis points over the third quarter of fiscal 2024.

Net income attributable to THOR Industries, Inc. and diluted earnings per share for the third quarter of fiscal 2025 were $135.2 million and $2.53, respectively, compared to $114.5 million and $2.13, respectively, for the third quarter of fiscal 2024.

EBITDA and Adjusted EBITDA for the third quarter of fiscal 2025 were $233.0 million and $254.8 million, respectively, compared to $232.3 million and $236.1 million, respectively, for the third quarter of fiscal 2024. See the reconciliation of non-GAAP measures to the most directly comparable GAAP financial measures included at the end of this release.

THOR’s consolidated results were primarily driven by the results of its individual reportable segments as noted below.

Segment Results

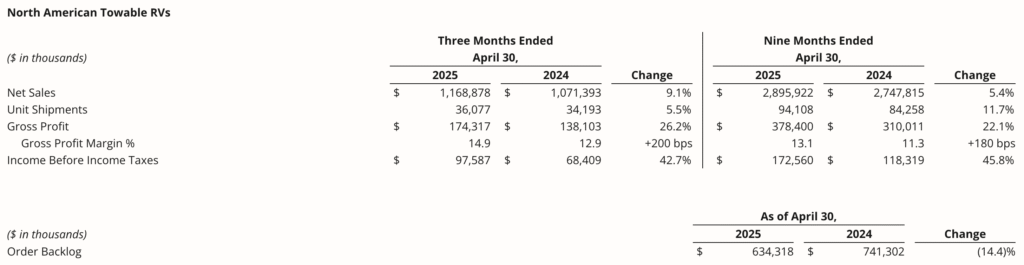

- North American Towable RV net sales for the third quarter of fiscal 2025 increased 9.1% compared to the prior-year period. This increase in net sales was the result of a 5.5% increase in unit shipments compared to the prior-year period, as well as a 3.6% increase in the overall net price per unit primarily due to an increased proportion of fifth wheel units within our product mix.

- North American Towable RV gross profit margin increased 200 basis points to 14.9% for the third quarter of fiscal 2025 compared to 12.9% for the prior-year period. This improvement was due to the increase in net sales along with the combined net favorable impacts of reduced sales discounting, an improved warranty cost percentage and our ongoing cost-saving initiatives.

- North American Towable RV income before income taxes for the third quarter of fiscal 2025 increased to $97.6 million from $68.4 million in the third quarter of fiscal 2024. The increase in income before income taxes was primarily the result of the increase in net sales and the improvement in gross profit.

- North American Motorized RV net sales increased 3.1% for the third quarter of fiscal 2025 compared to the prior-year period. The increase resulted from a 10.9% increase in unit shipments, in part due to increased promotional activity in the current-year period, partially offset by a 7.8% decrease in net price per unit primarily due to a shift in product mix within our Class A product line toward a higher concentration of our more moderately-priced gas units, along with higher discounting levels in comparison to the prior-year period.

- North American Motorized RV gross profit margin was 10.5% for the third quarter of fiscal 2025 compared to 11.1% in the third quarter of fiscal 2024. The decrease in the gross profit margin percentage for the current period was driven mainly by the increase in sales discounting.

- North American Motorized RV income before income taxes for the third quarter of fiscal 2025 decreased slightly to $32.9 million from $33.2 million in the prior-year period, primarily due to the decrease in gross profit.

- European RV net sales decreased 5.1% for the third quarter of fiscal 2025 compared to the prior-year period driven by a 12.2% decrease in unit shipments offset in part by a 7.1% increase in the overall net price per unit. The increase in the overall net price per unit includes a 6.8% increase from the combined impact of changes in product mix and price along with a 0.3% increase due to the impact of changes in the foreign currency exchange rate.

- European RV gross profit margin decreased 130 basis points to 16.2% of net sales for the third quarter of fiscal 2025 from 17.5% in the prior-year period, primarily due to an increase in sales discounting.

- European RV income before income taxes for the third quarter of fiscal 2025 was $46.3 million compared to $77.4 million during the third quarter of fiscal 2024. The period-over-period decrease in income before income taxes was primarily attributable to the decrease in net sales.

Management Commentary

Todd Woelfer, Senior Vice President and Chief Operating Officer

“While our fiscal third quarter results exceeded expectations, our overall fiscal year is unfolding in a manner that is very consistent with our original projections. We foresaw and foretold a very challenging environment in the first half of our fiscal year and, during that time, we prudently managed our operations to align with the expected difficult market conditions. Key strategic initiatives have driven important recent wins for our brands, and we are confident that we are well-positioned to return to share gains over the longer term.

“Our financial guidance assumed a stronger second half of our fiscal year, and our fiscal third quarter performance reflects the value of our strategies in the currently difficult market. THOR’s focus on aligning production with retail sales and working with our valued independent dealer partners to ensure rational inventory levels for a suppressed retail marketplace positioned us well for the moment when retail surged, even moderately. Our fiscal third quarter results benefited from the continued execution of our strategies, and the management and production teams at our operating companies performed incredibly well, driving strong performance in our third quarter. In the fiscal third quarter, our consolidated gross margin improved to 15.3% compared 15.1% in the prior-year period. Our North American Towable segment, in particular, generated meaningful improvement on a year-over-year basis, posting a 200 basis point improvement in gross profit margin over the third quarter of fiscal 2024.

“As we anticipated and messaged at the beginning of our fiscal year, our North American Motorized and European segments have both seen year-over-year declines in gross margin but still achieved resilient results considering the challenging environments facing those segments. While our consolidated margin this quarter was unfavorably impacted by actions we took to deepen our partnerships with key dealers, strategically, deepening these key relationships is vital to our long-term market position and these decisions favorably position THOR for the future as we look ahead.”

“As we discussed at the end of our fiscal second quarter, significant restructuring steps at THOR were forthcoming. The strategic restructuring of Heartland to operate under Jayco’s outstanding management team creates significant opportunities for both brands going forward. This realignment, along with other key initiatives, will further optimize our enterprise structure and drive meaningful savings as the Company works to reduce its cost footprint. Both prior to and throughout the fiscal year thus far, we have transparently communicated our strategies and have remained vigilantly focused on executing those strategies despite the noise in both the macro and micro environments. Our teams’ dedication to the execution of those plans is exemplified in our successful third-quarter results.”

Colleen Zuhl, Senior Vice President and Chief Financial Officer

“As a result of our strong quarter, on April 30, 2025, we had liquidity of approximately $1.49 billion, including approximately $508.3 million of cash on hand and approximately $985.0 million available under our asset-based revolving credit facility. In addition to the solid foundation provided by our total liquidity position and overall strong balance sheet, during the third quarter, we generated cash from operations of approximately $257.7 million, bringing our fiscal year-to-date total to $319.2 million. Despite our lower year-to-date net income, through the third fiscal quarter of 2025 we have improved our cash flow from operating activities by over $100 million on a year-over-year basis by executing on our proven operating model and significantly reducing our working capital.”

“True to our historical commitment of taking a measured and conservative approach to cash management and capital allocation, especially during challenging economic periods, through the third quarter of fiscal 2025, we have made selective capital expenditures of approximately $85.1 million with a priority on time-sensitive investments in our facilities and machinery. Through the first three quarters of fiscal 2025, we have also reduced our total indebtedness by approximately $139.2 million and returned capital to our shareholders primarily through the payment of $79.8 million in quarterly dividends. Subsequent to the end of our third fiscal quarter, we further reduced our indebtedness with a $55.0 million payment against the principal balance of our USD term loan. While we were unable to repurchase shares during our fiscal third quarter due to trading restrictions, THOR remains well positioned to take advantage of the currently suppressed securities market with our strong cash position. Management’s view remains that there are few other capital allocation options that offer such significant return to our shareholders,” added Zuhl.

Outlook

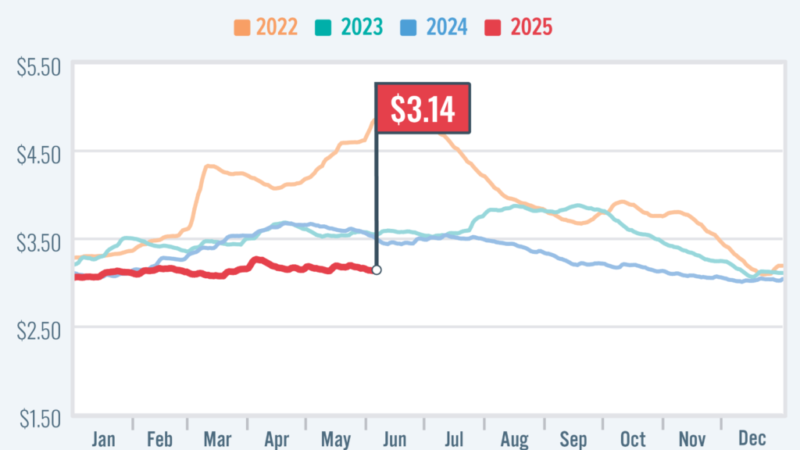

“Last quarter, THOR expressed the belief that RVIA’s prior expectation of calendar 2025 industry wholesale unit shipments exceeding 350,000 was aggressive. Recently, RVIA lowered their expectations to a most likely scenario of approximately 337,000 units, which is more in line with THOR’s long-held view for the calendar year. We expect the fourth quarter of our fiscal 2025 and the first quarter of our fiscal 2026 to be challenging. The current economic uncertainty has led to downward pressure on consumer confidence and has negatively impacted retail pull-through. We believe that upon the resolution of this uncertainty, we will see improved consumer confidence and the return of a strong retail environment. In the meantime, we will continue to execute the strategies necessary to maximize our performance in the given market conditions. Our focus will remain on controlling what we can control and prudently managing the Company through the macroeconomic challenges. As we do so, THOR will continue to demonstrate that it is well-equipped to emerge from the current downturn stronger and more resilient,” concluded Martin.

Fiscal 2025 Guidance

“THOR’s strong fiscal third quarter results strengthened the alignment of our year-to-date performance with our full-year financial guidance. Despite the strong quarter, margin pressures persist as we continue to manage through softer retail and wholesale demand in our North American Motorized and European segments and implement strategic actions to strengthen our relationships with our independent dealers. Taking into consideration results to date and our expectations for our North American and European operations for the final fiscal quarter, the Company has reaffirmed its revised financial guidance for fiscal 2025,” commented Woelfer.

“While we are maintaining our revised full-year guidance, we recognize that potential swings from uncertainties in the macro environment could be significant. Due to recent developments in trade policies, and considering the remaining duration of our fiscal year, THOR believes that its performance is still slated to fall solidly within its previously announced guidance, assuming no new material shifts within the macro or global trade environment. We will continue to provide transparent viewpoints of our performance and market conditions to enable investors and analysts to appreciate the current operating environment and our performance within that environment. The addition of Seth Woolf to our team better enables us to ensure that we are communicating THOR’s performance and value proposition in a transparent and effective manner,” concluded Woelfer.

For fiscal 2025, the Company’s full-year financial guidance includes:

- Consolidated net sales in the range of $9.0 billion to $9.5 billion

- Consolidated gross profit margin in the range of 13.8% to 14.5%

- Diluted earnings per share in the range of $3.30 to $4.00

Supplemental Earnings Release Materials

THOR Industries has provided a comprehensive question and answer document, as well as a PowerPoint presentation, relating to its quarterly results and other topics.

To view these materials, go to http://ir.thorindustries.com.

About THOR Industries, Inc.

THOR Industries is the sole owner of operating subsidiaries which, combined, represent the world’s largest manufacturer of recreational vehicles.

For more information on the Company and its products, please go to www.thorindustries.com.