THOR Industries Announces Second Quarter Fiscal 2024 Results – RVBusiness – Breaking RV Industry News

ELKHART, Ind. – THOR Industries, Inc. (NYSE: THO) today announced financial results for its second fiscal quarter ended Jan. 31.

The company anticipates stronger performance in the second half of fiscal 2024 while lowering fiscal 2024 guidance to reflect it’s prudent focus on operational executon ahead of market recover.

Fiscal Second Quarter 2024 Highlights

- Consolidated net sales for the second quarter were $2.21 billion.

- Consolidated gross profit margin for the second quarter was 12.3%.

- Net income attributable to THOR Industries, Inc. and diluted earnings per share for the second quarter of fiscal 2024 were $7.2 million and $0.13, respectively, inclusive of a $14.7 million charge related to the November 15, 2023 refinancing of the Company’s debt facilities.

- The Company revised its full-year fiscal 2024 consolidated net sales and diluted earnings per share guidance to a consolidated net sales range of $10.0 billion to $10.5 billion and diluted earnings per share in the range of $5.00 to $5.50.

“Our fiscal second quarter, similar to the prior-year period, presented a challenging operating environment as seasonally lower retail demand and cautious dealer sentiment impacted our results. As macro conditions continue to pressure the top-line, our teams proactively navigated through the retail offseason to improve the competitive positioning of our operating companies and independent dealer partners. Notably, we continued to work with our North American independent dealer partners to closely match wholesale production with the pace of retail sales and we enacted promotional programs to assist independent dealers in moving prior-model-year units and stimulate retail demand. With the rapid increase in interest rates over the past year, dealers face elevated floorplan financing costs that have put substantial pressure on their operations. As a result, we currently believe that even though the levels and mix of channel inventory are well-positioned ahead of the retail selling season, dealers will remain focused on limiting inventory levels as they manage interest expense,” said Bob Martin, President and CEO of THOR Industries.

“Over the long term, we remain encouraged as attendance figures at recent retail RV shows and consumer interest in the lifestyle remain strong. Our teams will continue to monitor evolving market trends as we progress through the upcoming selling season, and we remain highly confident in our operating teams and flexible business model to deliver value for our independent dealer partners and end consumers,” added Martin.

Second-Quarter Financial Results

Consolidated net sales were $2.21 billion in the second quarter of fiscal 2024, compared to $2.35 billion for the second quarter of fiscal 2023.

Consolidated gross profit margin for the second quarter of fiscal 2024 was 12.3%, an increase of 20 basis points when compared to the second quarter of fiscal 2023.

Net income attributable to THOR Industries, Inc. and diluted earnings per share for the second quarter of fiscal 2024 were $7.2 million and $0.13, respectively, compared to $27.1 million and $0.50, respectively, for the second quarter of fiscal 2023. In the second quarter of fiscal 2024, as a result of the amendments and associated maturity date extensions and interest rate margin reductions related to the November 15, 2023 refinancing of the Company’s debt facilities, the Company recognized total expense of $14.7 million. Approximately $7.5 million of this expense is classified as interest expense in the Company’s Condensed Consolidated Statements of Income and Comprehensive Income and primarily represents extinguishment charges, and the remaining $7.2 million of this expense is classified as administrative expense and primarily represents third-party costs attributed to the modified debt facilities.

Management Commentary

“Similar to last year, our fiscal second quarter financial results were impacted by cautious wholesale ordering patterns by our North American independent dealers in response to challenging seasonal market conditions and the elevated interest rate environment. Against this backdrop, our operating teams maintained a prudent focus on operational execution that prioritizes through-cycle profitability while also actively assisting independent dealers in managing their respective inventory positions. We have implemented a disciplined operating approach in a softer demand environment that involves producing the right mix of products at price points that resonate with today’s more budget-conscious consumer. In addition, we are working with our supplier partners to identify opportunities to reduce costs where possible,” said Todd Woelfer, Senior Vice President and Chief Operating Officer.

“In North America, we took deliberate actions of maintaining production discipline balanced with increased dealer assistance to help address the current macro environment. During the fiscal second quarter, we continued to sustain production levels that mirror the pace of retail sales, resulting in modest restocking of approximately 4,000 units, far below historical restocking levels for our fiscal second quarter. Our teams provided increased incentive support to our independent dealers aimed at helping pull prior-model-year product through and to assist dealers facing cash flow constraints. Additionally, through the quarter, we continued to leverage our variable cost model as we achieved greater footprint consolidation and operational efficiencies. As a result of these actions, we are well positioned to work with our independent dealers to endure current market conditions and emerge in a stronger position with the resumption of long-term market growth trends,” continued Woelfer.

“In Europe, fiscal second quarter net sales increased 20.9% while income before income taxes increased by more than 200% compared to the prior-year period. While we consider independent dealer inventories of European products to be restocked to appropriate levels exiting the second quarter of fiscal 2024, we are extremely pleased with the continued efforts of our European teams to drive continued operational efficiencies to sustain a strong profitability profile and work towards recapturing market share of motorized product as a result of improved chassis availability. This positioned our European companies to provide acceptable levels of inventories to our European dealers,” concluded Woelfer.

“Despite navigating through a challenging quarter, we continue to actively manage our balance sheet to maintain a strong financial position. During the quarter, the Company entered into an amendment to its term-loan credit facility to extend its maturity from February 2026 to November 2030 and reduce the applicable margin used to determine the interest rate on USD loans by 0.25% while concurrently amending its ABL agreement to extend the maturity from September 2026 to November 2028. This proactive refinancing secured access to long-term financing with favorable pricing terms and largely unchanged covenants and provisions while also ensuring adequate capital availability. As of January 31, 2024, we had liquidity of approximately $1.3 billion, including approximately $340.2 million in cash on hand and approximately $938.0 million available under our asset-based revolving credit facility. Looking ahead to the second half of fiscal 2024, and consistent with historical trends, we expect to generate strong net cash flow from operations driven by operating results in addition to reduced net working capital levels. Our financial strength and strong cash generation profile will continue to provide significant financial flexibility and support our efforts to advance and capitalize on our long-term strategic plan,” said Colleen Zuhl, Senior Vice President and Chief Financial Officer.

Outlook

“We are cautious heading into the prime retail selling season as we believe North American dealers will maintain tight control over inventory levels until retail demand firms. The macro environment remains under pressure from elevated interest rates that impact the cash flow of our independent dealers as well as consumers’ desire to make large discretionary purchases. Given this backdrop, we will maintain a prudent focus on solid operational execution through disciplined production, product portfolio optimization and cost management as we move into the second half of the fiscal year,” said Martin.

“Although the near-term environment is challenging, we expect improving market conditions as we progress through calendar 2024. We continue to be very optimistic about the strong underlying interest for the RV lifestyle and consumer demand for our robust RV product offering. As the global leader in the RV industry, our ability to continually innovate and adapt in an ever-evolving market landscape positions us to succeed. Furthermore, our strong balance sheet and cash generation ability, underpinned by our variable cost model, enable us to advance on our strategic initiatives to drive long-term growth,” added Martin.

THOR’s consolidated results were primarily driven by the results of its individual reportable segments as noted below.

Segment Results

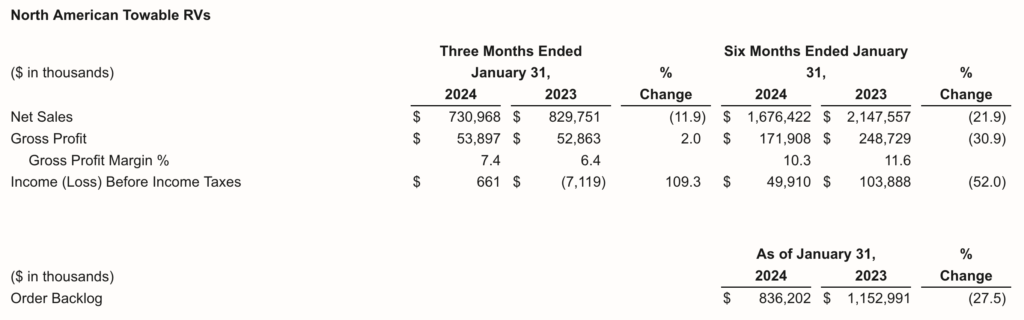

- North American Towable RV net sales were down 11.9% for the second quarter of fiscal 2024 compared to the prior-year period, driven by a 10.2% increase in unit shipments offset by a 22.1% decrease in the overall net price per unit. The decrease in the overall net price per unit was primarily due to the combined impact of a shift in product mix toward travel trailers and more moderately-priced units along with price compared to the prior-year period.

- North American Towable RV gross profit margin was 7.4% for the second quarter of fiscal 2024, compared to 6.4% in the prior-year period. The increase in gross profit margin was primarily driven by a decrease in the material cost percentage, due to the combined favorable impacts of product mix changes and cost-savings initiatives, partially offset by higher labor and manufacturing overhead percentages.

- North American Towable RV income before income taxes for the second quarter of fiscal 2024 was $0.7 million, compared to a loss before income taxes of $7.1 million in the second quarter of fiscal 2023. This improvement was driven primarily by lower amortization costs and larger gains on the sales of fixed assets in the current year period.

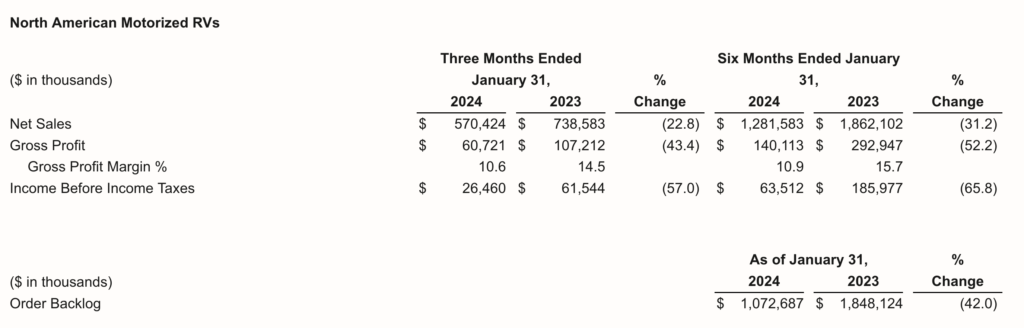

- North American Motorized RV net sales decreased 22.8% for the second quarter of fiscal 2024 compared to the prior-year period. The decrease was primarily due to an 18.4% reduction in unit shipments, partly due to independent dealer restocking in the prior-year period, as well as a 4.4% decrease resulting from changes in product mix and net price per unit as current-year shipments trended toward more moderately-priced units and included elevated sales discounts compared to the prior-year period.

- North American Motorized RV gross profit margin was 10.6% for the second quarter of fiscal 2024, compared to 14.5% in the prior-year period. The decrease in the gross profit margin for the second quarter of fiscal 2024 was primarily driven by an increase in sales discounts and chassis costs as well as an increase in manufacturing overhead cost as a percentage of net sales due to the reduction in net sales.

- North American Motorized RV income before income taxes for the second quarter of fiscal 2024 decreased to $26.5 million compared to $61.5 million in the prior-year period, driven by the decrease in net sales and the decline in the gross margin percentage.

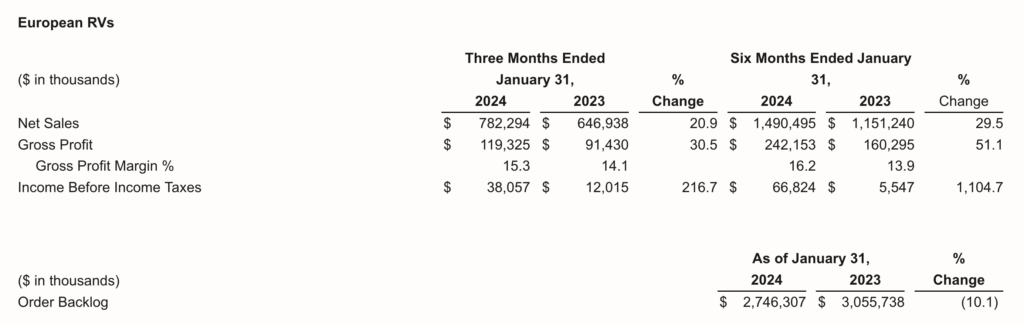

- European RV net sales increased 20.9% for the second quarter of fiscal 2024 compared to the prior-year period, driven by a 3.9% increase in unit shipments and a 17.0% increase in the overall net price per unit due to the total combined impact of changes in foreign currency, product mix and price. The overall net price per unit increase of 17.0% includes a 4.1% increase due to the impact of foreign currency exchange rate changes.

- European RV gross profit margin was 15.3% of net sales for the second quarter of fiscal 2024 compared to 14.1% in the prior-year period. This improvement in the gross profit margin for the quarter was primarily driven by net selling price increases, product mix changes and a reduction in labor costs as a percentage of net sales.

- European RV income before income taxes for the second quarter of fiscal 2024 was $38.1 million compared to income before income taxes of $12.0 million during the second quarter of fiscal 2023. The improvement was primarily driven by the increase in net sales.

Fiscal 2024 Guidance

The Company’s fiscal 2024 guidance has been revised to reflect challenging market conditions expected to persist into the second half of fiscal 2024. Based on current North American order intake levels through the end of February, the Company is lowering its consolidated net sales and diluted earnings per share guidance ranges to reflect a lowered fiscal year 2024 North American industry wholesale shipment range of between 330,000 and 340,000 units, which is more conservative than our previous shipment range of between 350,000 and 365,000 units.

For fiscal 2024, the Company’s updated full-year guidance now includes:

- Consolidated net sales in the range of $10.0 billion to $10.5 billion (previously $10.5 billion to $11.0 billion)

- Consolidated gross profit margin in the range of 14.0% to 14.5% (previously 14.5% to 15.0%)

- Diluted earnings per share in the range of $5.00 to $5.50 (previously $6.25 to $7.25)

“The combination of the delay in interest rate relief and softer return of the retail market as the macroeconomic challenges persist has delayed the return of stronger top and bottom lines from our expectations at the beginning of our fiscal year. Because we have not assumed any material relief from these macroeconomic challenges through the balance of fiscal 2024, we have revised our guidance to match our current outlook and will continue to manage the business in line with this more cautious view. While this delay will impact our earnings results in fiscal 2024, we have strong confidence in our ability to deliver on our revised fiscal 2024 outlook,” concluded Martin.

Supplemental Earnings Release Materials

THOR Industries has provided a comprehensive question and answer document, as well as a PowerPoint presentation, relating to its quarterly results and other topics.

To view these materials, go to http://ir.thorindustries.com.

About THOR Industries, Inc.

THOR Industries is the sole owner of operating companies which, combined, represent the world’s largest manufacturer of recreational vehicles.

For more information on the Company and its products, please go to www.thorindustries.com.