Soft Marine Demand Continues, Some Bright Spots Exist – RVBusiness – Breaking RV Industry News

The latest data from National Marine Manufacturers Association’s (NMMA) Monthly Recreational Boating Industry Data Summary report, covering the rolling period from April 2024 through March 2025, offers a tempered view of the recreational boating market as it navigates economic headwinds and evolving consumer behavior. While core indicators reflect continued softness in retail sales, some resilience in key segments and moderating economic pressures suggest a complex — but potentially stabilizing — market ahead.

Key findings from the March 2025 report include:

- For the 12-month period ending March 2025, total new powerboat retail unit sales decreased 7.4% year-over-year, reaching 231,144 units.

- In the first quarter of 2025, retail unit sales were down 8.4% compared to the same period in 2024, totaling 38,940 units. This marks a modest softening from February’s 4.8% decline, indicating the market continues to face near-term challenges.

- The Personal Watercraft and Yacht segments saw gains, up 325 and 40 units respectively, over the previous March.

“With our complete picture of March in hand across wholesale and retail, it’s clear the industry continued adjusting to a shifting economic climate as the question of tariffs loomed throughout the month and as we look at early data for April and into May, we’re seeing a bit of a see-saw that could play out into the summer,” said Ellen Bradley, NMMA’s senior vice president and chief brand officer. “While sales volumes are softer compared to the post-pandemic peak, there are bright spots peeking out and the boating industry’s challenge and opportunity lies in adapting to today’s more cautious consumer while promoting the wellness, connection and adventure that boating uniquely provides. Remaining vigilant in understanding shifting consumer behaviors and adapting our strategies accordingly is essential. Whether it’s through innovative product development, engaging lifestyle marketing campaigns like Discover Boating, or closer partnerships with our dealer and supplier networks to identify new opportunities, the industry’s ability to inspire and connect with the next generation of boaters will continue define our long-term trajectory.”

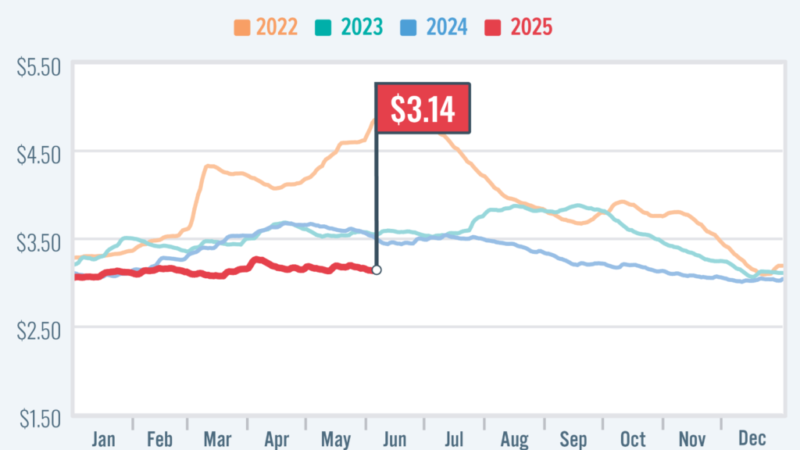

Macroeconomic conditions in March again offered a mixed picture for the recreational boating sector as inflation cooled to 2.4%, down from 2.8% in February, offering modest relief to consumer budgets. The 30-year fixed mortgage rate dipped slightly to 6.7%, yet high financing costs continue to impact interest-sensitive purchases like boats. Consumer confidence dropped in March to 92.9, and the Consumer Sentiment Index fell to 57.9, reflecting the consumer caution that had been building. Housing starts declined sharply to 1.34 million units, while gas prices began to ease. While the broader economic outlook remains uncertain, the industry has reason for measured optimism.

NMMA’s Monthly Recreational Boating Industry Data Summary report is published at the beginning of each month and is available at no cost to members. The full report includes comprehensive retail and wholesale data, engine and segment breakdowns, and key economic indicators relevant to marine businesses.

NMMA’s Monthly Recreational Boating Industry Data Summary report is available at no cost for members. Associate members can purchase an annual subscription for $1,800.

Download the latest report here.