Shyft Group Sees Slight Sales Decline in Q4, Off 9.9% in ’24 – RVBusiness – Breaking RV Industry News

NOVI, Mich. – The Shyft Group Inc. (NASDAQ: SHYF), the North American leader in specialty vehicle manufacturing, assembly and parent company of Spartan Chassis, today reported operating results for the fourth quarter and full-year ended December 31, 2024.

Operational highlights included:

- Delivered double-digit Fleet Vehicles and Services (FVS) margins bolstered by operational improvements

- Strong Specialty Vehicles (SV) margins

- Successfully shipped Blue Arc™ Class 4 EV trucks to FedEx

- Provides full-year 2025 sales outlook of $870 to $970 million, up 17% year-over-year at the midpoint

- Entered into transformative merger agreement with Aebi Schmidt; remains on track to close by mid-2025

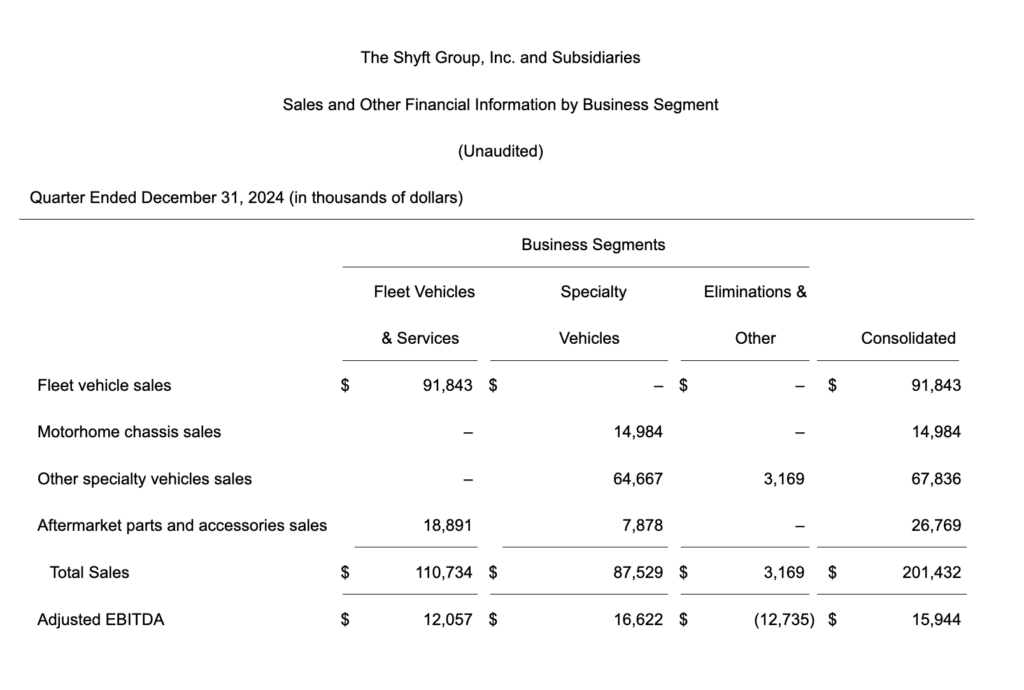

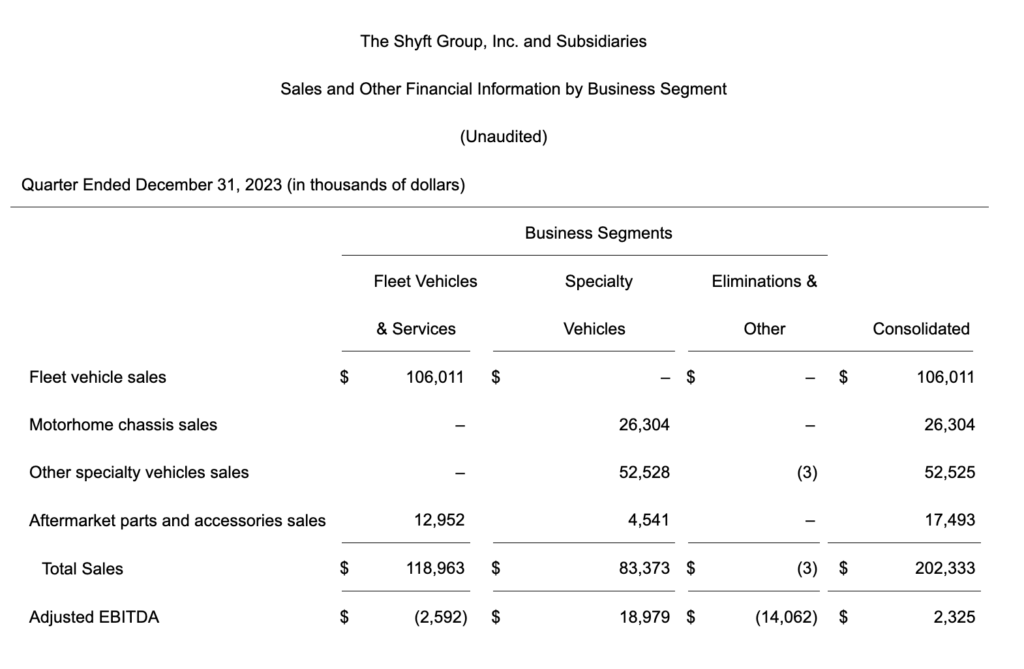

Fourth Quarter 2024 Financial Highlights

For the fourth quarter of 2024 compared to the fourth quarter of 2023:

- Sales of $201.4 million, a decrease of $0.9 million, or 0.4%, from $202.3 million

- Net loss of $3.4 million, or ($0.10) per share, compared to a loss of $4.4 million, or ($0.13) per share; 2024 results include $8.5 million of transaction expenses

- Adjusted EBITDA of $15.9 million, or 7.9% of sales, an increase of $13.6 million, from $2.3 million, or 1.1% of sales; results include $5.8 million of EV pre-production related costs versus $9.3 million in the prior year

- Adjusted net income of $5.0 million, or $0.15 per share, compared to a loss of $0.9 million, or ($0.03) per share

- Consolidated backlog1 of $313.2 million as of December 31, 2024, down $96.0 million, or 23.5%, compared to $409.3 million as of December 31, 2023

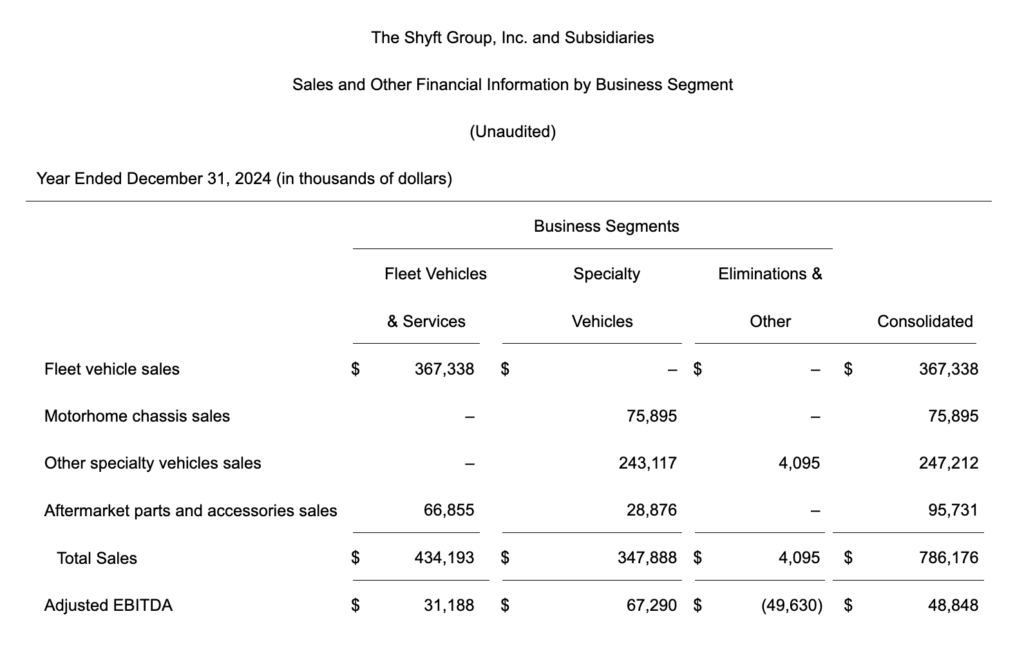

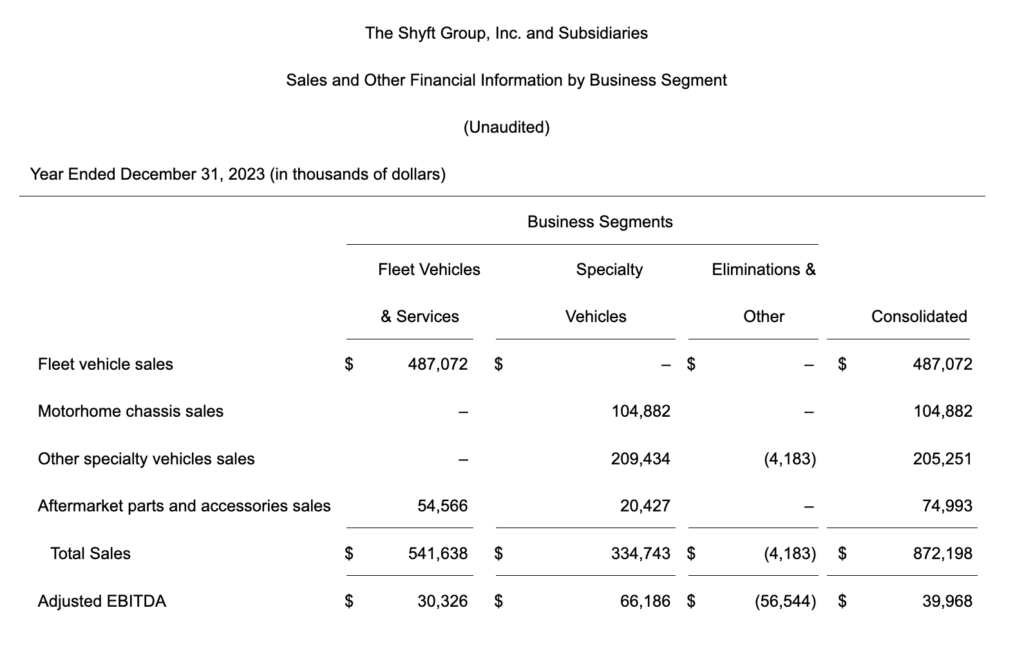

Full-Year 2024 Financial Highlights

For the full-year 2024 compared to the full-year 2023:

- Sales of $786.2 million, a decrease of $86.0 million, or 9.9%, from $872.2 million

- Net loss of $2.8 million, or ($0.08) per share, compared to net income of $6.5 million, or $0.19 per share

- Adjusted EBITDA of $48.8 million, or 6.2% of sales, an increase of $8.8 million, from $40.0 million, or 4.6% of sales; results include $23.3 million of EV pre-production related costs versus $32.6 million in the prior year

- Adjusted net income of $15.0 million, or $0.44 per share, compared to adjusted net income of $18.7 million, or $0.54 per share

“Our disciplined execution of Shyft’s operational framework drove meaningful adjusted EBITDA growth and margin improvement,” said John Dunn, President and CEO. “I am pleased with the team’s relentless focus on operational excellence as SV sustained strong profitability, supported by steady infrastructure demand, while FVS achieved double-digit margins despite a challenging parcel market.”

2025 Financial Outlook

“Building on our solid results this quarter, we expect continued improvement in our profitability in 2025. Blue Arc EV transitioning into production, together with the anticipated recovery of the parcel market in the second half of the year, are expected to support these improvements,” said Scott Ocholik, Interim Chief Financial Officer.

Full-year 2025 outlook, notwithstanding further changes in the operating environment, is as follows:

- Sales of $870 to $970 million

- Adjusted EBITDA of $62 to $72 million

- Adjusted earnings per share of $0.69 to $0.92

- Free cash flow of $25 to $30 million

Dunn concluded, “As we move forward in 2025, our pending merger with Aebi Schmidt is accelerating our strategy, establishing the company as a global leader in specialty vehicles, with the scale and resources delivering growth, enhancing our customer-centric approach, and maximizing value for our shareholders. Our integration efforts are well underway, ensuring a seamless transition that leverages the strengths of both organizations. We are excited to unite our talented teams and build an even stronger platform for long-term success.”

Conference Call and Webcast Information

The Shyft Group will host a conference call at 8:30 a.m. ET today to discuss these results and current business trends. The conference call and webcast will be available via:

Webcast: https://theshyftgroup.com/investor-relations/webcasts/

Conference Call: 1-844-868-8845 (domestic) or 412-317-6591 (international)