Seeking Alpha Analyzes Camping World’s Financial Results – RVBusiness – Breaking RV Industry News

EDITOR’S NOTE: The following is an edited excerpt of a report by Sandpiper Investment Research that was published by Seeking Alpha, a popular crowd-sourced content service that publishes news on financial markets. Click here to read the report in full.

Camping World Holdings (NYSE:CWH) is a provider of recreational vehicles (RVs) and camping-related gear. Over the years, the company has pursued an accretive RV dealership roll-up strategy and pushing greater reliance upon the less cyclical used RV market. With challenges in the RV industry including softer demand post-pandemic, the company’s latest quarters have shown lower EBITDA as the company navigates cyclical headwinds. In this article, I’ll explain why I see an opportunity here for Camping World, given low investor sentiment and a potential trough in consumer demand for RVs.

Company Overview

Camping World, as the name might imply, specializes in selling RVs, camping gear, and related outdoor products. It operates as both a retailer and a service provider for RV enthusiasts across the United States. Founded by Marcus Lemonis, Camping World has become one of the largest RV dealerships in the country, offering a wide range of RVs, from motorhomes to travel trailers, as well as accessories and camping supplies. The company also provides maintenance and repair services for RVs, making it a comprehensive resource for both new and experienced RV owners.

Camping World has over 100 dealership locations, making it the largest player in the market for RV sales and supplies. Operating in a fragmented industry, the company has a competitive advantage whereby its scale provides it with several benefits over smaller peers. This includes a wider assortment of inventory, better gross margins (even with volume discounts), and more favorable terms with lenders.

Background

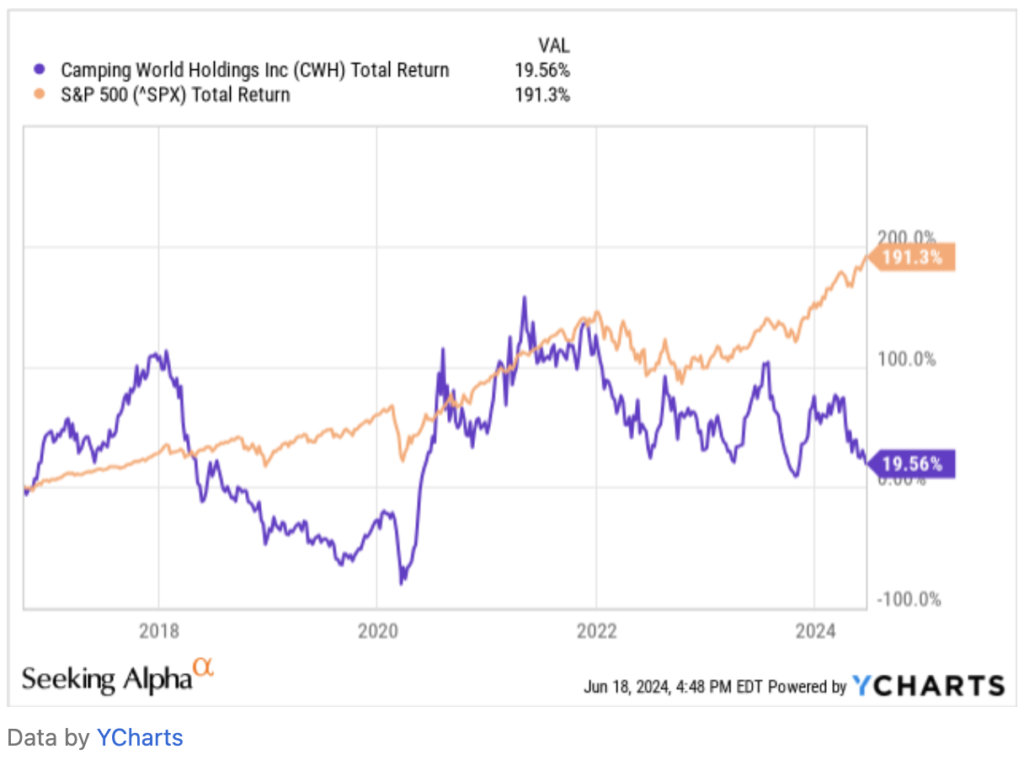

Shares of Camping World have been trading close to 52-week lows, providing a disappointing return of 29% year to date for investors. Over the last ten years, shares are essentially flat, having delivered a total return of 191%, most of which came from the company’s 2.7% dividend. Compared to the S&P500’s return of -20% over the same period, Camping World’s shares have underperformed significantly.

When looking at the financial performance of Camping World over time, the company has growth in revenues and EBITDA at CAGRs of 10.2% and 6.7%, respectively. In the last five years, the company has exhibited a decelerating growth rate, with revenues and EBITDA growing at 5.4% and 3.2%, respectively (source: S&P Capital IQ). With the revenue CAGR higher than the EBITDA CAGR for both periods, this shows that Camping World hasn’t been able to extract margin expansion consistently over time.

When looking at the financial performance of Camping World over time, the company has growth in revenues and EBITDA at CAGRs of 10.2% and 6.7%, respectively. In the last five years, the company has exhibited a decelerating growth rate, with revenues and EBITDA growing at 5.4% and 3.2%, respectively (source: S&P Capital IQ). With the revenue CAGR higher than the EBITDA CAGR for both periods, this shows that Camping World hasn’t been able to extract margin expansion consistently over time.

So what’s going on? One of the biggest challenges is that the camping industry in general is highly cyclical. After all, you’re not going to go out and buy an RV if you’ve lost your job in a recession or if food inflation is hitting your wallet. Thus, Camping World does well when the economy does well (disposable incomes rise) and it does poorly when the economy suffers (disposable incomes fall).

Another factor is that there was a strong pull-forward of demand during the pandemic era, when people were at home (or camping!) and wanted to spend money. Now, it’s a buyers’ market for RVs as new RV sales fell roughly 20% in 2023, according to a dealer association in Canada. While rentals are still strong, there’s still a lot of pre-owned inventory on dealership lots right now and demand has been soft for new RVs.

In the U.S., demand is slightly better, but these are still large-dollar items for individuals and families, with a small pop-up, tow-behind trailer costing between $12,000 to $15,000, all the way up to others that go for $250,000 and higher for a motorhome or luxury offering. With higher interest rates and the cost of borrowing going up, consumers are more sensitive to the overall price tag of recreational vehicles, making careful financial planning and decision-making increasingly crucial.