RV Segment Boosts Patrick Industries’ Q1 Financial Results – RVBusiness – Breaking RV Industry News

First Quarter 2024 Highlights (compared to First Quarter 2023 unless otherwise noted)

- Net sales increased 4% to $933 million driven by a 15% increase in RV revenue, a 5% increase in housing revenue, and acquisitions, which together more than offset lower marine revenue.

- As previously announced, Patrick completed the acquisition of Sportech, LLC, a supplier of high-value component solutions to the powersports industry on January 24th, representing the Company’s largest acquisition to date.

- Operating margin increased 20 basis points to 6.4%. Excluding acquisition transaction costs and purchase accounting adjustments in both periods, adjusted operating margin increased 70 basis points year-over-year.

- Net income increased 16% to $35 million compared to $30 million in the first quarter of 2023. Diluted earnings per share of $1.59 increased 18% compared to $1.35 for the first quarter of 2023.

- Excluding acquisition transaction costs and purchase accounting adjustments in both periods, adjusted diluted earnings per share increased 31% to $1.79.

- Adjusted EBITDA increased 14% to $111 million; adjusted EBITDA margin increased 110 basis points to 11.9%.

- Cash flow provided by operations was $35 million in the first quarter compared to cash used in operations of $1 million in the same period last year. On a trailing twelve-month basis, operating cash flow through the first quarter of 2024 was $445 million, an increase of 3% compared to $434 million through the first quarter of 2023.

- Maintained solid balance sheet and liquidity position, with net leverage at 2.8x, which reflects the acquisition of Sportech in January, helping to ensure ability to capitalize on potential future opportunities.

ELKHART, Ind. – Patrick Industries, Inc. (NASDAQ: PATK), a leading component solutions provider for the Outdoor Enthusiast and Housing markets, today reported financial results for the first quarter ended March 31, 2024.

Net sales increased 4% to $933 million, an increase of $33 million compared to the first quarter of 2023. The increase in sales was primarily driven by higher revenue from our RV and housing end markets combined with the acquisition of Sportech, which together more than offset lower revenue from our marine end market.

Operating income of $59 million in the first quarter of 2024 increased $3 million compared to $56 million in the first quarter of 2023. Operating margin of 6.4% increased 20 basis points compared to 6.2% in the same period a year ago, as acquisition transaction costs and purchase accounting adjustments were more than offset by higher fixed cost absorption within our RV businesses and the benefits of cost savings initiatives executed in prior periods. Excluding acquisition transaction costs and purchase accounting adjustments in both periods, adjusted operating margin improved 70 basis points to 7.0% in the quarter.

Net income increased 16% to $35 million compared to $30 million in the first quarter of 2023. Diluted earnings per share of $1.59 increased 18% compared to $1.35 for the first quarter of 2023.

Excluding acquisition transaction costs and purchase accounting adjustments in both periods, adjusted net income increased 29% to $39 million or $1.79 per diluted share.

“Patrick returned to growth in the first quarter as a result of our disciplined operating management, market share growth, and strategic acquisition and diversification strategy,” said Andy Nemeth, chief executive officer. “We generated 15% higher RV revenue, which when coupled with stronger housing revenue and the first quarter acquisition of Sportech more than offset a 35% decline in our marine revenue. We leveraged our cost structure and delivered higher consolidated net sales and profit along with margin expansion.

“I am extremely proud of the entire Patrick team for their hard work during the quarter as our focus on providing the highest quality service and delivering value-added solutions supported our customers across our end markets,” Nemeth continued. “Our strong financial foundation and liquidity position facilitated our acquisition of Sportech, solidifying powersports as another Outdoor Enthusiast platform for Patrick. Our first quarter results further demonstrate the benefits of our diversification strategy, and when combined with our customer-focused philosophy, investment in higher-engineered products and ability to scale quickly to OEM needs, help to ensure that Patrick is in an ideal position to drive future organic and strategic growth as we look forward to an expected recovery in demand.”

Jeff Rodino, President – RV, said, “We are excited about the future of Patrick, as we realize the benefits of the investments we have made in business, talent, and infrastructure. Our team hit the ground running in the first quarter as we supported and collaborated with our customers, remaining agile and ready to pivot when necessary. We remain focused on profitable growth and generating free cash flow while maintaining a balanced capital allocation strategy, with a focus on expanding our presence within our end markets as we strive to make Patrick the supplier of choice to the Outdoor Enthusiast and Housing markets.”

First Quarter 2024 Revenue by Market Sector

(compared to First Quarter 2023 unless otherwise noted)

RV (45% of Revenue)

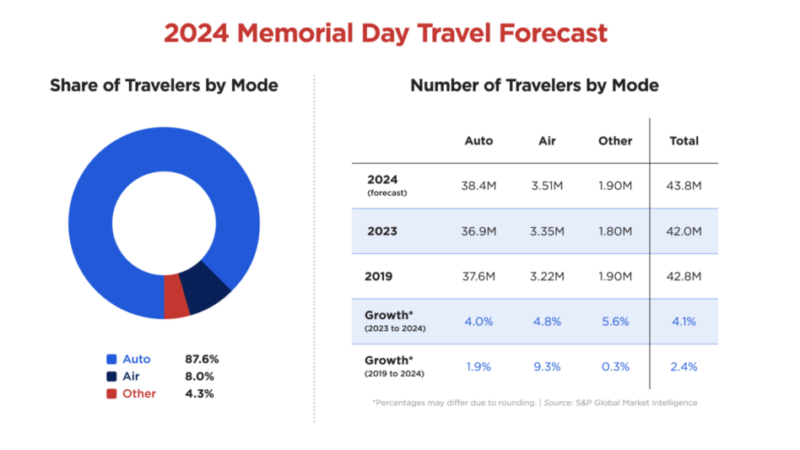

- Revenue of $421 million increased 15% while wholesale RV industry unit shipments increased 9%.

- Content per wholesale RV unit (on a trailing twelve-month basis) decreased 9% to $4,859. Compared to the fourth quarter of 2023, content per wholesale RV unit (on a trailing twelve-month basis) increased 1%, representing the first sequential increase in content per unit since the first quarter of 2023.

Marine (17% of Revenue)

- Revenue of $155 million decreased 35% while estimated wholesale powerboat industry unit shipments decreased 34%. Powersports revenue was previously included in our Marine end market. End market revenue and content per unit reflect this change for the relevant periods.

- Estimated content per wholesale powerboat unit (on a trailing twelve-month basis) decreased 9% to $4,049. Compared to the fourth quarter of 2023, estimated content per wholesale powerboat unit (on a trailing twelve-month basis) decreased less than 1%.

Powersports (9% of Revenue)

- Revenue of $83 million increased 152%, driven primarily by the acquisition of Sportech.

Housing (29% of Revenue, comprised of Manufactured Housing (“MH”) and Industrial)

- Revenue of $275 million increased 5%; estimated wholesale MH industry unit shipments increased 13%; total housing starts increased 1%.

- Estimated MH content per wholesale MH unit (on a trailing twelve-month basis) increased 1% to $6,422. Compared to the fourth quarter of 2023, estimated content per wholesale MH unit (on a trailing twelve-month basis) increased 1%.

Balance Sheet, Cash Flow and Capital Allocation

For the first three months of 2024, cash provided by operations was $35 million compared to cash used in operations of $1 million for the prior year period. This improvement was driven primarily by a $27 million reduction in working capital utilization and a $5 million increase in net income. Purchases of property, plant and equipment totaled $15 million in the first quarter of 2024, reflecting continued investments in alignment with our automation and technology initiatives. On a trailing twelve-month basis, free cash flow through the first quarter of 2024 was $391 million, an increase of 11% compared to $352 million through the first quarter of 2023. Our long-term debt increased approximately $373 million during the first quarter of 2024 primarily to fund the acquisition of Sportech.

We remained disciplined in allocating and deploying capital, returning approximately $13 million to shareholders in the first quarter of 2024 through dividends. We remain opportunistic on share repurchases and had $78 million left authorized under our current plan at the end of the first quarter.

Our total debt at the end of the first quarter was approximately $1.41 billion, resulting in a total net leverage ratio of 2.8x (as calculated in accordance with our credit agreement). Pro forma net leverage at the time of the acquisition of Sportech in January 2024 was approximately 2.9x. Available liquidity, comprised of borrowing availability under our credit facility and cash on hand, was approximately $413 million.

Business Outlook and Summary

“Our team continues to execute on our business objectives, including providing innovative product solutions, generating long-term profitable growth, maintaining a strong financial foundation, and our goal of providing a best-in-class customer experience delivering value for all stakeholders,” continued Mr. Nemeth. “We are poised and ready to meet the opportunities and challenges that may present themselves this year, as evidenced by our solid performance over the last two years despite the headwinds we faced in our markets. The RV and MH markets returned to year-over-year wholesale shipment growth in the first quarter and we believe our marine end market will begin to stabilize in the back half of 2024. We have a number of product innovations in development which will also help drive further organic growth. Our job is to remain operationally and financially agile, ready to support our customers in any environment. As Patrick enters its 65th year as a company, we remain optimistic about the future and see positive long-term trends within the Outdoor Enthusiast and Housing markets we serve, with numerous profitable organic and strategic growth opportunities available to the Company in the future.”

Conference Call Webcast

Patrick Industries will host an online webcast of its first quarter 2024 earnings conference call that can be accessed on the Company’s website, www.patrickind.com, under “For Investors,” on Thursday, May 2, 2024 at 10:00 a.m. Eastern Time. In addition, a supplemental earnings presentation can be accessed on the Company’s website, www.patrickind.com under “For Investors.”

About Patrick Industries, Inc.

Patrick (NASDAQ: PATK) is a leading component solutions provider serving the RV, Marine, Powersports and Housing markets. Since 1959, Patrick has empowered manufacturers and outdoor enthusiasts to achieve next-level recreation experiences. Our customer-focused approach brings together design, manufacturing, distribution, and transportation in a full solutions model that defines us as a trusted partner. Patrick is home to more than 85 leading brands, all united by a commitment to quality, customer service, and innovation. Headquartered in Elkhart, IN, Patrick employs approximately 10,000 skilled team members throughout the United States. For more information on Patrick, our brands, and products, please visit www.patrickind.com.