RV Park Sales Slow Slightly Due to Interest Rates, Inflation

Credit: Shutterstock

Inflation does not appear to be dampening consumers’ enthusiasm for camping this year, but higher interest rates are slowing down the sales pace of campground and RV park properties, according to campground operators and park brokers.

“The pace of sales and transactions per month are definitely slowing for everyone, just like house, car and RV sales are slowing,” said Russell Baehre, of Baehre Real Estate LLC in Kerrville, Texas.

Campground and RV park sales are slowing for a variety of reasons.

“Banks are quoting higher interest rates, higher debt service coverage ratios and looking for higher loan-to-value ratios. This has all affected CAP rates and values,” Baehre said.

Inflation, meanwhile, is affecting parks’ bottom lines.

“The inflation rate has affected all of the parks’ net income because they are all having to pay higher wages, electricity, insurance, which either has to get passed down to the consumer, i.e., the RVer, or absorbed by the park,” Baehre said. “If absorbed by the park it inevitably lowers their net income and, in the end, the value from that perspective.”

John Sheedy, vice president of Park Brokerage Inc., said prices for campgrounds and RV parks are coming down in response to rising interest rates.

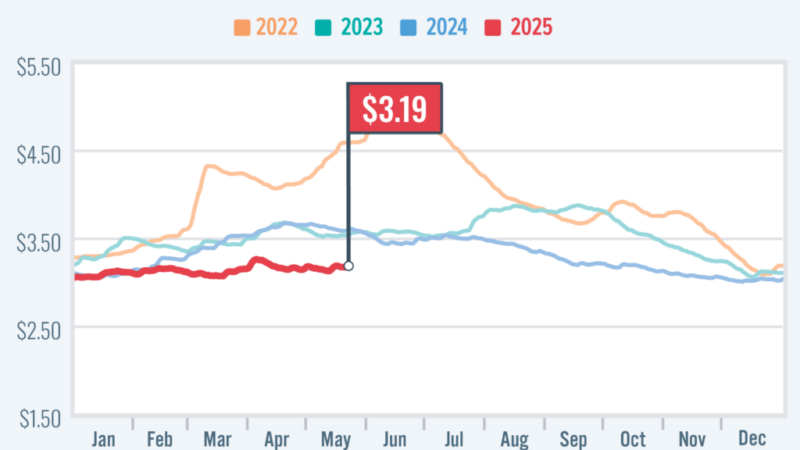

“Compared to 2021, when one could get a mortgage in the 4% to 5% range, current mortgage rates for RV parks are generally in the high 6% to 7% range, which has increased underlying monthly mortgage payments by 30% to 40%,” Sheedy said.

John Sheedy

Insurance rates are also spiking in areas of the country that are at risk of wildfires and hurricanes, he said.

“You are seeing significant insurance cost increases on the sale of properties and buyers are factoring in this additional cost when purchasing,” Sheedy said.

Sheedy estimates that RV park prices have fallen anywhere from 10% to 30% as a result of market conditions as well as parks’ year-over-year revenue. Many parks had lower income in 2022 versus 2021 for a variety of reasons, including a softer economy and higher gas prices, he estimates.

Despite the negative effects of higher inflation and interest rates, Baehre said he is still selling parks as fast as he can list them. Sheedy also continues to see very strong interest in RV park purchases.

“There has never been this much investor interest in RV parks, especially at the institutional level, but the prices do have to make sense,” he said.

Sheedy added that even though RV park and campground prices are generally lower than they were in 2021, RV park and campground valuations remain higher than they have ever been.

“It’s important to look at your valuations over a five to 10-year window and not be emotionally attached to one all-time high moment,” Sheedy said. “2021 was likely the exception, not the rule. If every owner went back five years without knowing what their property was worth in 2021, they’d be ecstatic. Most parks, while down 15% to 20% since 2021, are still up 60% to 80% in value since 2018. It’s extremely difficult to time a sale perfectly. (But) most parks and campgrounds are still worth a lot of money.”

For his part, Scott Crompton, a broker with VESKCO, said he is also seeing continued investor interest in private parks. “

“RV parks, like other recurring revenue model businesses, will continue to attract private and institutional buyers.” he said, adding, “There’s a big appetite for very well-run parks that have made investments in infrastructure. A well-run, well-managed, well-built RV park is always going to have good value.”

Jesse Pine

Jesse Pine, a broker at NAI Outdoor Hospitality Brokers, also remains optimistic about the strength of demand for private parks.

“The transaction volume has decreased compared to eight or 12 months ago, and that is mostly due to higher interest rates making purchasing an RV park more expensive and lenders being more cautious in writing new loans,” he said, adding, “If rates settle and come down 100 basis points, I would expect the volume to resume back to where it was. Generally, the high-interest rates are raising cap rates marginally, which is decreasing the overall value of properties. Also, 2021 was a banner year for most owners and (in) 2022 parks were down 5-10% in gross income commonly across the country, coupled with higher expenses like rising utility, labor and construction costs, so the result was lower than expected net income.

“Overall though, there are as many RV park buyers as ever,” Pine continued, “and they are often first-time buyers coming from other real estate asset types who are seeking higher yields and are looking at RV parks as a quality investment choice to add to their portfolio. As long as the numbers make sense, and both buyers and sellers have some common ground on pricing, then transactions will keep on a steady pace this year. Large parks with a mix of short- and long-term guests near major metros or close to a major tourism draw will continue to be most sought after to a broad buyer pool.”

For their part, companies that have been looking to invest in RV parks and campgrounds plan to continue to do so, including Athena Real Estate of Orlando, Fla., which has grown its Applebrook brand of RV parks and resorts from a single park, Cypress Campground in Winter Haven, Fla. 15 years ago to 13 RV parks and resorts in four states, including RV resorts in New Orleans, La., Atlantic City, N.J., and Lake George, N.Y.

Richard J. O’Brien

“It’s definitely a different market,” said Richard J. O’Brien, CEO of Athena Real Estate. But he said his company plans to continue to acquire RV parks and expand its footprint across the country. “We buy across the country so long as a park has multiple demand drivers and 200 sites or greater. We are also looking to be creative to partner with owners development parks and park owners in the Western part of the U.S.”

Higher interest rates and inflation are making park buyers more selective, however.

“Before you could borrow money at 4% and now it’s 8%. That makes it harder to buy,” said James Omstrom, of Open Road Resorts in Heath, Texas. “That doesn’t mean you can’t find good properties. But if we make an offer, we have to be cognizant of what (costs) we’re taking on.”

Despite these hurdles, families and small investors continue to be very interested in purchasing campgrounds, according to Cathy Reinard, an associate broker with DWC Properties in Brockport, N.Y.

“I am seeing that a family buyer or a small investor seems to be willing to pay more money overall for a park than the larger capital groups are at this time,” she said. “I believe it is because a family buyer is in this business for the long haul, or at least a longer period of time than a lot of the capital investment groups. They feel they can refinance the park later when rates drop so they are willing to pay more money in general for the park as long as they can get it financed.

Cathy Reinard

“The current interest rate environment has created a lot of buyers with a strong down payment,” Reinard added. “Buyers who take a look at SBA and USDA loans for the longer amortization, because these buyers have faith in themselves, they are less nervous about where the economy is going. Many of these investor groups are looking to flip out in four or five years and don’t feel that they have the room to pay the crazy prices that were paid in the COVID years. Investors that want to be in the space for a while and family buyers are encouraged by the fact that this industry always does pretty well, even in an economic downturn. I primarily list KOAs for sale and I have seen an upsurge in interested buyers wanting the support and marketing power of a franchise. With the independent parks I sell, I have seen a lot more park owners and potential buyers asking about what associations they can join. What groups are there to support them in their endeavors?”

Inflation, meanwhile, is driving up the cost of both operating a park and making improvements.

“Inflation is dramatically higher than it was pre-COVID,” Omstrom said. “Whether it’s labor, materials, moving dirt, everything is significantly higher.”

As a result, he said, inflation could slow the pace of new park development and park expansions.

“Say you took on $1 million in debt in March of 2020 with an interest rate of 3.5%. Today, that rate is 7.5%,” Omstrom noted. “Your borrowing costs have more than doubled. So, what you can do depends on how cheap the park was to begin with. If you’re going to improve the park with all concrete roads, it’s going to be expensive. You’d better be in a market where you can get very good rates (for your RV sites and rental accommodations).”

Chris Scheer

Despite these rising development costs, some private park operators are moving ahead with their plans for both new campgrounds and expansions of existing parks, including Billings, Mont.-based Kampgrounds of America Inc.

(KOA).

“Despite inflation and external factors causing increases in development and construction costs, we’re continuing to see a high level of investment in both existing and new campgrounds,” said Chris Scheer, KOA’s chief financial officer. “Throughout 2022 five new KOA construction contracts were signed. In total, there are now 29 campgrounds in development, including three that are corporately owned. On existing KOA locations, KOA’s Campground Design Services completed designs for 3,504 new and redesigned sites. This includes 2,248 RV Sites, 435 with KOA Patios and 359 various accommodations and tent sites. Both established campground owners and new entrants into the market are still seeing the value of investing in campgrounds.”

Inflation does not seem to be hurting consumer interest in camping, either. KOA’s January camping survey found that 48% of campers felt that camping offers a more cost-friendly way to travel.

“Four in ten also shared that, even if the economy worsens, they will continue to camp while taking fewer vacations of other types,” Sheer said. “Impressively, 24% of campers plan to camp more if the economy continues to lag.”

Overall, KOA’s more than 500 campgrounds experienced a slight decrease in the number of camper nights compared to the extremely busy 2021, which was offset by an increase in the “per camper night” rate charged to campers caused by high inflation.

“At KOA,” Sheer said, “we anticipate a level of camping this year that is on par with 2022,” a year in which overall registration revenues were more than 30% higher than KOA’s pre-pandemic record set in 2019.

[embedded content]

Source: https://rvbusiness.com/rv-park-sales-slow-slightly-due-to-interest-rates-inflation/