REV Reports Fiscal Q1 Results; Reaffirms 2025 Guidance – RVBusiness – Breaking RV Industry News

- First quarter net sales of $525.1 million compared to $586.0 million in the prior year quarter, the latter of which included $76.6 million related to the Bus Manufacturing Businesses1

- Excluding the impact of the Bus Manufacturing Businesses, net sales increased $15.7 million, or 3.1% compared to the prior year quarter

- First quarter net income of $18.2 million compared to net income of $182.7 million in the prior year quarter, the latter of which included a $257.5 million gain on the sale of Collins1

- Record first quarter Adjusted EBITDA2 was $36.8 million compared to $30.5 million in the prior year quarter, the latter of which included $9.9 million related to Bus Manufacturing Businesses

- Excluding the impact of the Bus Manufacturing Businesses, Adjusted EBITDA increased $16.2 million, or 78.6% compared to the prior year quarter.

- First quarter Adjusted Net Income2 of $20.9 million compared to $14.7 million in the prior year quarter

- The company repurchased approximately 0.6 million of its common shares for $19.2 million during the quarter

- Reaffirms the 2025 guidance provided in our December 11, 2024 fourth quarter earnings press release

BROOKFIELD, Wis. – REV Group, Inc. (NYSE: REVG), a manufacturer of industry-leading specialty and recreational vehicles, today reported results for the three months ended Jan. 31, 2025 (first quarter 2025). Consolidated net sales in the first quarter 2025 were $525.1 million, compared to $586.0 million for the three months ended Jan. 31, 2024 (first quarter 2024). Net sales for the first quarter 2024 included $76.6 million attributable to the Bus Manufacturing Businesses. Excluding the impact of the Bus Manufacturing Businesses, net sales increased $15.7 million, or 3.1% compared to the prior year quarter. The increase, excluding the impact of the Bus Manufacturing Businesses, was primarily due to higher net sales in the Specialty Vehicles segment, partially offset by lower net sales in the Recreational Vehicles segment.

The company’s first quarter 2025 net income was $18.2 million, or $0.35 per diluted share, compared to net income of $182.7 million, or $3.06 per diluted share, in the first quarter 2024, which included a $257.5 million gain on the sale of Collins. Adjusted Net Income for the first quarter 2025 was $20.9 million, or $0.40 per diluted share, compared to Adjusted Net Income of $14.7 million, or $0.25 per diluted share, in the first quarter 2024. Adjusted EBITDA in the first quarter 2025 was $36.8 million, compared to $30.5 million in the first quarter 2024. Adjusted EBITDA for the first quarter 2024 included $9.9 million attributable to Bus Manufacturing Businesses. Excluding the impact of the Bus Manufacturing Businesses, Adjusted EBITDA increased $16.2 million, or 78.6% compared to the prior year quarter. The increase, excluding the impact of the Bus Manufacturing Businesses, was primarily due to the higher contribution from the Specialty Vehicles segment and lower contribution from the Recreational Vehicles segment.

“We are pleased to have delivered record first quarter results, demonstrating the strength of our operational execution and disciplined approach. This performance reinforces our confidence in the momentum we are building and positions us well for the year ahead. As a result, we are reaffirming our Fiscal 2025 guidance provided in December,” REV Group Inc. president and CEO, Mark Skonieczny, said. “Within the quarter we utilized our strong balance sheet and financial position to recommence share repurchases, which we view as an attractive use of capital at the current valuation. With a solid foundation of execution and momentum in place, we remain focused on driving continued growth and creating long-term value for our shareholders.”

1 In fiscal 2024, the company exited bus manufacturing through the sale Collins Bus Corporation (“Collins”) in the first quarter, and El Dorado National (California), Inc (“ENC”) in the fourth quarter. Collins and ENC are collectively referred to as the “Bus Manufacturing Businesses”.

2 REV Group, Inc. Adjusted Net Income and Adjusted EBITDA are non-GAAP measures that are reconciled to their nearest GAAP measure later in this release.

REV Group First Quarter Segment Highlights

Specialty Vehicles Segment

Specialty Vehicles segment net sales were $370.2 million in the first quarter 2025, a decrease of $47.0 million, or 11.3%, from $417.2 million in the first quarter 2024. Net sales for the first quarter 2024 included $76.6 million attributable to the Bus Manufacturing Businesses. Excluding the impact of the Bus Manufacturing Businesses, net sales increased $29.6 million, or 8.7% compared to the prior year quarter. The increase in net sales, excluding the impact of the Bus Manufacturing Businesses, compared to the prior year quarter was primarily due to increased shipments of fire apparatus, a favorable mix of ambulance units, and price realization, partially offset by lower shipments of terminal trucks. Specialty Vehicles segment backlog at the end of the first quarter 2025 was $4,226.1 million compared to $3,864.1 million at the end of the first quarter 2024. Backlog at the end of the first quarter 2024 included $84.2 million related to the Bus Manufacturing Businesses. Excluding the impact of the Bus Manufacturing Businesses, backlog increased $446.2 million compared to the prior year quarter. The increase, excluding the impact of the Bus Manufacturing Businesses, was primarily the result of continued demand and order intake for fire apparatus and ambulance units and pricing actions, partially offset by lower order intake for terminal truck units.

Specialty Vehicles segment Adjusted EBITDA was $35.2 million in the first quarter 2025, an increase of $9.0 million, or 34.4%, from Adjusted EBITDA of $26.2 million in the first quarter 2024. Adjusted EBITDA for the first quarter 2024 included $9.9 million attributable to the Bus Manufacturing Businesses. Excluding the impact of the Bus Manufacturing Businesses, Adjusted EBITDA increased $18.9 million, or 116.0% compared to the prior year quarter. Profitability within the segment, excluding the impact of the Bus Manufacturing Businesses, benefited from higher sales volume of fire apparatus as a result of throughput improvements, a favorable mix of ambulance units, and price realization, partially offset by inflationary pressures and lower contribution from the terminal trucks business.

Recreational Vehicles Segment

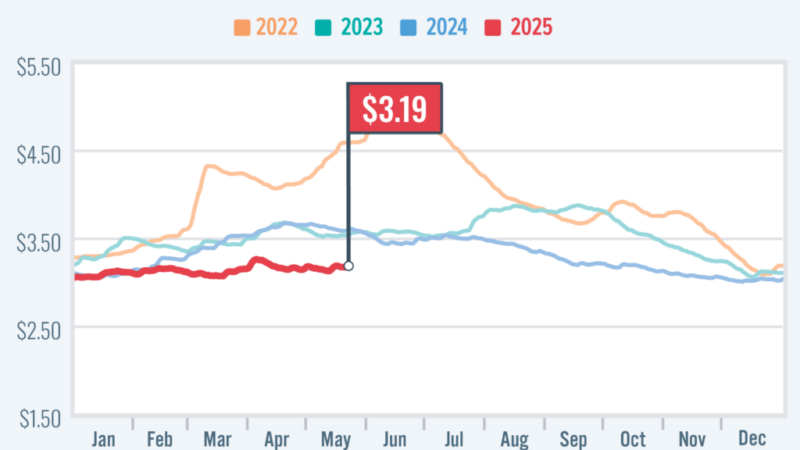

Recreational Vehicles segment net sales were $155.0 million in the first quarter 2025, a decrease of $14.4 million, or 8.5%, from $169.4 million in the first quarter 2024. The decrease in net sales compared to the prior year quarter was primarily due to decreased unit shipments and increased dealer assistance, partially offset by pricing actions. Recreational Vehicles segment backlog at the end of the first quarter 2025 was $264.5 million, a decrease of $112.2 million compared to $376.7 million at the end of the first quarter 2024. The decrease was primarily the result of lower order intake in certain categories, unit shipments against backlog, and order cancelations.

Recreational Vehicles segment Adjusted EBITDA was $9.2 million in the first quarter 2025, a decrease of $2.4 million, or 20.7%, from $11.6 million in the first quarter 2024. The decrease was primarily due to lower unit shipments, increased dealer assistance, and inflationary pressures, partially offset by productivity and cost reduction initiatives.

Working Capital, Liquidity, and Capital Allocation

Net debt3 totaled $108.4 million as of January 31, 2025, including $31.6 million cash on hand. The company had $262.9 million available under its ABL revolving credit facility as of January 31, 2025, a decrease of $86.7 million as compared to the October 31, 2024 availability of $349.6 million. On February 20, 2025, the Company amended the 2021 ABL Facility, extending the maturity of the facility and modifying certain terms. Details can be found in the Form 8-K filed on February 24, 2025.

During the first quarter 2025, the company repurchased approximately 0.6 million of its common shares for $19.2 million at an average purchase price of $33.09 per share, excluding commissions, fees and excise taxes. Trade working capital4 for the company as of January 31, 2025 was $290.2 million, compared to $248.2 million as of October 31, 2024. The increase was primarily due to an increase in accounts receivable, and a decrease in accounts payable, partially offset by an increase in customer deposits. Capital expenditures in the first quarter 2025 were $4.9 million compared to $10.5 million in the first quarter 2024.

| __________________________ |

| 3 Net Debt is defined as total debt less cash and cash equivalents. |

| 4 Trade Working Capital is defined as accounts receivable plus inventories less accounts payable and customer advances. |

Quarterly Dividend

The company’s board of directors declared a regular quarterly cash dividend in the amount of $0.06 per share of common stock, payable on April 11, 2025, to shareholders of record on March 28, 2025, which equates to a rate of $0.24 per share of common stock on an annualized basis.

Conference Call

A conference call to discuss the company’s first quarter 2025 business and financial results and our outlook is scheduled for March 5, 2025, at 10:00 a.m. ET. A supplemental slide deck will be available on the REV Group, Inc. investor relations website. The call will be webcast simultaneously over the Internet. To access the webcast, listeners can go to http://investors.revgroup.com/investor-events-and-presentations/events at least 15 minutes prior to the event and follow instructions for listening to the webcast. An audio replay of the call and related question and answer session will be available for 12 months at this website.

About REV Group

REV Group (REVG) companies are leading designers and manufacturers of specialty vehicles and related aftermarket parts and services, which serve a diversified customer base, primarily in the United States, through two segments: Specialty Vehicles and Recreational Vehicles. The Specialty Vehicles Segment provides customized vehicle solutions for applications, including essential needs for public services (ambulances and fire apparatus) and commercial infrastructure (terminal trucks and industrial sweepers). REV Group’s Recreational Vehicle Segment manufactures a variety of RVs, from Class B vans to Class A motorhomes. REV Group’s portfolio is made up of well-established principal vehicle brands, including many of the most recognizable names within their industry. REV Group trades on the NYSE under the symbol REVG. Investors-REVG