REV Group Reports Q2 Results, Updates Fiscal 2024 Outlook – RVBusiness – Breaking RV Industry News

- Second quarter net sales of $616.9 million compared to $681.2 million in the prior year quarter

- Second quarter net income of $15.2 million compared to net income of $14.2 million in the prior year quarter

- Second quarter Adjusted EBITDA1 of $37.5 million compared to $41.9 million in the prior year quarter, the latter of which included $10.2 million of Adjusted EBITDA attributable to Collins Bus Corporation which was divested on Jan. 26, 2024

- Second quarter Adjusted Net Income(1) of $20.9 million compared to $20.8 million in the prior year quarter

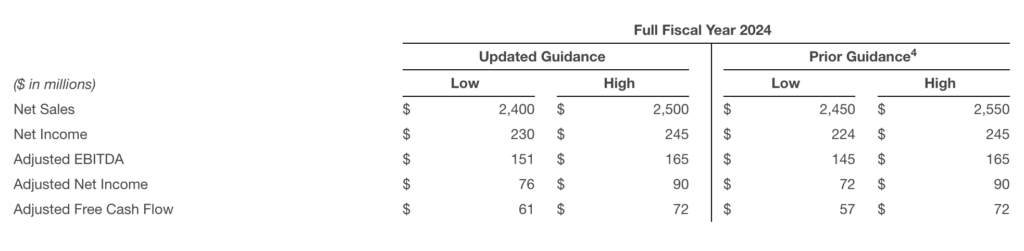

- Updated full-year fiscal 2024 outlook:

- Net sales of $2.4 to $2.5 billion, net income of $230.0 to $245.0 million, Adjusted EBITDA of $151.0 to $165.0 million, and Adjusted Net Income of $76.0 to $90.0 million;

- Net cash from operating activities of $20.0 to $35.0 million, which includes approximately $71.0 million of income tax and transaction costs related to divestiture activities, and Adjusted Free Cash Flow1 of $61.0 to $72.0 million

BROOKFIELD, Wis. – REV Group, Inc. (NYSE: REVG), a manufacturer of industry-leading specialty and recreational vehicles, today reported results for the three months ended April 30, 2024 (“second quarter 2024”). Consolidated net sales in the second quarter 2024 were $616.9 million, compared to $681.2 million for the three months ended April 30, 2023 (“second quarter 2023”). Net sales for the second quarter 2023 included $46.9 million attributable to Collins. Excluding the impact of the Collins divestiture, net sales decreased $17.4 million, or 2.7% compared to the prior year quarter. The decrease was primarily due to lower net sales in the Recreational Vehicles segment, partially offset by higher net sales in the Specialty Vehicles segment.

The company’s second quarter 2024 net income was $15.2 million, or $0.28 per diluted share, compared to net income of $14.2 million, or $0.24 per diluted share, in the second quarter 2023. Adjusted Net Income for the second quarter 2024 was $20.9 million, or $0.39 per diluted share, compared to Adjusted Net Income of $20.8 million, or $0.35 per diluted share, in the second quarter 2023. Adjusted EBITDA in the second quarter 2024 was $37.5 million, compared to $41.9 million in the second quarter 2023. Adjusted EBITDA for the second quarter 2023 included $10.2 million attributable to Collins. Excluding the impact of the Collins divestiture, Adjusted EBITDA increased $5.8 million, or 18.3% compared to the prior year quarter. The increase was primarily due to higher contribution from the Specialty Vehicles segment, partially offset by lower results in the Recreational Vehicles segment.

“We are pleased to have delivered another strong quarter of operating results,” REV Group Inc. President and CEO, Mark Skonieczny, said. “We continue to experience robust demand in our Fire and Ambulance businesses and remain focused on operating initiatives that drive throughput improvements across our manufacturing sites. The Specialty Vehicles segment results demonstrate that these initiatives are taking hold and continue to build from prior quarters’ momentum. Within the Recreational Vehicles segment, we continue to be proactive in managing our cost structure to align with end market demand and delivered operating margins in line with our expectations. The progress we have made across the enterprise provides us confidence in our ability to deliver our full-year fiscal guidance.”

REV Group Second Quarter Highlights

- Effective Jan. 26, 2024, the company completed the sale of Collins to Forest River Bus, LLC. In connection with the completion of the sale of Collins, the company received cash consideration of $308.2 million, inclusive of certain preliminary working capital adjustments. The company used a portion of the proceeds from the sale of Collins to reduce outstanding borrowings under its 2021 ABL facility to zero. On Feb. 16, 2024, remaining proceeds, as well as borrowings under the ABL, were used to return cash to shareholders in the form of a $3.00 per common share special cash dividend, totaling $179.3 million.

- On Feb. 20, 2024, the company closed a registered underwritten public offering of 18,400,000 shares of its common stock by American Industrial Partners (AIP), then the company’s largest equity holders. 10,400,000 of these shares were sold to the public, and the remaining 8,000,000 shares were repurchased by the company for a purchase price of $126.1 million. The company funded the repurchase with borrowings under its ABL. The company did not sell any shares of common stock and did not receive any proceeds in connection with this offering.

- On March 15, 2024, the company closed a registered underwritten secondary public offering of 7,395,191 shares of the Company’s common stock by AIP. The company did not sell any shares of common stock and did not receive any proceeds in connection with this offering. The offering reduced AIP’s ownership in company shares to approximately 3.4%. In connection with the closing of the offering, AIP no longer had the right to nominate any directors to the board of directors and AIP’s representatives on the board tendered their resignations from the board effective as of March 15, 2024. These resignations were not the result of any disagreement with the Company.

- On April 15, 2024, the board of directors approved the appointment of Amy Campbell as Senior Vice President / Chief Financial Officer. Upon Campbell joining the company, Mark Skonieczny, who had been serving as the company’s interim CFO, stepped down as interim CFO and continued in his role as President and Chief Executive Officer.

- On April 30, 2024, the company sold the operating assets of the Fire Regional Technical Center in Florida. This transaction represented the sale of the company’s last remaining owned fire dealership. The business has now transitioned to a fully independent dealership distribution model.

- On May 30, 2024, the company announced that Cynthia (Cindy) Augustine was elected as an independent member of its board of directors.

“The actions taken by the company were aimed at simplifying our portfolio of products and operating structure, returning cash to our shareholders, and fortifying our leadership team. We continue to believe that the operational improvements we have made in the business, along with these actions, provides opportunity for earnings growth and will accelerate shareholder value creation,” said Skonieczny.

Specialty Vehicles Segment Highlights

Specialty Vehicles segment net sales were $437.4 million in the second quarter 2024, an increase of $12.4 million, or 2.9%, from $425.0 million in the second quarter 2023. Net sales for the second quarter 2023 included $46.9 million attributable to Collins. Excluding the impact of the Collins divestiture, net sales increased $59.3 million, or 15.7% compared to the prior year quarter. The increase in net sales compared to the prior year quarter was primarily due to price realization and increased shipments of fire apparatus and ambulance units, partially offset by lower shipments of terminal trucks. Specialty Vehicles segment backlog at the end of the second quarter 2024 was $4,064.4 million compared to $3,358.5 million at the end of the second quarter 2023. Backlog at the end of the second quarter 2023 included $191.5 million related to Collins. Excluding the impact of the Collins divestiture, backlog increased $897.4 million compared to the prior year quarter. The increase was primarily the result of continued demand and order intake for fire apparatus and ambulance units, along with pricing actions, partially offset by a decrease in backlog related to the wind down of municipal transit operations, increased unit shipments, and lower order intake for terminal truck units.

Specialty Vehicles segment Adjusted EBITDA was $33.8 million in the second quarter 2024, an increase of $13.5 million, or 66.5%, from Adjusted EBITDA of $20.3 million in the second quarter 2023. Adjusted EBITDA for the second quarter 2023 included $10.2 million attributable to Collins. Excluding the impact of the Collins divestiture, Adjusted EBITDA increased $23.7 million, or 234.7% compared to the prior year quarter. Profitability within the segment benefited from price realization and higher sales volume of fire apparatus and ambulance units, partially offset by inflationary pressures and lower sales volume of terminal trucks.

Recreational Vehicles Segment Highlights

Recreational Vehicles segment net sales were $179.7 million in the second quarter 2024, a decrease of $76.9 million, or 30.0%, from $256.6 million in the second quarter 2023. The decrease in net sales compared to the prior year quarter was primarily due to decreased unit shipments and increased discounting, partially offset by price realization. Recreational Vehicles segment backlog at the end of the second quarter 2024 was $274.7 million, a decrease of $220.3 million compared to $495.0 million at the end of the second quarter 2023. The decrease was primarily the result of lower order intake in certain categories, unit shipments against backlog, and order cancelations.

Recreational Vehicles segment Adjusted EBITDA was $12.1 million in the second quarter 2024, a decrease of $17.0 million, or 58.4%, from $29.1 million in the second quarter 2023. The decrease was primarily due to lower unit shipments, increased discounting, and inflationary pressures, partially offset by price realization and cost reduction actions.

Working Capital, Liquidity, and Capital Allocation

Net debt(2) totaled $181.8 million as of April 30, 2024, including $38.2 million cash on hand. The company had $280.3 million available under its ABL revolving credit facility as of April 30, 2024, a decrease of $103.8 million as compared to the October 31, 2023 availability of $384.1 million. Trade working capital(3) for the company as of April 30, 2024 was $324.0 million, compared to $318.5 million as of October 31, 2023. The increase was primarily due to a decrease in accounts payable and customer advances, partially offset by a decrease in accounts receivable and inventory. Capital expenditures in the second quarter 2024 were $5.9 million compared to $6.8 million in the second quarter 2023.

Updated Fiscal Year 2024 Outlook

Quarterly Dividend

The company’s board of directors declared a regular quarterly cash dividend in the amount of $0.05 per share of common stock, payable on July 12, 2024, to shareholders of record on June 28, 2024, which equates to a rate of $0.20 per share of common stock on an annualized basis.

Conference Call

A conference call to discuss the company’s fiscal year 2024 second quarter financial results and our outlook is scheduled for 10 a.m. ET, June 5, 2024. A supplemental slide deck will be available on the REV Group, Inc. investor relations website. The call will be webcast simultaneously over the Internet. To access the webcast, listeners can go to http://investors.revgroup.com/investor-events-and-presentations/events at least 15 minutes prior to the event and follow instructions for listening to the webcast. An audio replay of the call and related question and answer session will be available for 12 months at this website.

About REV Group

REV Group (REVG) companies are leading designers and manufacturers of specialty vehicles and related aftermarket parts and services, which serve a diversified customer base, primarily in the United States, through two segments: Specialty Vehicles and Recreational Vehicles. The Specialty Vehicles Segment provides customized vehicle solutions for applications, including essential needs for public services (ambulances and fire apparatus) and commercial infrastructure (terminal trucks and industrial sweepers). REV Group’s Recreation Vehicle Segment manufactures a variety of RVs, from Class B vans to Class A motorhomes. REV Group’s portfolio is made up of well-established principal vehicle brands, including many of the most recognizable names within their industry. Several of REV Group’s brands pioneered their specialty vehicle product categories and date back more than 50 years. REV Group trades on the NYSE under the symbol REVG. Investors-REVG

1 Adjusted Net Income, Adjusted EBITDA and Adjusted Free Cash Flow are non-GAAP measures that are reconciled to their nearest GAAP measure later in this release.

2 Net Debt is defined as total debt less cash and cash equivalents.

3 Trade Working Capital is defined as accounts receivable plus inventories less accounts payable and customer advances.

4 Guidance from the 1Q fiscal year 2024 results announcement, as presented in our press release dated March 6, 2024.