Priority RV Network Dealers Convene for ‘23 Annual Meeting

Attendees mingle on the trade floor of the 2023 Priority RV Network annual meeting. (Photos Adrienne Angelo/RVBusiness)

Priority RV Board Chairman Michael Peay, left, of Holiday World, and Priority RV President Michael Regan of Crestview RV.

The Priority RV Network (PRVN), a unique, 27-year-old, Missoula, Mon.-based dealer cooperative, has emerged from the last three post-pandemic years in good shape in terms of membership, dealer locations, supplier participation and member rebates after a pretty strong 2022.

That’s the basic message issued by several board members in a Tuesday (April 4) interview with RVBusiness on the opening day of their 2023 Priority RV Network annual meeting held at the M Resort Spa Casino in Henderson, Nev., on the outskirts of Las Vegas.

That’s not to say that Priority didn’t face some challenges just like every other business organization, having canceled its annual meetings in 2020 and 2021 due to the viral pandemic, conceded PRVN’s board members including the following U.S. dealers quoted in this posting from the Las Vegas meetings:

- PRVN President Mike Regan, president of Priority of Buda, Texas-based Crestview RV with three central Texas dealerships

- Board Chairman Michael Peay, president of Holiday World, based in Katy, Texas, which operates five stores in Texas and one in New Mexico

- Secretary Brian Wilkins, president of Wilkins RV, Bath, N.Y., including seven New York State RV dealerships

- Treasurer Mark Bretz, board chairman of Missoula, Mont.-based Bretz RV & Marine, overseeing four RV dealershiips in Montana and Idaho

- Board member Andy Heck, president and co-owner of Alpin Haus RV, Amsterdam, N.Y., with four RV outlets in eastern New York and New Jersey.

- Board member Ben Hirsch: COO of Campers Inn RV, the Jacksonville, Fla.-based owner/operator of 37 dealerships throughout the U.S.

Yet, Priority is actually coming off a pretty strong series of years, 2022 having been its best year to date in terms of revenue, the board members told RVB.

“As far as the number of rooftops, we are in great shape despite losing a few dealers along the way, when you take into account the number of new dealers and the existing dealers who have expanded,” said Regan.

At the end of the day, in fact, Priority’s board reports that it currently has the same number of dealers that it had two years ago – 138 locations owned by 88 member-dealer shareholders – attrition notwithstanding.

“So, over the last couple of years, we’ve lost some dealers to consolidation,” said Regan, seated in a conference room with the other Priority board members. “But at the same time, we have dealers within our group who have consolidated and expanded their operations. And then we’ve brought in new members to our group, too.”

Curiously, there’s only one other U.S. organization of independent RV dealers, ROUTE 66 RV Network, that tends to mirror in certain ways the Priority template, said Regan, adding that Priority operates as a pure cooperative owned by its dealer-members versus a more proprietary approach in ROUTE 66’s case. “Every member in this group is a shareholder,” Regan explained. “And then we rebate the money back from our vendors. And we give about 95% of our revenue back to our owners.

“So, we retain only about five percent (of those revenues) to operate and staff the cooperative and cover our expenses,” he added. “It’s not a non-profit organization, but we operate it like a non-profit entity. Our group is different than ROUTE 66, although I don’t know that one’s better than the other. It’s just different.”

As for the national economic backdrop of this year’s PRVN annual meeting – at which Priority is honoring two of its longest serving, 25-year vendor-partners, Bank of the West and NTP-STAG – Regan and other board members were outspoken regarding the industry’s surprising experiences over the past three years that wound up being among the RV industry’s best years ever.

Priority RV Treasurer Mark Bretz of Bretz RV & Marine

“I think that in all our collective lifetimes, we never would have imagined that the business would be like it has been for the last three years,” maintained Bretz. “So, we have incredibly unrealistic expectations of what things should be and we’re measuring ourselves against those expectations.

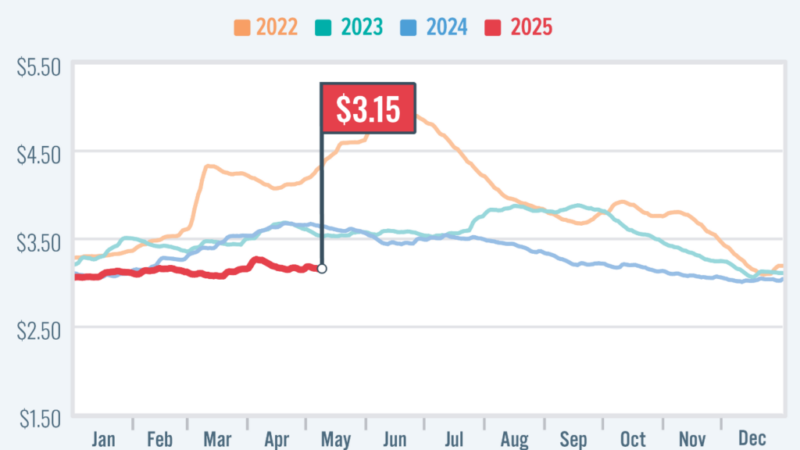

“In hindsight, it appears that probably in the third quarter of last year, business started to slow down,” he added. “The fourth quarter for most dealers was quite soft. And while there may be some different opinions on the first quarter of this year, I think the real outcome is going to depend on whether the Fed is successful in its stated intentions to stop inflation at any cost.

“If that’s truly the case, I think that we’re going to see continued softening in this industry,” commented Bretz. The last time they said that – 1980 and ‘81 – was brutal on this industry with 21 and a half percent interest rates.”

Added Wilkins: “I think as an industry, we’ve battling interest rates. The prices of our products have gone up and I think we had some demand pulled ahead in 2021 and 2022. In other words, I think we had some demand in 2020 and 2021 where we sold some customers who actually would have purchased new units in 2022, 2023 and 2024. So, we pulled some demand ahead and I think we’re battling that a little bit, along with the prices of the product and interest rates going up. So, due to those three forces, I think you’re paying the price a little bit for those three really good years.

Priority RV Secretary Brian Wilkins of Wilkins RV

“And, as Mark’s saying, the good operators will work our way through it and figure it out, realizing that we’ve gone through it before,” Wilkins confided. “But I think it’s going to be a little bumpy.”

Peay, looking back at the same 1980-81 time frame, pointed out that unemployment wasn’t as low then as it now and that there are still plenty of people working and earning incomes right now which – despite some current inflation – should play into the industry’s hands.

“At the same time,” Peay told RVB, “we now have inventory that we didn’t have two and three years ago that came to us from June through September. And because manufacturers had 2022 models still in the yard, they didn’t make a model year change in May or June like they usually do, and they kept that ’22 model year open with 22’s arriving in August and even September depending on the transport companies.

“So, we have new ’22 model year units that came in later than ever before, and so RV dealers are all working through that, some panicking and dumping inventory, which makes it very confusing again for the consumer to figure out what really is the best price,” he maintained. “And I don’t know if anybody really knows today.”

Source: https://rvbusiness.com/priority-rv-network-dealers-convene-for-23-annual-meeting/