Lippert Reports $3.7B Net Sales, $143M Net Income for 2024 – RVBusiness – Breaking RV Industry News

ELKHART, Ind. – LCI Industries (NYSE: LCII), a leading supplier of engineered components to the recreation and transportation markets, today reported fourth quarter and full year 2024 results.

“Lippert demonstrated continued market leadership and resilience in 2024, leveraging cost savings and operational improvements to increase EBITDA by $89 million over 2023,” stated commented Jason Lippert, LCI Industries’ President and Chief Executive Officer. “This performance came despite a challenging RV and marine industry backdrop, as meaningful investments toward innovations like our Touring Coil Suspension, anti-lock braking systems, our Chill Cube revolutionary RV air conditioning system, and our new RV window series fueled content expansion and further market share gains. Our diversified end markets — particularly our Aftermarket segment — helped us navigate volatility by expanding growth opportunities and bolstering profitability. Our Aftermarket business also continues to benefit from a growing presence within Camping World stores, as we achieved revenue growth of $12 million within the 14 newly upfitted locations against an environment that was declining only a year ago.

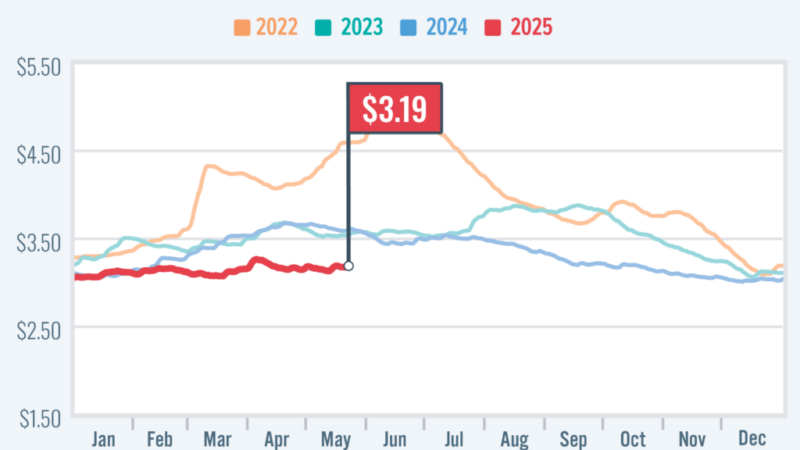

“As we enter 2025, we are focused on continuing to expand profitability and remain committed to achieving further cost savings in addition to the significant strides made in 2024,” Lippert continued. “We’re also seeing modest improvement in the RV market, with consolidated January sales up 6% year-over-year along with growing optimism from customers.

“Overall, not only is Lippert well positioned to capitalize on an industry recovery due to our operational flexibility and agility, but we have the playbook required to further expand business in our other end markets, including aftermarket, building products, transportation, and utility trailers. We believe these factors, along with our experienced leadership team and numerous competitive advantages, will enable us to achieve our target of $5 billion in net sales organically by 2027 as well as a return to double digit operating margins,” Lippert said.

“Thanks to the dedication of our experienced leadership team and team members, along with our focus on safety, quality, and customer service, we strengthened our leadership position within the recreation space in 2024. As we enter 2025, we remain committed to creating value for all stakeholders through disciplined execution and strategic growth initiatives,” commented Ryan Smith, LCI Industries’ Group President-North America.

Fourth Quarter 2024 Results

Consolidated net sales for the fourth quarter of 2024 were $803.1 million, a decrease of 4% from 2023 fourth quarter net sales of $837.5 million. Net income in the fourth quarter of 2024 was $9.5 million, or $0.37 per diluted share, compared to a net loss of $2.4 million, or $(0.09) per diluted share, in the fourth quarter of 2023. EBITDA in the fourth quarter of 2024 was $45.8 million, compared to EBITDA of $35.6 million in the fourth quarter of 2023. Additional information regarding EBITDA, as well as reconciliations of this non-GAAP financial measure to the most directly comparable GAAP financial measure of net income (loss), is provided in the “Supplementary Information – Reconciliation of Non-GAAP Measures” section below.

The decrease in year-over-year net sales for the fourth quarter of 2024 was primarily driven by lower sales to North American marine and utility trailer OEMs, declines in wholesale shipments of motorhome RV units and an increased shift in unit mix towards lower content single axle travel trailers, partially offset by increased North American RV wholesale shipments of travel trailers and fifth-wheels and market share gains in the automotive aftermarket.

Full Year 2024 Results

Consolidated net sales for the full year 2024 were $3.7 billion, a decrease of 1% from full year 2023 net sales of $3.8 billion. Net income for the full year 2024 was $142.9 million, or $5.60 per diluted share, compared to net income of $64.2 million, or $2.52 per diluted share, for the full year 2023. EBITDA for the year ended December 31, 2024 was $343.9 million, compared to EBITDA of $255.2 million for the year ended December 31, 2023. Additional information regarding EBITDA, as well as reconciliations of this non-GAAP financial measure to the most directly comparable GAAP financial measure of net income (loss), is provided in the “Supplementary Information – Reconciliation of Non-GAAP Measures” section below.

The decrease in year-over-year net sales was primarily driven by decreased industry production levels in the North American marine, utility trailer, and European RV markets and an increased shift in RV unit mix towards lower content single axle travel trailers, partially offset by a 7% increase in total North American RV wholesale shipments and sales from acquisitions. Net sales from acquisitions completed in 2023 and 2024 contributed approximately $21.4 million in 2024.

January 2025 Results

January 2025 consolidated net sales were approximately $328 million, up 6% from January 2024, primarily due to increases in RV OEM sales of 17% and aftermarket sales of 6%, partially offset by softness in international and other adjacent markets.

OEM Segment – Fourth Quarter Performance

OEM net sales for the fourth quarter of 2024 were $621.6 million, a decrease of $36.5 million compared to the same period of 2023. RV OEM net sales for the fourth quarter of 2024 were $376.1 million, down 3% compared to the same prior year period, primarily driven by a 21% decrease in motorhome wholesale shipments and a shift in RV unit mix towards lower content single axle travel trailers, partially offset by a 7% increase in North American travel trailer and fifth-wheel wholesale shipments and market share gains. Adjacent Industries OEM net sales for the fourth quarter of 2024 were $245.5 million, down 9% year-over-year, primarily due to lower sales to North American marine and utility trailers OEMs. This decline was driven by current dealer inventory levels, inflation, and elevated interest rates impacting retail consumers. North American marine OEM net sales in the fourth quarter of 2024 were $55.1 million, down 15% year-over-year.

Operating profit of the OEM Segment was $1.9 million in the fourth quarter of 2024, or 0.3% of net sales, compared to an operating loss of $11.7 million, or (1.8)% of net sales, in the same period in 2023. The operating profit expansion of the OEM Segment for the quarter was primarily driven by operational improvements, partially offset by the impact of fixed costs spread over decreased sales.

Aftermarket Segment – Fourth Quarter Performance

Aftermarket net sales for the fourth quarter of 2024 were $181.6 million, an increase of 1% compared to the same period of 2023. Resiliency in the Aftermarket Segment was primarily driven by market share gains in the automotive aftermarket, partially offset by lower volumes within the marine aftermarket. Operating profit of the Aftermarket Segment was $14.3 million in the fourth quarter of 2024, or 7.9% of net sales, in line with the same period of 2023. The operating profit margin of the Aftermarket Segment for the quarter was impacted by increased labor costs due to product mix and increased facility costs resulting from investments to expand capacity within the automotive aftermarket, partially offset by decreased material costs.

“Our automotive aftermarket business has consistently outperformed, achieving a 7% increase in sales in the full year 2024 that has helped offset softness in the RV and marine aftermarkets,” commented Jamie Schnur, LCI Industries’ Group President – Aftermarket. “This growth was further fueled by Lippert’s increasing content on RVs, which drives demand for our replacement and repair parts. By continuing to differentiate ourselves through high-quality product offerings and exceptional service, we are building further trust with both dealers and consumers. Moving forward, we remain focused on expanding our presence in premium markets to support Lippert’s long-term, profitable growth.”

Income Taxes

The Company’s effective tax rate was 24.5% and 13.5% for the year and quarter ended December 31, 2024, respectively, compared to 22.7% and 65.2% for the year and quarter ended December 31, 2023, respectively. The increase in the effective tax rate for the full year 2024 compared to 2023 was primarily due to an increase in the state tax rate. Due to certain operating losses in the fourth quarter of 2023, discrete adjustments related to an increase in life insurance contract assets had a proportionately larger impact on the tax rate in that period.

Balance Sheet and Other Items

At December 31, 2024, the Company’s cash and cash equivalents balance was $165.8 million, compared to $66.2 million at December 31, 2023. The Company used $109.5 million for dividend payments to shareholders, $89.2 million for the repayment of debt (net of borrowings), $42.3 million for capital expenditures, and $20.0 million for an acquisition in the twelve months ended December 31, 2024.

The Company’s outstanding long-term indebtedness, including current maturities, was $757.3 million at December 31, 2024, and the Company was in compliance with its debt covenants. As of December 31, 2024, the Company had $452.5 million of borrowing availability under the revolving credit facility.

Conference Call & Webcast

LCI Industries will host a conference call to discuss its fourth quarter results at 8:30 a.m. Eastern time, Tuesday, Feb. 11, which may be accessed by dialing (833) 470-1428 for participants in the U.S. and (929) 526-1599 for participants outside the U.S. using the required conference ID 823178. Due to the high volume of companies reporting earnings at this time, please be prepared for hold times of up to 15 minutes when dialing in to the call. In addition, an online, real-time webcast, as well as a supplemental earnings presentation, can be accessed on the Company’s website, www.investors.lci1.com.

A replay of the conference call will be available for two weeks by dialing (866) 813-9403 for participants in the U.S. and (44) 204-525-0658 for participants outside the U.S. and referencing access code 151640. A replay of the webcast will be available on the Company’s website immediately following the conclusion of the call.

About LCI Industries

LCI Industries (NYSE: LCII), through its Lippert subsidiary, is a global leader in supplying engineered components to the outdoor recreation and transportation markets. We believe our innovative culture, advanced manufacturing capabilities, and dedication to enhancing the customer experience have established Lippert as a reliable partner for both OEM and aftermarket customers. For more information, visit www.lippert.com.