Lazydays Q3: ‘Encouraged by Recapitalization Transactions’ – RVBusiness – Breaking RV Industry News

Ron Fleming, Interim CEO, said, “Despite challenging financial results during the third quarter, which continued to be impacted by economic and other industry-wide demand headwinds, we are very encouraged by the completion of last week’s recapitalization transactions. These transformative transactions have fortified the company’s financial foundation and operational focus and mark a turning point for Lazydays as we position ourselves for a stronger, more agile future. With a streamlined balance sheet, enhanced liquidity, and a simplified dealership network, we are better equipped to navigate the evolving RV landscape and deliver on our commitment to industry leadership.”

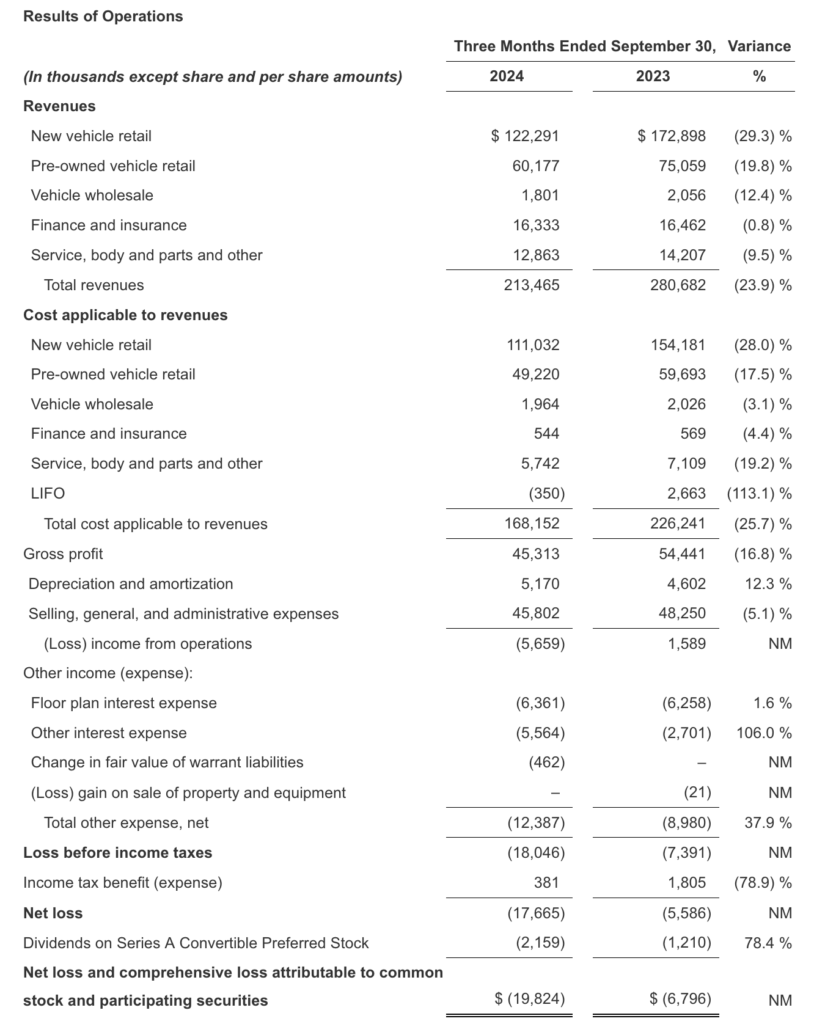

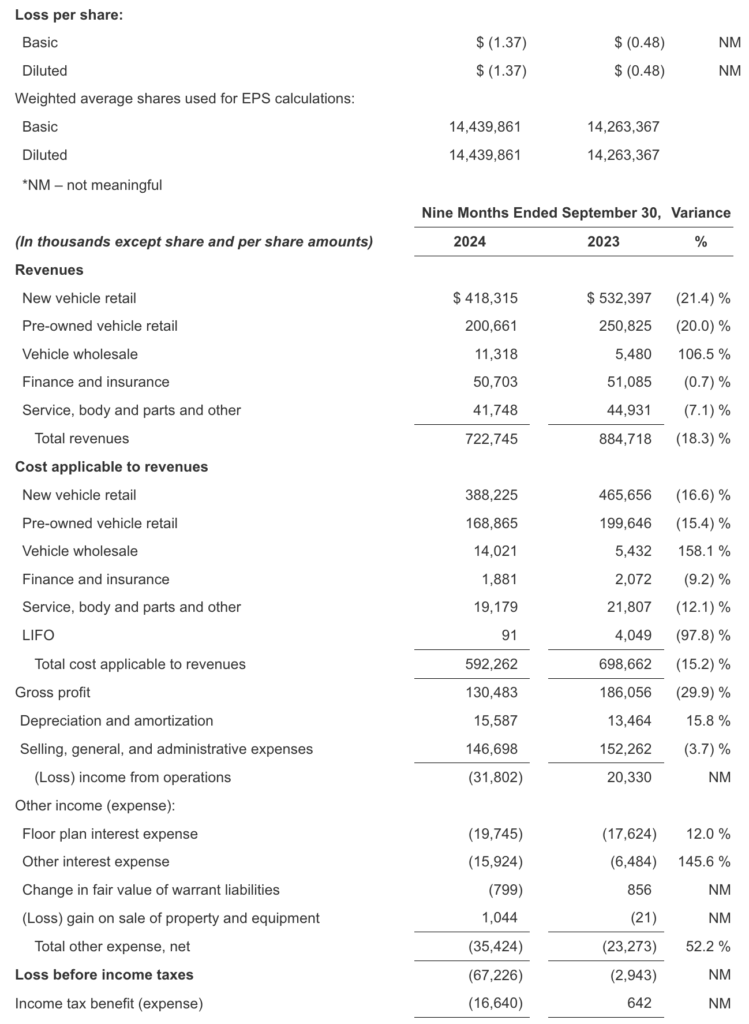

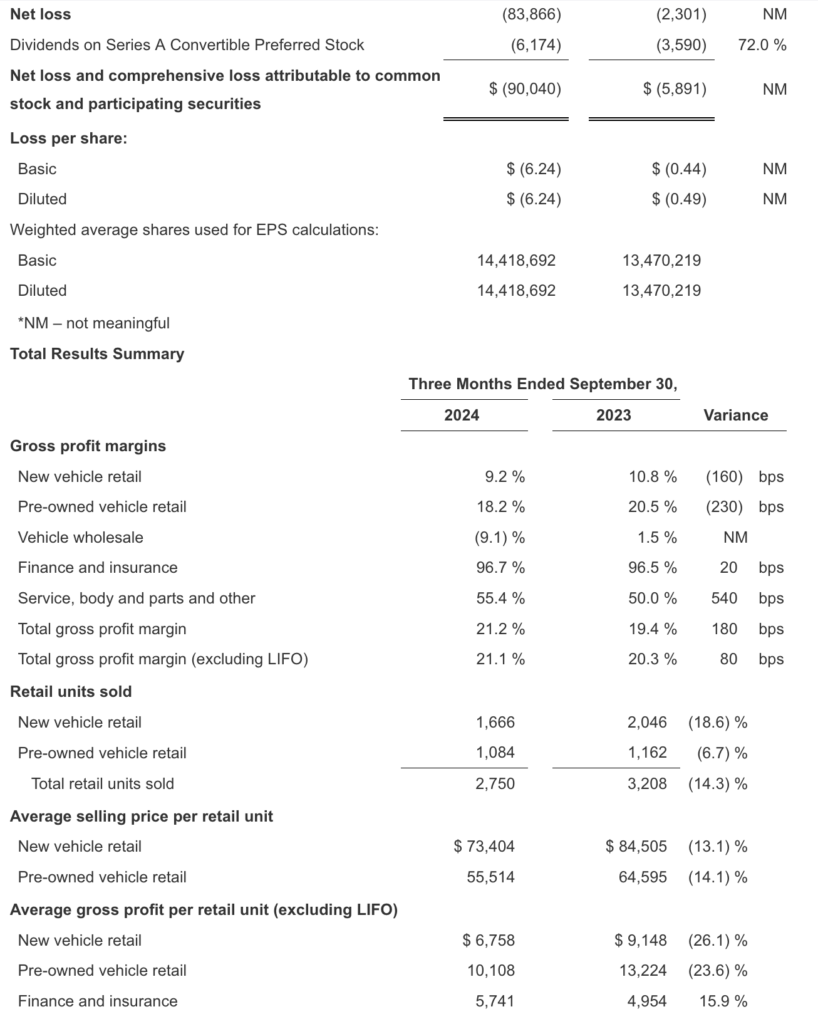

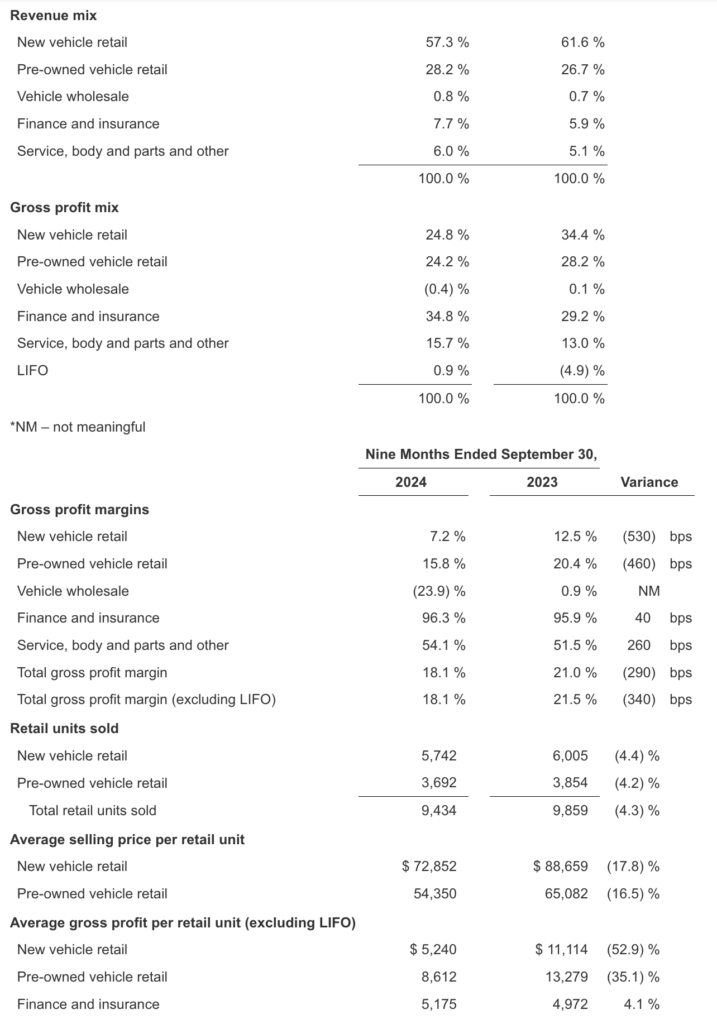

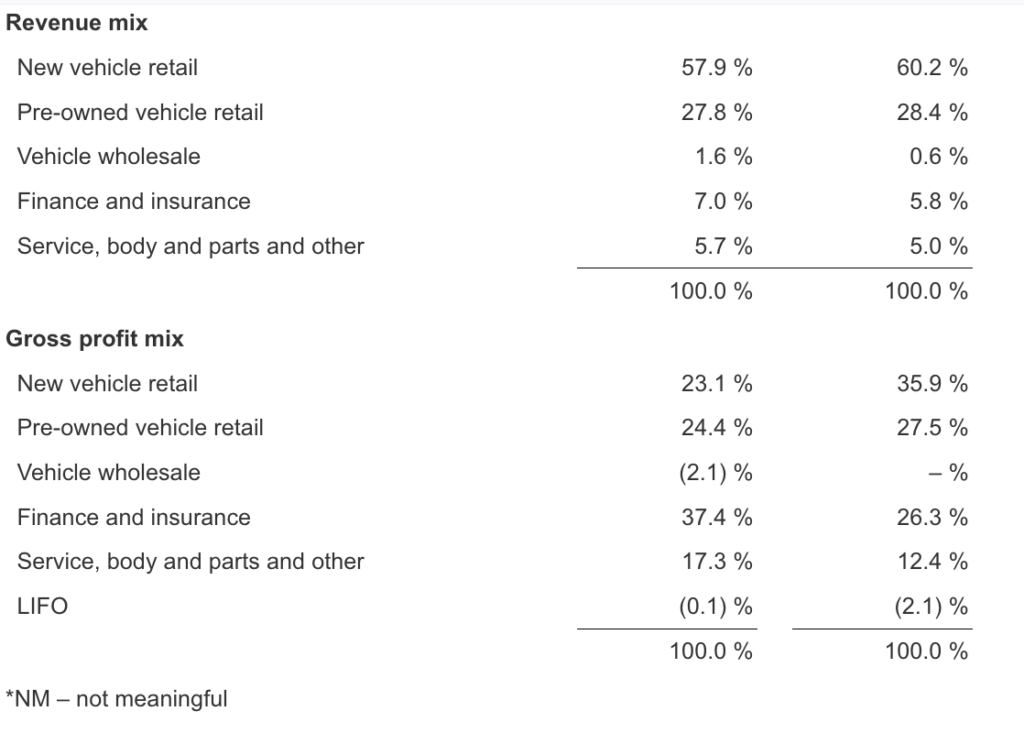

Total revenue for the third quarter was $213.5 million compared to $280.7 million for the same period in 2023. Total revenue for the nine months ended September 30, 2024 was $722.7 million compared to $884.7 million for the same period in 2023.

Net loss for the third quarter was $17.7 million compared to net loss of $5.6 million for the same period in 2023. Adjusted net loss, a non-GAAP measure, was $16.2 million compared to adjusted net loss of $2.9 million for the same period in 2023. Net loss per diluted share was $1.37 compared to net loss per diluted share of $0.48 for the same period in 2023. Adjusted net loss per diluted share, a non-GAAP measure, was $1.27 compared to adjusted net loss per diluted share of $0.29 for the same period in 2023.

Net loss for the nine months ended September 30, 2024 was $83.9 million compared to net loss of $2.3 million for the same period in 2023. Adjusted net loss, a non-GAAP measure, was $62.1 million compared to adjusted net income of $2.2 million for the same period in 2023. Net loss per diluted share was $6.24 compared to net loss per diluted share of $0.49 for the same period in 2023. Adjusted net loss per diluted share, a non-GAAP measure, was $4.73 compared to adjusted net loss per diluted share of $0.07 for the same period in 2023.

See Reconciliation of Non-GAAP Measures for additional details regarding our adjusted results of operations.

A conference call is scheduled for at 8:30 a.m. ET today that will also be broadcast live over the internet.

The conference call may be accessed by telephone at (877) 407-8029 / +1 (201) 689-8029. To listen live on the Lazydays’ website or for replay, visit https://www.lazydays.com/investor-relations.