Jason Lippert Addresses Shareholders in 2024 Annual Report – RVBusiness – Breaking RV Industry News

EDITOR’S NOTE: As part of Elkhart, Ind.-based Lippert Components Inc.’s 2024 financial report – published March 28 – company President and CEO Jason Lippert offered the following address to shareholders under the heading “Consistent Execution, Operational Discipline and Diversified Growth Drove Strong Cash Generation.”

“The market never stands still, and 2024 brought its share of surprises — but Lippert tackled them with agility and efficiency, enabling us to enter 2025 even stronger. Our RV and marine businesses showed resilience, and we continued to leverage our strengths in building products, international markets and the aftermarket to sustain revenues near prior-year levels despite a challenging environment, while effectively expanding margins. Our profitability improvement was bolstered by our increased focus on operational efficiency, which we believe has further positioned us to both organically reach our $5 billion revenue target in 2027 and reclaim double-digit margins.

“RV shipments remained below historical levels and consumers continued to favor smaller single axle trailers due, in part, to temporary macroeconomic conditions, including interest rate sensitivity and affordability trends. Despite this, Lippert increased market share and organic content across our top five RV OEM product categories — appliances, awnings, chassis, furniture, and windows — through our continued focus on innovation. From next-generation suspension systems to top- tier window innovations, we are redefining what it means to be an industry leader.

“Our CURT Touring Coil Suspension (TCS) is rapidly securing OEM adoption with those customers raving about its superior ride quality; our Lippert Anti-Lock Brake System (ABS) is helping to redefine safety standards in towables; and our Furrion Chill Cube, one of the quietest and most powerful air conditioners in its class, is attracting strong interest from OEMs and consumers.

“We also expanded our RV content offerings with premium 4K Windows and glass patio systems that certain OEMs, including Brinkley RV, have already integrated into high-end models.

“Marine volumes remained subdued as dealers worked through elevated inventory levels, and we felt that on the production side. Dealers, however, are increasingly optimistic that retail sales will rebound in the second half of 2025 as consumer confidence improves and inventory normalizes. With inventory levels more balanced and demand expected to rebound—historically a swift recovery — we believe we are well-positioned with the right products and a proven track record to capitalize on the recovery when it occurs.

“Beyond RV and Marine, innovations drove meaningful growth across our diverse end markets. In the automotive aftermarket, our CURT brand, acquired in 2019, delivered 7% organic growth during the year, highlighting our ability to execute meaningful acquisitions that ultimately contribute to long-term success. Building products also fueled stability during the year, supported by notable traction in residential windows that contributed $20 million in growth, as more residential distributors and builders recognize the value of our entry-level vinyl window products.

“Our transportation and utility trailer business also gained momentum, with industry leaders like PJ Trailers and Big Tex adopting our ABS and TCS systems. Additionally, we continue to capture new opportunities in the on-highway and off-highway transportation markets by providing glass and window solutions for school buses, transit, and off-road vehicles.

Collectively, these markets represent significant addressable opportunities and we are applying our proven OEM playbook to help drive growth in these high-potential areas.

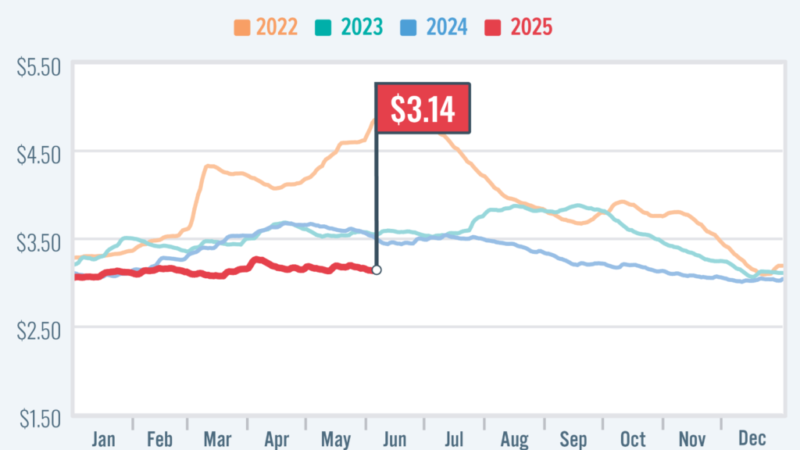

“We have seen that our strength across adjacent markets boosts margins and provides counter- cyclical benefits that balance profitability across economic cycles. This augments the decisive actions we took in 2024 to improve our cost structure and drive efficiency. We increased our EBITDA margin by 250 basis points, as we delivered $28 million in non-material cost savings, with even more reductions planned for 2025. Factory consolidations, strategic sourcing initiatives, and investments in automation have also lowered fixed costs and strengthened our ability to scale efficiently as demand rebounds. At the same time, lower steel prices helped gross margins, and we expect further pricing levers to help us partially offset potential tariff headwinds in 2025. We believe these initiatives, combined with disciplined cost control, should drive 25% incremental margin on new revenue in 2025, accelerating our path back to double-digit operating margin.

“Our disciplined execution is not just strengthening margin, it is also driving long- term value creation for shareholders. Back in November, we announced a 10% increase in our quarterly dividend to $1.15 per share, reflecting our confidence in Lippert’s financial strength and our dedication to delivering shareholder value. Our strong execution and operational discipline produced $370 million in operating cash flow for the full year, reduced net debt by $89 million, and lowered our net debt to EBITDA ratio to less than 2.0x, increasing our flexibility to pursue strategic growth opportunities, including M&A. We have successfully completed 70+ acquisitions over the past two decades, each expanding our product portfolio.

“Beyond financial performance, we are committed to operating responsibly and sustainably to benefit our shareholders, team members, customers, and communities.

“In 2024, we published our third year of Scope 1 and Scope 2 emissions data, expanded resource and waste monitoring, and invested in energy-efficient manufacturing. This focus on transparency and sustainable growth earned us a spot on Newsweek’s 2025 list of America’s Most Responsible Companies. We also continued to foster a purpose-driven culture that empowers team members and supports communities, as we surpassed our 100,000-hour volunteer goal and contributed to numerous local causes.

“Heading into 2025, we believe our resilient business model and unwavering focus on innovation put us in a great position to capitalize on the opportunities ahead.

“Historically, the RV industry rebounds quickly, often doubling shipments within 3 to 5 years following economic downturns. In the interim, we are confident in our ability to gain market share, return to 3-5% organic growth in content per towable unit, organically reach our $5 billion revenue target in 2027, and deliver sustainable value for shareholders.

“None of this progress would be possible without our incredible team members, whose passion and dedication power our success. As we continue to push boundaries, we remain grateful to our customers, partners, and shareholders for their trust and support—and we look forward to delivering even more in the years ahead.

Jason D. Lippert

President and Chief Executive Officer

Lipper’s annual report for 2024 can be accessed by clicking here.