Industry Advocacy Needed as Camper Parity Bill Progresses – RVBusiness – Breaking RV Industry News

The RV Dealers Association (RVDA) and RV Industry Association (RVIA) continue their efforts to gain approval for the bipartisan Travel Trailer and Camper Tax Parity Act (H.R. 332) as a Senate companion bill is expected to be introduced soon.

The Travel Trailer and Camper Tax Parity Act was first introduced in the House of Representatives in January by U.S. Reps. Rudy Yakym (R-IN) and Dina Titus (D-NV).

“Indiana’s Second District is the home of the ‘RV Capital of the World,’ an essential part of our local economy” said Yakym. “I am proud to reintroduce this sensible and bipartisan legislative solution along with Congresswoman Titus that will support the continued growth of the RV industry and ensure Americans can enjoy the natural beauty of our nation through RV travel and outdoor adventures for generations to come.”

“Many families and tourists across the country find the best way to explore our nation’s national parks and beautiful natural landscapes is from an RV,” said Titus. “This bipartisan legislation would help RVs stay competitive with other elements of the recreation industry and allow even more people to explore our country in this unique way.”

This latest activity comes at a time when Congressional leaders will be debating new tax legislation over the next few weeks.

“RVDA and RVIA are working together on this legislation as we have for the past several years,” RVDA President Phil Ingrassia told RVBusiness. “This year we have invested in an online portal that makes it easy for industry members to support the legislation. They simply enter their information and then basically point and click to send a note to their representatives. We’ve had more than 70 dealers use the portal to contact representatives.”

At question is a drafting oversight in the 2017 Tax Cuts and Jobs Act, ensuring that RV dealers can fully deduct interest on floor plan financing for all RVs, including non-motorized towable trailers, which constitute 88% of RV sales.

The current bill would enable all RV dealers to fully deduct the interest on floor plan loans for travel trailers.

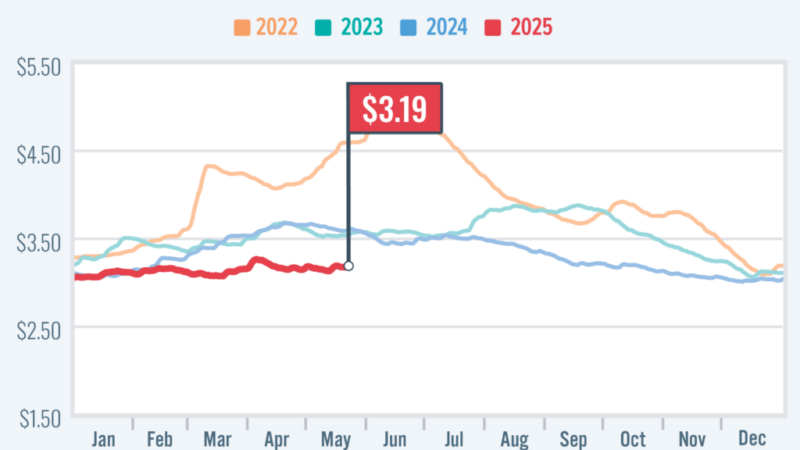

Currently, interest on floor plan financing for travel trailers is subject to a 30% limitation based on earnings before interest and taxes for dealers with more than $29 million in annual sales, unlike motorhomes.

Earlier this year, the House version of the bill picked up an additional seven Republican sponsors.

In the past, when legislation was supported by the RV industry, it usually also was supported by other parties interested in outdoor recreation such as marine and powersports.

This particular issue, however, only affects towable RVs, so the industry is largely advocating for the change by itself.

“It’s really important that we activate on this issue as an industry because there isn’t that other vocal support,” Ingrassia said. “It’s a very narrow issue. It’s up to the RV industry to educate Congress on this issue and we really need dealers to help and even if dealers are under the $29 million annual revenue threshold, if they grow, it could impact them. We’ve seen very strong growth in annual revenue and sales and we want that to continue, so we need to get this fixed.”

Dealers who would like to send a letter to their representative or who plan to meet in person are encouraged to visit http://bit.ly/4j6mdsD to access a form letter or to familiarize themselves with talking points.