Happe: Winnebago Still ‘Bullish’ on Future of RV Industry – RVBusiness – Breaking RV Industry News

Michael Happe

Noting that the company’s field inventory turn rates have returned to pre-COVID status, Winnebago Industries President & CEO Michael Happe painted a realistic, yet optimistic portrait of the market.

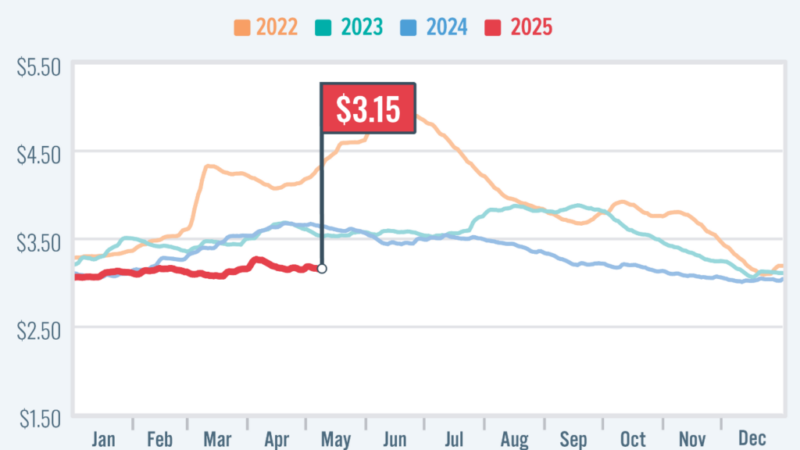

Speaking to investment analysts following Winnebago’s Fiscal Q1 2024 financial performance report, Happe said many of the macroeconomic headwinds remain in place – unsteady consumer confidence, interest rates and constraining inventory among them – and are expected to impact the market through Q2.

However, he added, Winnebago believes there will be a “strong rebounding outdoor economy in the back half of calendar year 2024 and especially into 2025.”

“The RV industry added unit inventory for the first time in many months during October of 2023, and we do not anticipate significant further de-stocking industry-wide as we turn towards spring,” Happe said. “Dealers continue to work through model year 2023 inventory during this quieter period of the year and mitigate the cost implications of higher inventory financing rates on their business.

“Overall, we maintain our bullish position on the future of the RV and marine industries and our brands will be well situated to participate strongly in the cyclical upswing when it occurs,” he said.

He added that Winnebago agrees with the RV Industry Association’s (RVIA) recently revised forecast of 350,000 wholesale RV shipments in 2024. “We are aligned with that projection at this time, and believe this number will closely correlate with calendar year industry retail as well,” he noted.

In his prepared remarks, Happe also highlighted previously announced news that Grand Design would be developing a motorized RV, expected to be ready in Q4, as well as the launch of the company’s Advanced Technology Group’s new innovation center.

“In the years ahead, the center will support the design of a new generation of RV and marine products that will harness and apply emerging technologies,” Happe said, adding that the early 2023 acquisition of Lithionics Battery will play a major role in the center’s initiatives. “Lithionics is expanding its electrical products offering, penetrating the Winnebago Industries’ product portfolios with its exciting battery packs and battery management system offerings, expanding business with other outdoor mobility OEMs and preparing its catalog of products for application into the marine industry.”

What follows is an edited account of the Q&A portion of the conference call:

On the retail market’s climate in past 1-2 months and whether there’s a growing sense of optimism:

Happe: We aren’t seeing a lot of surprises in the retail environment right now. It has generally been tracking on both the RV and marine side to the internal projections that we have had for both calendar ’23 and sort of the trend line that’s headed towards, obviously, calendar ’24 here in the coming weeks.

I did mention that we are seeing positive retail from both Grand Design RV and Barletta. And when I say positive, I mean positive over same weeks the year prior – so truly positive. The other businesses are, again, trending as we expected and are gradually improving in a comp standpoint versus the year prior.

As Bryan (Hughes, Winnebago’s CFO) and I both indicated, if we are to reach that 2024 retail level of 350,000 units approximately, we’ll have to gradually see an overall trend of RV retail comps closer to ultimately flat to maybe later in calendar ’24 positive versus the year prior. So, no surprises on the trends that we’re projecting internally. The bigger challenge in the current short term is dealers just continuing to very carefully manage their own inventories.

On whether more affordable units are having any traction in the marketplace:

Happe: I think any movement to that end would be very subtle at this time.

We are trying to address the affordability challenge in the marketplace for new consumers of RVs and boats through a variety of tactics. Certainly, some of that includes support for units in dealer inventory that are either aging in place or may be particularly pressured from a price standpoint. We have also introduced several new models within a few of our brands that we believe will be more attractive to consumers shopping for lower price points. And then the last thing that we’re definitely doing is we are passing on the benefits of reduced inflation or in some cases even deflation to our dealers as well. Our businesses are being fair at the time where we have a bill of material that is going the right direction in terms of a lower cost of goods. Those products are seeing that benefit pass through to the dealers as well.

But at this time of year, retail-wise, it’s difficult to see a significant movement by consumers reacting to affordability easing in the marketplace.

On how dealers are faring with aged inventory:

Happe: I won’t get into any specifics by brand but we feel we are in good relative condition to the rest of the industry. When we look across all of our businesses, RV and Marine, we think that less than 5% of our inventory at the end of quarter one was model year 2022. We believe somewhere in the neighborhood of 40% to 45% was model year ’23, and subsequently that means about half of our inventory was model year 2024.

If you compare that to previous fiscal years at that point in time, end of Q1, we are a little bit heavier on prior model year inventory. In this case, that would be model year 2023 and a little bit lighter on current model year inventory, that being model year 2024. The numbers that I just quoted, generally, the RV numbers as part of that are a little bit lower in a positive way, meaning we have less prior model year inventory.

In the Marine side, we probably have a little bit more prior model year inventory that we’re working through. I’ve seen some notes from some of the sell side analysts that are probably on the call today that have probably done some scrapes of online dealer inventory. And it appears that we are in good shape versus the rest of the industry in terms of inventory position. So a little elevated but not anything that is causing us great consternation at this time.

Source: https://rvbusiness.com/happe-winnebago-still-bullish-on-future-of-rv-industry/