Eberspaecher Posts Fiscal Year with Operational Turnaround – RVBusiness – Breaking RV Industry News

ESSLINGEN, Germany – The Eberspaecher Group provided a balanced product portfolio in 2023, according to a press release from the company.

Highlights included:

- Double-digit percentage net revenue growth in 2023

- Positive operating result and cashflow

- A good start to 2024 with falling transformation costs

“In a challenging fiscal year, the company generated net revenue of EUR 3.0 billion, an increase of 10.3% compared to the previous year. The company is successfully continuing its transformation. Earnings before interest and taxes (EBIT) adjusted for extraordinary items totaled EUR 58.0 million, underlining the operational turnaround. The significant improvement in cash flow also illustrates the effectiveness of the measures introduced,” the release stated.

The Eberspaecher Group recorded significant progress with its transformation in the 2023 fiscal year: “Operationally, we achieved the turnaround by consistently managing measures last year. In addition, the double-digit percentage growth in net revenue once again proved that we have the right product portfolio,” said Managing Partner Martin Peters, when summarizing the fiscal year. While customer demand for products relating to conventional drives remained at a high level globally, around 90% of revenue in the area of thermal management and vehicle electronics were already generated with products that are independent of the passenger car combustion engine.

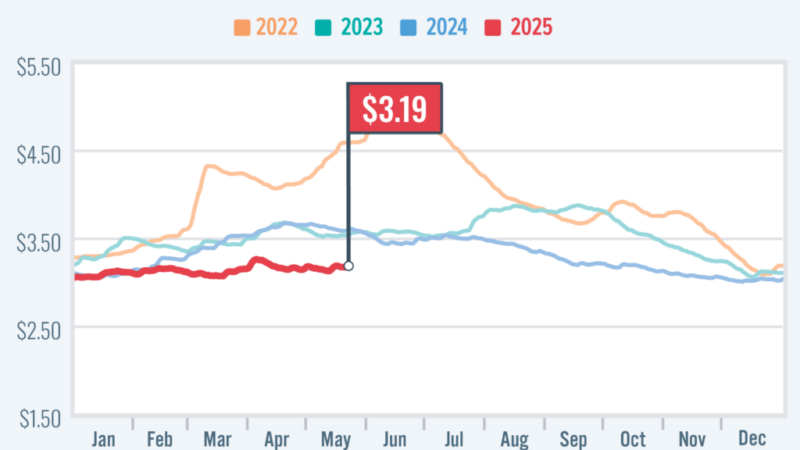

“We are ready for the future,” said Peters, adding: “But our industry remains in a difficult overall situation.” Geopolitical uncertainties and persistently high energy prices and inflation rates shaped the business environment. As global supply chains were affected by bottlenecks in the first half of the year, customer call-offs decreased over the course of the year. This particularly affected products related to e-mobility, which were and are being launched on the market more slowly than expected.

The consolidated revenue of the Eberspaecher Group decreased by -1.4% to EUR 6,349.0 million (prior year: EUR 6,437.5 million). Net revenue – adjusted for transitory items such as monoliths that are installed in exhaust systems and do not contribute to value creation – increased by 10.3% to EUR 3,002.9 million in 2023, significantly exceeding the forecast. The purely operating result of the Eberspaecher Group, adjusted for extraordinary items and one-off expenses in connection with the transformation, amounted to EUR 58.0 million (prior year: EUR 26.6 million). This reflects the progress made in operational improvement. The measures introduced to optimize cash management took effect and led to a significantly improved cash flow from operating activities of EUR 269.2 million (prior year: EUR 187.7 million). The continued high research and development expenses of EUR 55.9 million (prior year: EUR 51.6 million) underlines the investments in further expanding the technology portfolio in all Divisions. An average of 11,171 people were employed at around 80 locations in 30 countries.

Outlook

In a year that will continue to be very challenging for the entire automotive industry, the Company does not expect the markets to ease in 2024 and therefore predicts sales to fall below the prior year’s level. “We are therefore continuing to work consistently on our competitiveness,” emphasizes Martin Peters. He continues: “We are ready for the future as we have the right product portfolio for every drive type. In combination with our international positioning, we can be successful in all regions under changing market conditions.” The first months of 2024 gave him cause for optimism as the Group is on track operationally and has also won important new orders. The supplier is driving the transformation forward in a targeted manner by transferring existing technologies to new business areas and increasing efficiency and competitiveness in the core business.

CO2-neutral by 2040

As part of its approach to shaping a sustainable future, Eberspaecher has anchored a new overarching goal as an integral part of the corporate strategy: the company will become CO2-neutral by 2040, therefore going beyond the previous plan to achieve CO2-neutral production by 2030. Over the past four years, the supplier has been able to reduce its global production-related CO2 emissions by 56%. In addition to the targeted reduction in energy consumption, the purchase of green electricity and the in-house use of photovoltaics at many locations have contributed significantly to this. The Group also assumes responsibility along the supply chain by using green steel, for example. The forward-looking sustainability activities were once again confirmed by the non-profit organization CDP in its annual assessment with a “B score”. Further information on the activities in the three areas of activity for the clean mobility of tomorrow – Green Footprint, People and Innovation – can be found in the 2023 Sustainability Report.

2023 business performance in the individual Divisions

The Purem by Eberspaecher Division, which specializes in exhaust technology, recorded another increase. Net revenue adjusted for transitory items totaled EUR 2.2 billion (prior year: EUR 1.9 billion), an increase of 13.4% compared to the prior year. Gross revenue fell by 1.9% to around EUR 5.5 billion (prior year: EUR 5.7 billion). The contrasting development is due to a lower proportion of transitory items. These primarily include monoliths coated with precious metals, which are used in exhaust systems and whose raw material price fell significantly.

The Americas Business Unit recorded revenue significantly above the prior year’s level. This is mainly due to the ramp-up of the two plants in Louisville (Kentucky) and St. Louis (Missouri). In Europe, more complex exhaust systems for producing higher-value vehicles were in demand in the first half of the year. The European truck business also developed positively. Revenue in Asia was roughly on a par with the prior year due to the generally weak market situation. The Division expanded its production footprint to 19 countries by opening two new production plants in Thailand and Malaysia.

In addition to new products for future emission standards, such as Euro 7 and its global counterparts, the Division is further developing its core competences in exhaust technology into new technologies. In order to make a positive contribution to climate protection, Purem by Eberspaecher is supporting several hydrogen management projects for both fuel cell applications and the hydrogen engine.

At EUR 714.4 million (prior year: EUR 721.1 million), revenue in the Climate Control Systems Division in 2023 was slightly below the prior year’s level. On the one hand, this is due to reduced customer call-offs for electrical high-voltage heaters because electric vehicles are coming onto the market more slowly than expected. It is also due to the weaker retrofit and spare parts business for thermal management solutions in the North American truck market and the German passenger car aftermarket. On the other hand, revenue in the area of air conditioning systems for buses increased. Product innovations for climate-friendly heating and cooling for conventional and electric drives in this area were also brought to market maturity. Breezonic, the first self-developed rooftop air conditioning system with heat pump function and app and touchscreen control for recreational vehicles, was also presented to the public.

The Automotive Controls Division recorded an increase in revenue of over 44% to EUR 92.3 million (prior year: EUR 64.0 million). In the first half of the year, demand for electronic control units, especially those installed in electrical heaters for electric vehicles, was still at a very high level. However, declining customer call-offs in the second half of the year slowed further development. The series development of a complex battery management system (BMS) for a 12-volt lithium-ion battery opens up a completely new product segment. Eberspaecher is one of the first companies in Europe to have a BMS in the low-voltage range with a connection to the vehicle’s on-board network in series production.

The Hydrogen Mobility business area operates in a market that is still very young and characterized by high volatility and project business. This small business area more than doubled its business volume compared to the prior year. The core sales regions for fuel cell applications are the USA and Asia.

The annual report provides a comprehensive overview of the Eberspächer Group’s fiscal year 2022. More information on the Group of Companies can be found in the media service.