Brown & Brown Reports $1.026 Billion in 4th Quarter Revenue – RVBusiness – Breaking RV Industry News

DAYTONA BEACH, Fla. – Brown & Brown, Inc. (NYSE:BRO) announced its unaudited financial results for the fourth quarter and full year of 2023.

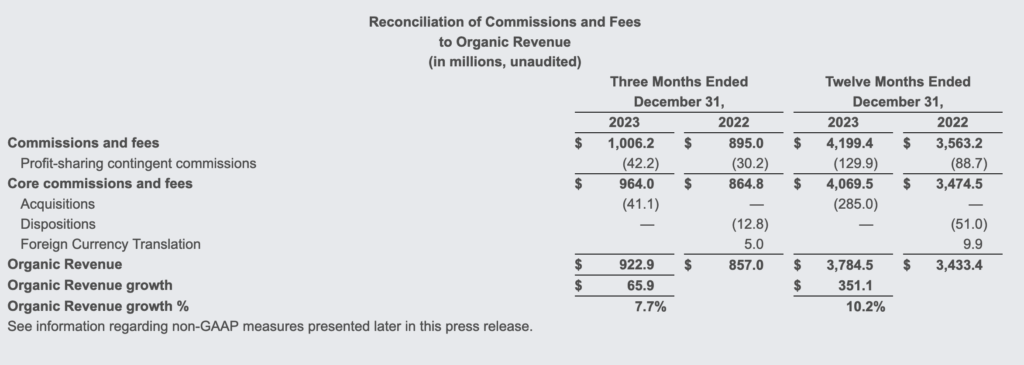

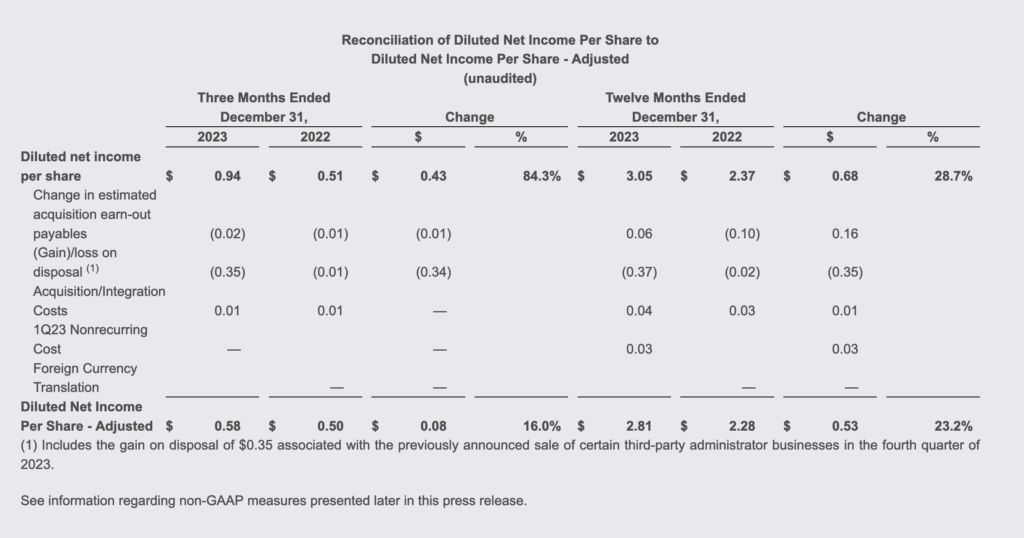

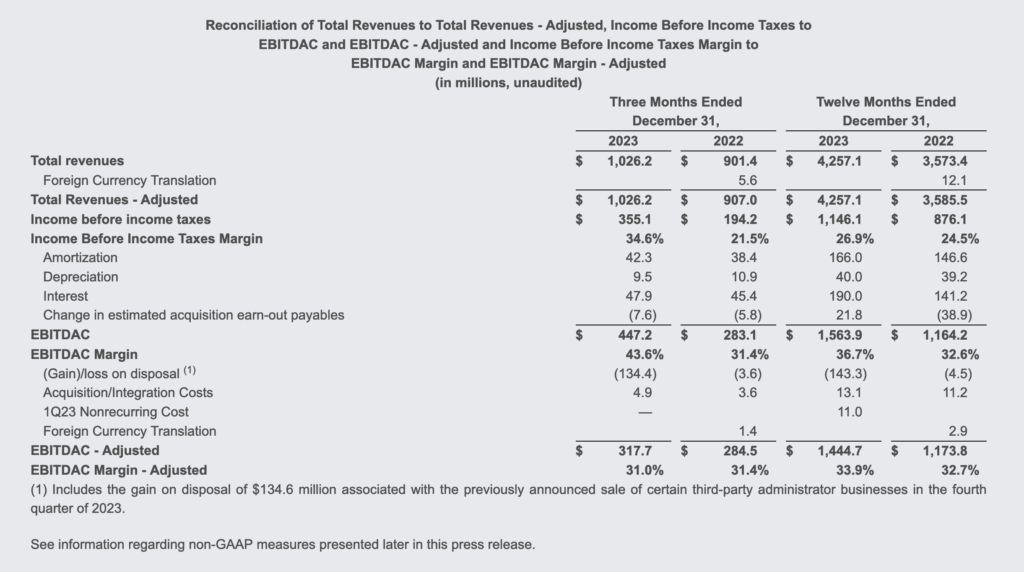

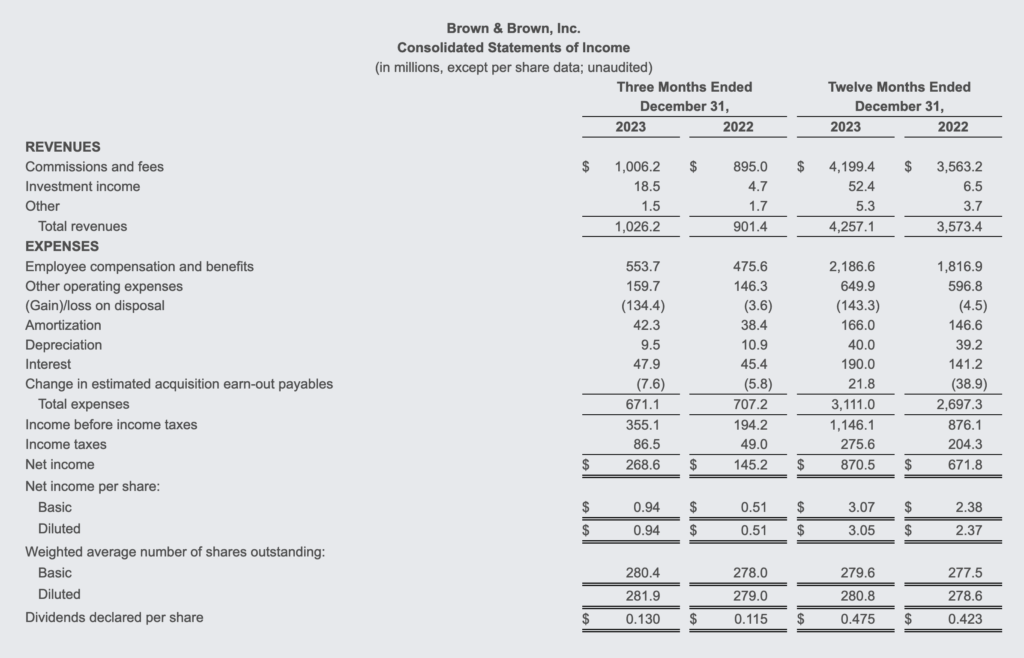

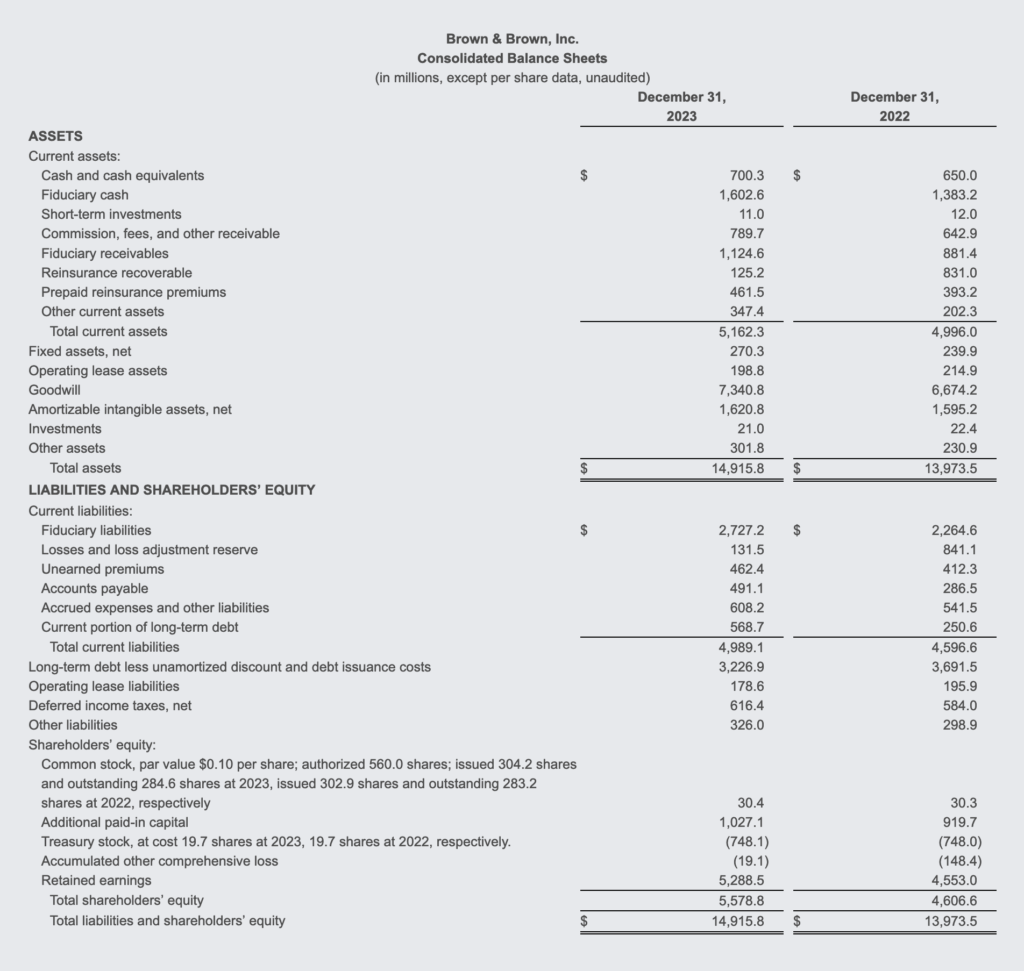

Revenues for the fourth quarter of 2023 under U.S. generally accepted accounting principles (“GAAP”) were $1,026.2 million, increasing $124.8 million, or 13.8%, compared to the fourth quarter of the prior year, with commissions and fees increasing by 12.4% and Organic Revenue increasing by 7.7%. Income before income taxes was $355.1 million, increasing 82.9% from the fourth quarter of the prior year with Income Before Income Taxes Margin increasing to 34.6% from 21.5%. EBITDAC – Adjusted was $317.7 million, increasing 11.7% from the fourth quarter of the prior year with EBITDAC Margin – Adjusted decreasing to 31.0% from 31.4%. Net income was $268.6 million, increasing $123.4 million, or 85.0%, and diluted net income per share increased to $0.94, or 84.3%, with Diluted Net Income Per Share – Adjusted increasing to $0.58, or 16.0%, each as compared to the fourth quarter of the prior year.

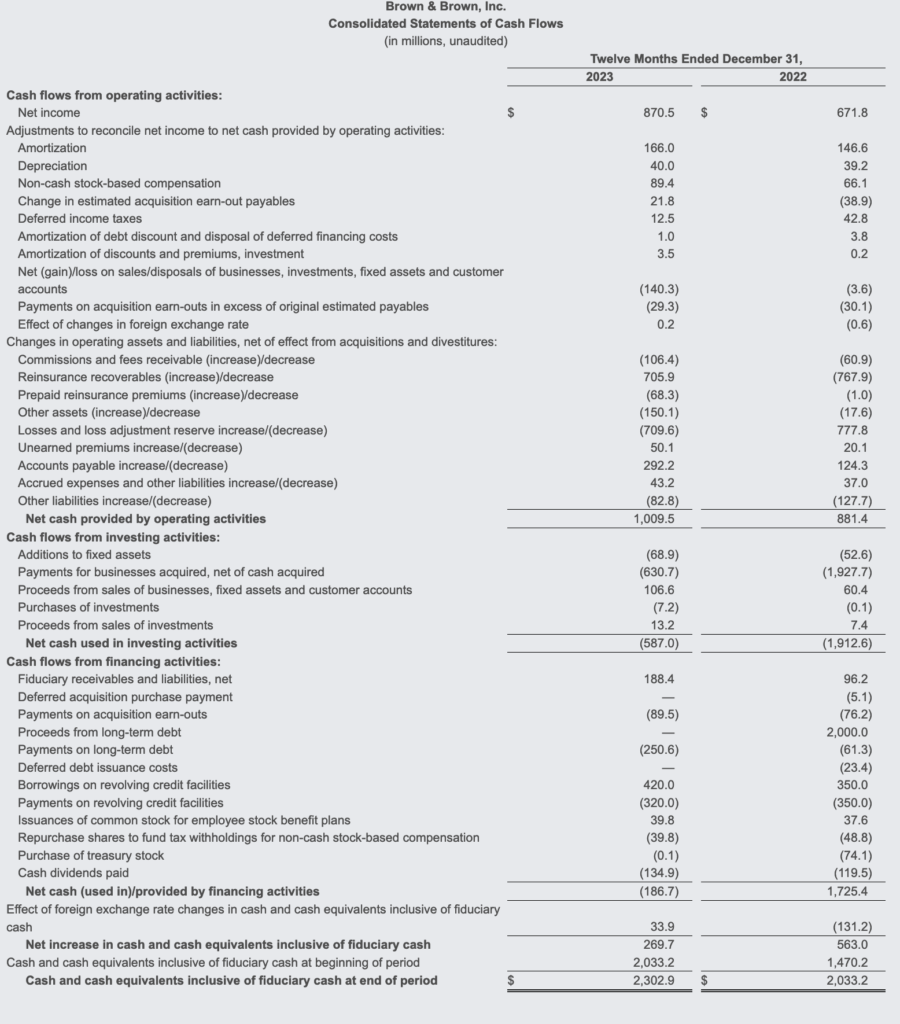

Revenues for the twelve months ended December 31, 2023 under GAAP were $4,257.1 million, increasing $683.7 million, or 19.1%, as compared to 2022, with commissions and fees increasing by 17.9%, and Organic Revenue increasing by 10.2%. Income before income taxes was $1,146.1 million, increasing 30.8% with Income Before Income Taxes Margin increasing to 26.9% from 24.5% as compared to 2022. EBITDAC – Adjusted was $1,444.7 million, which was an increase of 23.1% and EBITDAC Margin – Adjusted increased to 33.9% from 32.7% as compared to 2022. Net income was $870.5 million, increasing $198.7 million, or 29.6%, with diluted net income per share increasing to $3.05, or 28.7%, and Diluted Net Income Per Share – Adjusted increasing to $2.81, or 23.2%, each as compared to 2022.

J. Powell Brown, president and chief executive officer of the company, noted, “We are extremely pleased with our performance in the fourth quarter and for the full year, in which we grew our revenues 10.2% organically and crossed our intermediate revenue goal of $4 billion. We now embark on our next goal of $8 billion.”

The company also announced a new alignment of its businesses in conjunction with the divestiture of certain businesses within our Services segment in the fourth quarter of 2023, moving from four to three segments beginning in 2024: Retail, Programs and Wholesale Brokerage.

A conference call to discuss the results of the fourth quarter and full year of 2023 will be held on Tuesday, January 23, 2024, at 8:00 AM (EST). The Company may refer to a slide presentation during its conference call. You can access the webcast and the slides from the “Investor Relations” section of the Company’s website at bbinsurance.com.