Record Crowd Gains Economic Insights at Power Breakfast

Over 1,000 attendees packed the RV Hall of Fame’s Northern Indiana Event Center for this morning’s RV Industry Power Breakfast. (Photos: RVBusiness)

ELKHART, Ind. – A record crowd of more than 1,000 people who attended the 2023 RV Industry Power Breakfast featuring RVBusiness gained a wealth of information regarding the economy at local, state and federal levels as well as pressure points facing the RV industry.

Indiana Gov. Eric Holcomb and nationally recognized economist Peter Morici led the pack of presenters at the 11th such event, held annually at the RV/MH Hall of Fame and Northern Indiana Event Center in Elkhart.

Also on tap was an industry panel featuring RV Industry Association (RVIA) Executive Vice President James Ashurst, RV Dealers Association (RVDA) President Phil Ingrassia, who were joined by their respective association chairmen, Forest River Inc.’s Kevin McArt and central Indiana dealer Nathan Hart of Walnut Ridge Family RV. Kampgrounds of America (KOA) President and CEO Toby O’Rourke also offered a presentation on the campground industry.

After opening remarks by emcee Gregg Fore, Elkhart Mayor Rod Roberson, surprise guest Indiana Lt. Gov. Suzanne Crouch made brief remarks, noting that the RV industry in Elkhart County generates $34 billion – or roughly 10% – of the economic activity in Indiana.

The industry panel – one of the most anticipated segments of the event – then took the stage, moderated by Bob Parish, VP of national accounts RV group, for Wells Fargo and Sherman Goldenberg, RVBusiness senior editor.

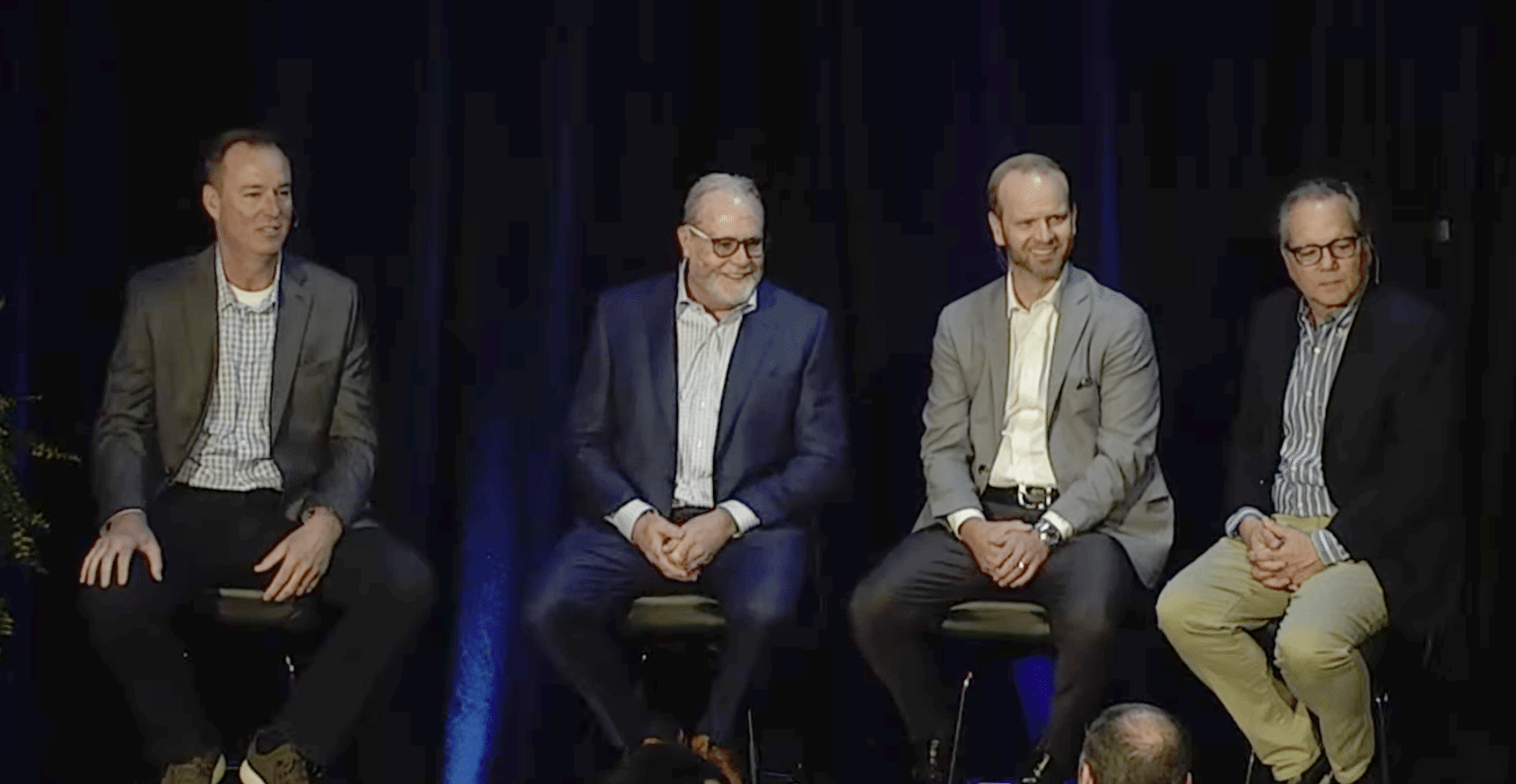

Industry Panel Features Top Execs

The industry panel featured, from left, RV Industry Association (RVIA) Executive Vice President James Ashurst, Forest River Inc.’s Kevin McArt, and central Indiana dealer Nathan Hart of Walnut Ridge Family RV and RV Dealers Association (RVDA) President Phil Ingrassia.

The panel — much like the program’s featured speakers — gives the audience the opportunity to hear from top-level executives. The difference, though, isn’t just in the panel’s makeup but it’s question-and-answer format — and with the industry still looking for a foothold as it settles into a more “normalized” sales year, audience members earlier submitted questions to moderators Goldenberg and Parish for panelist member’s views on a number of hot topics.

One theme that emerged time and time again was the industry’s ability to pull together to meet challenges.

“What we’ve seen over the last couple of years, coming out of Covid — but even before that — is the lines of communication between our two (association) boards have never been more open,” said Ingrassia when responding to a query on post-pandemic industry performance.

Hart, the current RVDA chairman, underscored the industry’s interwoven partnerships.

“Where else do you find an industry where you have manufacturers, suppliers, aftermarket lenders and campgrounds all working together for a common goal?” he noted. “We have a lot more in common than we do in terms of difference.”

Part of that solution, noted Ashurst in response to a question about Go RVing, is the associations’ ability to reach a changing audience.

“The impact of digital reach today has really changed what were the traditional forms of marketing,” he said. “The Go Rving team has stayed on top of these changes and gotten really good at focusing on these high-value audiences. As a consequence, over the last three years we’ve brought in a much younger, more diverse audience.”

One of the upshots to this focus, he outlined later in the discussion, is that the average age of a new buyer has dropped tremendously, creating a framework for future generations.

“During Covid, we did research every year of new buyers,” Ashurst noted. “Initially, the median age of an average RV owner was 54. In 2020, the average age of a new RV buyer dropped to 41. In 2022, that number dropped down to 33.”

That said, there are still challenges ahead. Asked by Parish about possible topics RV executives will delve into during June’s RVs Move America Week and Advocacy Day — both scheduled for Washington, D.C. — McArt said one pressing topic would be advocating for a dealer floorplan interest reduction on towables.

“While dealer inventory — or interest expenses — on motorhomes remains fully deductible, towables are limited to just 30% interest expense based on earnings. This is problematic because 85% of RVs in the market today are towables. This topic is more important than ever right now because of the high interest rates and the slowdown in the economy. So we will be asking legislators to support the Travel Trailer & Camper Tax Parity Act.”

Another topic sure to be up for discussion, he added, would be the renewal of the GSP (generalized system of preferences) program.

The program, which McArt said expired at the end of 2020, is a long-running U. S. trade preference program that allowed the industry to import luaun duty-free. Industry and association executives, he added, will be advocating for a six-year or longer renewal.

Other topics that came up for discussion included November’s RV Dealers Convention/Expo — “It’s not just for dealers. I had some manufacturer’s reps there last year who said they got a lot out of it,” said Hart — model-year changes and the industry-wide need for more technicians.

“We have 11,000 technicians that are currently at some stage of training in RVTI,” said Hart. “There are 786 dealerships that have at least one technician in training. Why isn’t that 1,500 dealerships? We need to be encouraging dealerships to have training programs to develop their own technicians so we can satisfy this need.”

All four panelists, however, believed the state of the industry — what moderator Goldenberg called “the 600-pound gorilla in the room” due to the country’s current economic uncertainty — was nonetheless healthy.

“Yes, it’s difficult — there are some challenges,” said Hart. “But we (dealers) are doing what we need to do to make our dealerships better, so when things bounce back we’ll be prepared to take care of our customers. But until consumers feel better about the future, I think we’ll continue to struggle a bit.

“We can see through the KOA (Kampground of America) numbers and the camping numbers that people are traveling. But maybe they don’t want to commit to buying a larger-ticket item until they feel more comfortable.”

McArt concurred.

“From my perspective, we need economic stability,” he said. “The Federal Reserve has raised interest rates 10 times since March of last year — that’s affecting the consumer confidence level and also raising everyone’s monthly payments. It’s making it more of a challenge for consumers to hit their monthly budgets. Some customers understand that this may be the ‘new normal’ — so we just need some economic stability. I think our industry will be much better off once that happens.”

And, added Ashurst, it’s not like the industry hasn’t encountered headwinds before.

“If you were to chart the industry performance over the past 40 years, it would look like an EKG (electrocardiogram used to record electrical signals from a person’s heart),” said Ashurst. “We’ve had downturns, and a lot of times those downturns were things that were out of our control. But as an industry, we’ve persevered over a considerable amount of time and have seen incredible growth.”

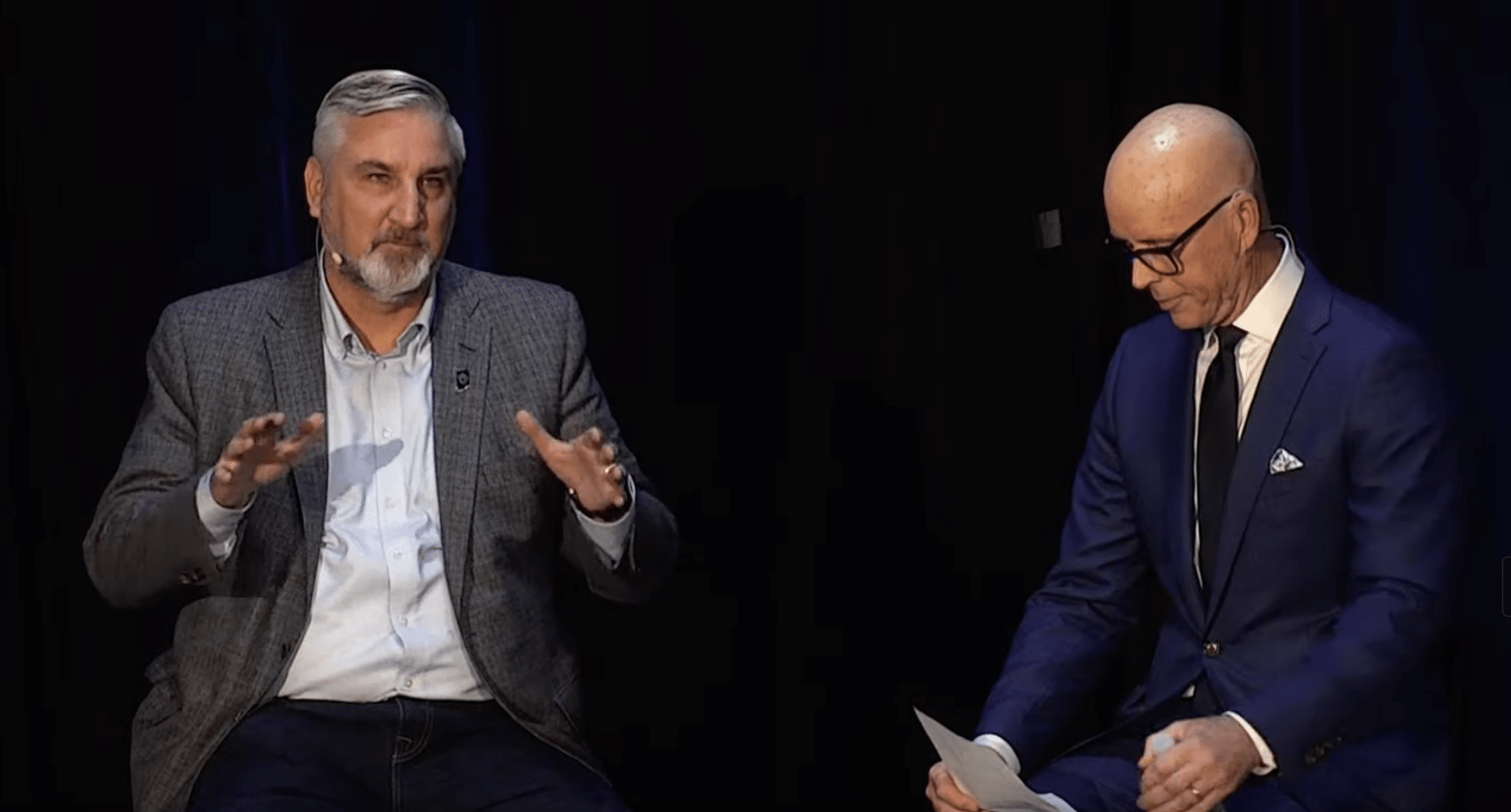

Governor Outlines Indiana’s Role

Indiana Governor Eric Holcomb, left, and WSBT-TV South Bend’s Morning News Anchor Bob Montgomery.

Following the panel, Bob Montgomery, WSBT-TV South Bend morning news anchor moderated a discussion with Indiana Gov. Eric Holcomb.

Montgomery noted that Forbes Magazine recently listed Indiana as the No. 1 place in the U.S. to start a business and asked Holcomb why that is.

Holcomb said that ranking was based on about 18 criteria, most of which revolve around the cost of doing business, cost of living, access to capital, unemployment rate – similar to a momentum index.

“But we obviously score on multiple fronts at the top of the list when it comes to our taxes and our regulatory environment,” he said. “You start there, but increasingly, our different economic engines around the state of Indiana – here, obviously the epicenter of RV production and distribution – venture capital is increasingly becoming very important to growing the local economies. Forbes recognized that and we share that fact all over the world.”

Regarding the elimination of the state income tax, the governor said that while it is a possibility, multiple factors must be considered to ensure there is replacement for the revenue it generates – roughly $8 billion in state coffers and $3 billion in local coffers.

You must also consider, he said, that states where there is no income taxes have large oil and gas reserves or coastlines with highly assessed property values.

“When you look at these things regionally and you look at tax structures and the portfolio here, we just jump off the map as an attractive place to invest, so you don’t want to jeopardize that as you look to increase revenue somewhere else (to replace an income tax),” Holcomb said.

Regarding the economy, Montgomery asked Holcomb if Indiana is poised to handle even more of a downturn.

“The answer is yes, we’re in a position of strength quite frankly,” Holcomb said. “And, by the way, we’ve proven, if you rewind the tape and go back to ’08 or ’09 or you go back a couple of years, the state of Indiana not only has a strong balance sheet – on both sides of the ledger – but we’re also willing to do the courageous thing. That’s tighten the belt in tough times.”

He added that his administration looks for efficiencies “while the storm is occurring, and you often learn a lot when you’re forced to. That’s the whole point and the culture in Indiana state government. We constantly talk about taking it to the next level. That’s the mentality. “

Directly related to the RV industry Holcomb also discussed the state’s efforts to improve camping opportunities, noting the state has 8,100 campsites, 81% of which have electrical hookups with 44% of those offering 50-amp service.

“We’re on the right track. We’re continuing to upgrade as this industry gets bigger, so will our recreational portfolio,” he said, including investment in broadband Internet service and electric vehicle charging stations.

When considering the recently-concluded state budget session, Holcomb said there was a “long list” of things that made him smile, but pointed out specificially, “when you think about the momentum that we’re able to build on right now and really accelerate away from, just, last week, let alone last year or the last two years,” he said.

For perspective, Holcomb said, “This is about momentum. This is about where we were and where we are right now. If you look at the 12 years prior to our administration taking office … capital investment coming in through the Indiana Economic Development Commission. They did about $49 billion in that 12-year period. In the next six years, we did about $60 billion.”

The previous record year brought in $8.7 billion. Last year’s tally was $22.2 billion, and this year’s pipeline is even more robust.

“We’re now chasing deals that are bigger than a single,” Holcomb said. “Now we’ve got to land all these birds, but we’ve got a really good track record and I’d rather be in the heart of the heartland than anywhere else.”

Holcomb, who’s in the last year of his second term, offered advice to his successor: “Don’t miss this breakfast, let’s start there.” he chuckled.

“Generally, it would be to surround yourself with a good team and the way to do that is by having an agenda that people can not only rally around, but understand they’re part of something bigger than themselves. Attract the best. Let people know what your agenda is, what your goals are, what the mission is, how you’re going to achieve that mission. Be informed. Let the data drive your decisions as hard as they may be. Have some courage to do the right thing,” he said. “Understand that typically in life it works out of you do that.”

KOA’s O’Rourke Highlights ‘Camping Journey’

Kampgrounds of America Inc.’s President and CEO Toby O’Rourke highlighted the importance of taking care of the customer during her speech at the 2023 RV Industry Power Breakfast on Thursday (May 11) morning at the RV/MH Hall of Fame in Elkhart, Ind.

KOA’s Toby O’Rourke speaks during the breakfast.

A key industry event for RV manufacturers, dealers and other leaders, this year more than 1,000 attendees took part and O’Rourke highlighted the customer’s Camping Journey as she noted that 68% of new campers are lukewarm or unlikely to camp again.

“For the past couple of years, when I’ve been asked about all these new people camping, I have always said that there is going to be a natural drop off,” she explained. “Camping is not going to be for everybody, but I really don’t accept that anymore and I don’t think you should either. I want to know what’s not okay for those people who don’t want to camp again, so we can fix it.”

When asked, 32% of people who went on an RV trip for the first time said the experience was good or great. O’Rourke noted that it begs the question, What was less than OK for the other 68%?

“Here’s the problem as I see it, the reality is that camping is an easy choice, but it’s not always easy,” noted O’Rourke. “What do I mean by that? People didn’t want to stay in hotels and get on airplanes during the pandemic. They wanted to be outdoors instead of indoors and we know that a lot of people now are looking for flexibility since the pandemic and 72% of campers think camping is more flexible than air travel and hotels, it’s also affordable. Two-thirds of people feel camping is more affordable than hotels and airlines.

“Camping continues to show its resiliency for all travelers, not just campers,” O’Rourke added. “Over half think that camping is a more affordable and of those people who already own RVs, 33% said they’re going to use it more than more times this year in place of other types of travel.”

However, O’Rourke noted that camping can be intimidating for new RVers as they learn how to drive/tow an RV, setup an RV, learn to start a fire, find a campsite…etc. She took attendees of the Power Breakfast through what she called the Camping Journey, noting that suppliers, RV makers, campgrounds, dealers…etc. all have a role to play in ensuring that a camper remains a camper.

She highlighted the ways in which people camp and that keeping people in the journey points them towards a path of RV ownership.

“We all share the customer in this lifecycle but just as we all share the customer, we can all lose the customer and we can lose the customer at any point,” O’Rourke noted. “They can have a bad experience at one part of the journey and then another part of the segment has lost that customer.

“Maybe the experience at the campground isn’t good and then we have lost a potential RV buyer,” she added. “Maybe they have a terrible RV service experience and decide to sell their RV, then we have lost a repeat camper. We all share the customer and we all lose the customer, and it’s important that we think about how we make it easier across the board. Otherwise, this isn’t a map of a campground journey, this is a map of exit ramps.”

O’Rourke then explored the idea of friction points (pain points) in the journey that prevent the industry from retaining campers.

A few of the pain points that O’Rourke explored include:

- Only 23% of new campers said the sales team was helpful to them when first buying their RV and learning how to use the RV.

- In the discover phase, a quarter of people don’t know where to camp or they think there are not enough parks that fit their style of camping.

- Two-thirds of people say packing, driving and setting up is a pain point for them.

- 35% say the quality of their RV and getting service on their RV is a pain point.

- Unpacking and cleaning is another pain point for first-time RVers.

“If we don’t smooth over these pain points, we are at risk of losing those 70% of people that are lukewarm about continuing to camp,” she explained. “We have to demand exceptional service at every point in the process. We have to make it easy to do business with us because our research shows that people who have a great first experience, over half of them are likely to camp again.

“I know we can increase that even more because if we can make the experience seamless, easy and less stressful, they can focus on spending time with their loved ones and enjoying the outdoors,” O’Rourke added. “That’s the whole reason they went camping in the first place and that emotional attachment to their loved ones is going to get them back camping again. We see that as we talk to teenagers. They have such great memories of or great feelings of camping with their family and then as they become adults, they try to replicate that with their own family. If it is not easy though, they’re likely to drop off.”

Looking at solutions to these pain points, O’Rourke used a buzzword, customer obsessed.

“Customer obsessed is being hyper focused on the customer experience,” she noted. “It is a commitment to being customer centric.”

She broke it down into a three-part outline, “Know. Improve. Measure.”

Know who the customer is and what their pain points are. 70% of new campers are Gen-Z or Millennials, so they are under the age of 42 and the average age of an RV buyer in 2022 was 33.

“We need to use data and invest in research to understand our customers,” said O’Rourke. “I have a lot of research but we have to go deeper and we have to get more granular on this new camper. Sometimes the best way to do it is through what we call ethnographies where you talk to people when they’re in the experience of using a product or engaging in the activity. How does knowing the age of the new camper change how we fix and identify these pain points in the process?”

She also looked at it from an accessibility point, noting that four in 10 campers say they have some difficulty walking or climbing stairs.

Improve products and processes. O’Rourke said that the research companies gather from learning about the customer can help them create products and experiences that match their desires.

“All of these pain points are ripe for innovation and they are also ripe for disruption,” she explained. “There are a lot of new companies starting up in this industry trying to address these pain points. We’re seeing a lot, for example, in the booking experience, trying to aggregate places for people to stay to make it easier for the camper to find somewhere to go.

“I would challenge you to think about how you can disrupt yourselves in the way that you do things,” O’Rourke added. “All of these pain points are also natural places for partnership. There are lots of ways within our ecosystem we can partner, for example, mobile technicians coming to campgrounds. I still think there is a lot to explore on the dealer and campground side.”

Measuring camper feedback is key. O’Rourke said it is important for everyone to be proactive about seeking out feedback.

“Go online and see what’s being said about you and also then respond currently to complaints,” she explained. “We need to move the dial when we measure customer satisfaction.”

O’Rourke touted how KOA has been utilizing the Net Promotor Score (NPS) which actively seeks feedback from costumers and then gives companies a score on how they are doing.

“I like NPS because it’s used everywhere and it allows us to benchmark all parts of our business against maybe people we admire or other companies,” O’Rourke said.

She wrapped up her speech by highlighting that this is a call to action for the industry and that everyone along the Camper’s Journey needs to be costumer focused.

“I think when we look at this from an economic standpoint, this is a powerful conversation to have,” O’Rourke explained. “When you reframe this and think about the lifetime value of a customer, imagine the impact of a single camping household. Campers, on average, will camp for 33 years and spend 11 nights, on average, camping per year. Imagine what that means when you look at the RVs they may purchase and the investment they are putting into camping. That number can add up pretty quickly.”

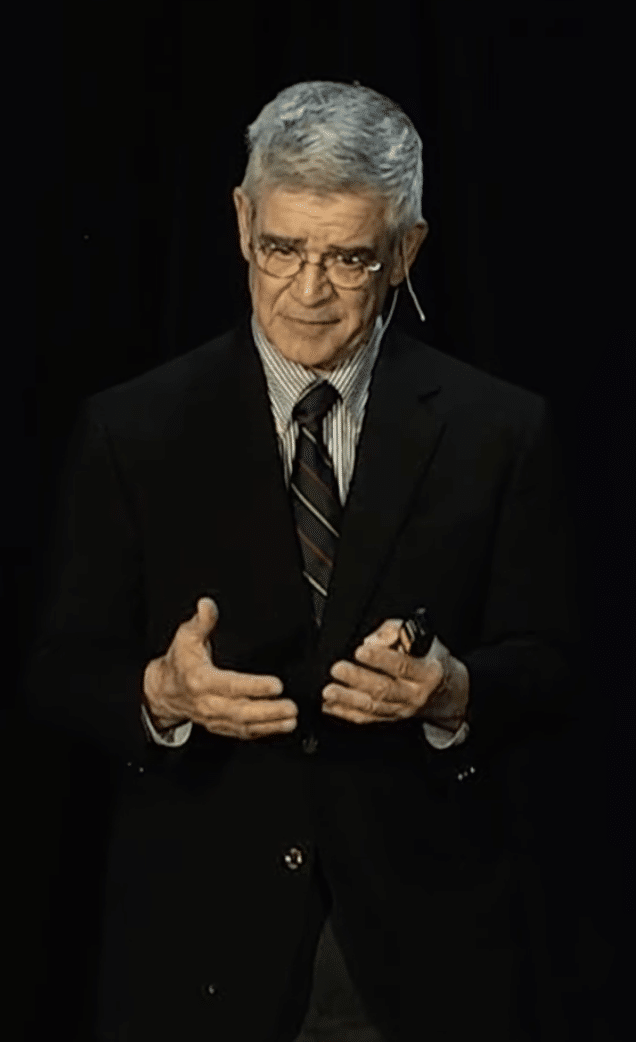

Economist Morici Gives Keynote Speech

Nationally recognized economist Peter Morici

Featured speaker and nationally recognized economist Peter Morici was the final attraction and started his remarks with some praise for Indiana.

During a speech in Washington, Morici remembered hearing a national security policy say, “Republicans like to cut taxes, that’s bad and that the market doesn’t work,” recalled. “When I hear that, and I get it a lot … I say, ‘Have you been to Indiana?’ I mean, Indiana does all the things that you say don’t work and Indiana is growing. It’s expanding. It’s thriving, without all the drama that Florida has. Governor, maybe you need to create a little drama so people start noticing all the great things that are going on in Indiana.”

Morici outlined long-cycle challenges including competition with China, Russia, Iran and North Korea, climate change, energy rebalancing, declining birth rates and artificial intelligence.

He touched on problems in the banking system – specifically the failure of Silicon Valley bank and how the San Francisco federal reserve should have seen problems in the bank’s balance sheet and acted to prevent the failure.

Morici pointed out that the U.S. economy is in a period of low growth and high inflation.

Meanwhile, government spending is at record levels, to the point where if nothing changes, by the mid-2030s, the government will have to borrow money to pay the interest on the national debt.

The consequences of current federal fiscal policy, he said, is:

- Long-term growth in the range of 1.5 to 1.8%

- Long-term inflation in the range of 3% or higher

- Significantly higher larger federal deficits over the next decade with the potential for a debt crisis

- Permanently higher interest rates

- Worker and wage inequality

- Households strapped with heavy debt

- More limited homeownership

- Lowered birth rates

- Renewed pressure for immigration reform.

Morici’s national economic forecast for 2024 calls for:

- Annual Gross Domestic Product – 0.7%

- Year-Over Year Consumer Price Index – 3.8%

- Core Consumer Price Index – 3.8%

- Unemployment rate – 4.1%

- Federal funds rate – 5.125%

- 10-year treasure bill – 3.80%

After presenting a series of RV industry data points, Morici said, that while large companies have been leanred how to weather economic headwinds, “The real pressure points in the industry for you,” Morici said. “Are the independent operators of campgrounds, your dealers and their bankers, to the extend they rely on smaller banks, because they’re going to be more vulnerable to these changes and it’s going to take time as they fall off the map for new ones to come on the map or as they change hands. It’s going to be very difficult during the next year, for example, for campgrounds to invest. It’s going to be more difficult for dealers to invest in more training programs. That’s where the pressure points are in the industry and that’s how I see the future for you.”

The event, facilitated by RVBusiness Magazine, is sponsored by Airxcel, Spartan Chassis, THOR Industries Inc., Dometic, RV Industry Association, KOA, Cummins, Wells Fargo, Forest River, Winnebago Industries and the RV Dealers Association.

Source: https://rvbusiness.com/record-crowd-gains-insights-from-power-breakfast-speakers/