2 Fed Officials Favor Keeping Key Rate at Peak Through 2023

WASHINGTON — Two Federal Reserve officials said Monday (Nov. 28) that they favor raising the Fed’s key rate to roughly 5% or more and keeping it at its peak through next year — longer than many on Wall Street have expected, according to an Associated Press report.

WASHINGTON — Two Federal Reserve officials said Monday (Nov. 28) that they favor raising the Fed’s key rate to roughly 5% or more and keeping it at its peak through next year — longer than many on Wall Street have expected, according to an Associated Press report.

John Williams, president of the Federal Reserve Bank of New York, who is among a core group of officials around Chair Jerome Powell, said in a speech to the Economic Club of New York that the central bank has “more work to do” to reduce inflation closer to its 2% target.

And James Bullard, president of the St. Louis Fed, suggested that financial markets are underestimating the likelihood the Fed will have to be more aggressive in its fight against the worst inflation bout in four decades.

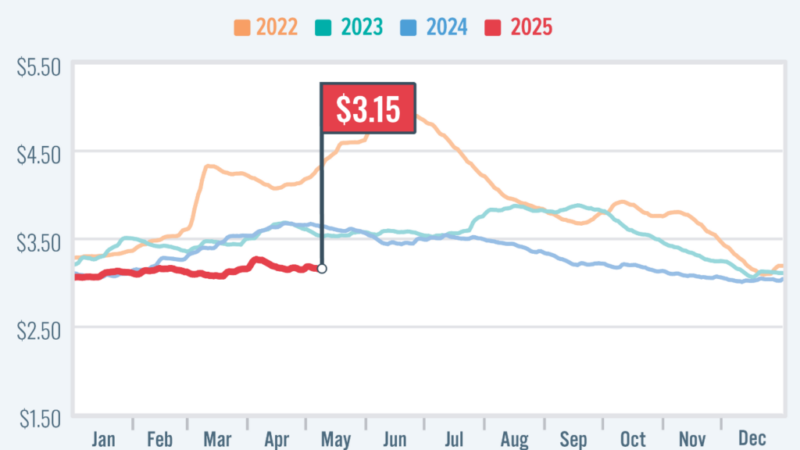

The Fed has raised its benchmark short-term rate six times this year, to a range of 3.75% to 4%, with each of the last four hikes being a historically large three-quarters of a point. The central bank is expected to raise rates by an additional half-point when it next meets in mid-December. Though that would represent a reduction in the size of its rate hikes, Fed officials have stressed that they expect to keep their key rate at a historically high level well into the future.

Read the full Associated Press report.

Source: https://rvbusiness.com/2-fed-officials-favor-keeping-key-rate-at-peak-through-2023/