THOR Industries Reports $2.35B in Net Sales for Q2 Fiscal 2023

ELKHART, Ind. – THOR Industries, Inc. (NYSE: THO) today (March 7) announced financial results for its second fiscal quarter ended Jan. 31, 2023.

ELKHART, Ind. – THOR Industries, Inc. (NYSE: THO) today (March 7) announced financial results for its second fiscal quarter ended Jan. 31, 2023.

Net sales for the second quarter were $2.35 billion, a decrease of 39.4% compared to the record second quarter of fiscal 2022 and a decrease of 14.0% over the same quarter of fiscal year 2021.

Other noted results included:

- Consolidated gross profit margin for the second quarter was 12.1%, a decrease of 530 basis points when compared to the second quarter of fiscal year 2022 and a 310 basis point decrease compared to the second quarter of fiscal year 2021.

- Earnings per share for the second quarter were $0.50 per diluted share, down from $4.79 per diluted share in the same period of the prior fiscal year and down from $2.38 per diluted share in the second quarter of fiscal year 2021.

- Net cash provided by operations for the first half of fiscal 2023 was $185.3 million as compared to net cash provided by operations of $298.1 million for the first half of fiscal 2022 and net cash used in operations of $88.6 million for the first half of fiscal 2021.

- The company revised its full-year fiscal 2023 net sales and diluted earnings guidance with a current net sales estimate of between $10.5 billion to $11.5 billion and diluted earnings per share in the range of $5.50 to $6.50.

Bob Martin

“Our fiscal second quarter presented a challenging market environment. Against this backdrop, our financial results and actions are a testament to our ability to operate in such a dynamic and challenging environment. Our resilient second quarter performance demonstrates the strength of THOR’s diverse product offering, the experience of our management teams and the success of our variable cost model. Despite the challenging quarter, THOR generated positive cash flow and maintained an already strong liquidity profile, positioning THOR to operate from a position of financial strength as we move beyond our second quarter,” said Bob Martin, president and CEO of THOR Industries.

“During the quarter, we continued to proactively and decisively balance wholesale production with the pace of softening retail sales through the traditionally slower winter retail season,” he continued. “This commitment to a disciplined production approach, combined with a softer-than-expected order intake, resulted in second quarter North American wholesale shipments of 25,372 units. Despite a significant slowdown of both sales and production, we expect the successful execution of our aggressive, proactive actions and our variable cost model to position our operating companies and independent dealer partners favorably heading into the second half of our fiscal 2023, which typically experiences stronger retail activity than our second quarter.

“While near-term demand will continue to be influenced by macroeconomic conditions, we believe the recent softening in demand to be temporary. We remain encouraged with the continued level of consumer interest for the RV lifestyle. We are experiencing a strong spring retail show season across the country with high attendance figures and solid retail activity. In addition, digital traffic across RV related sites remains well above pre-pandemic levels, reinforcing our long-term optimism for the industry and for THOR. While we are encouraged by these positive indicators, the current macroeconomic environment is still very dynamic. As a result, we have taken decisive steps to position our company to navigate the near-term softening market conditions,” said Martin.

Second-Quarter Financial Results

Consolidated net sales were $2.35 billion in the second quarter of fiscal 2023, compared to $3.88 billion in the second quarter of fiscal 2022 and $2.73 billion in the second quarter of fiscal 2021.

Consolidated gross profit margin for the second quarter was 12.1%, a decrease of 530 basis points when compared to the second quarter of fiscal year 2022 and a 330 basis point decrease when compared to the second quarter of fiscal year 2021.

Net income attributable to THOR Industries and diluted earnings per share for the second quarter of fiscal 2023 were $27.1 million and $0.50, respectively, compared to $266.6 million and $4.79, respectively, for the prior-year period and $132.5 million and $2.38, respectively, for the second quarter of fiscal 2021.

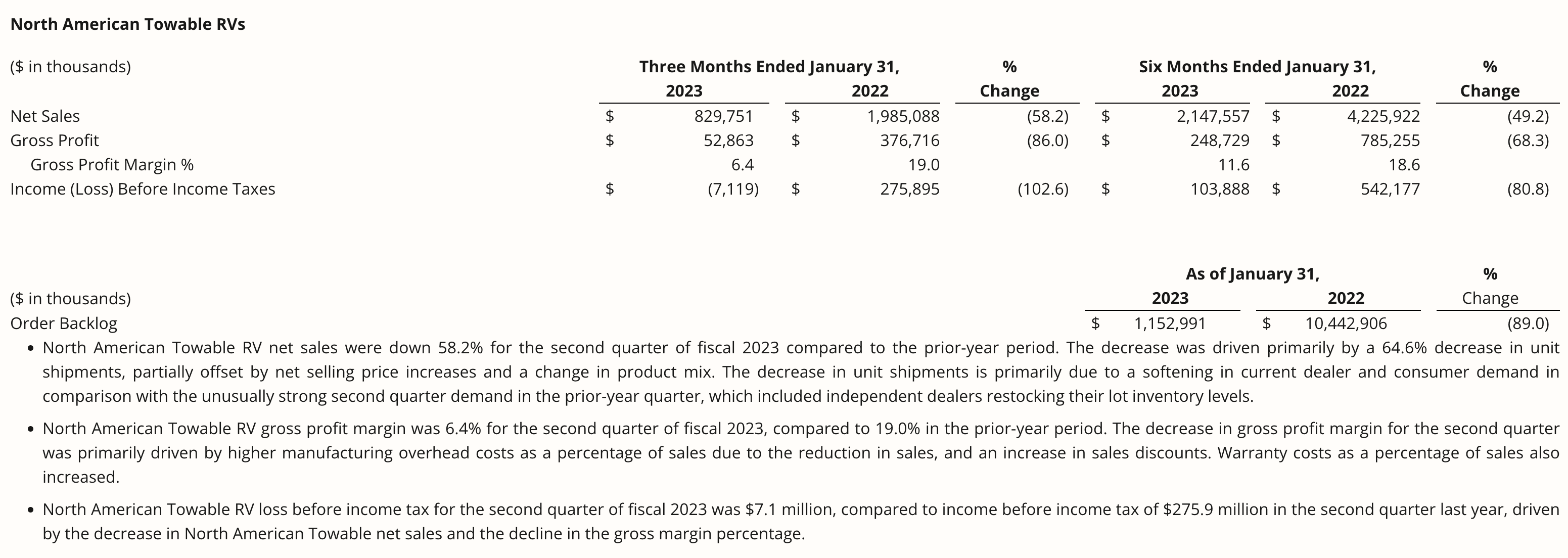

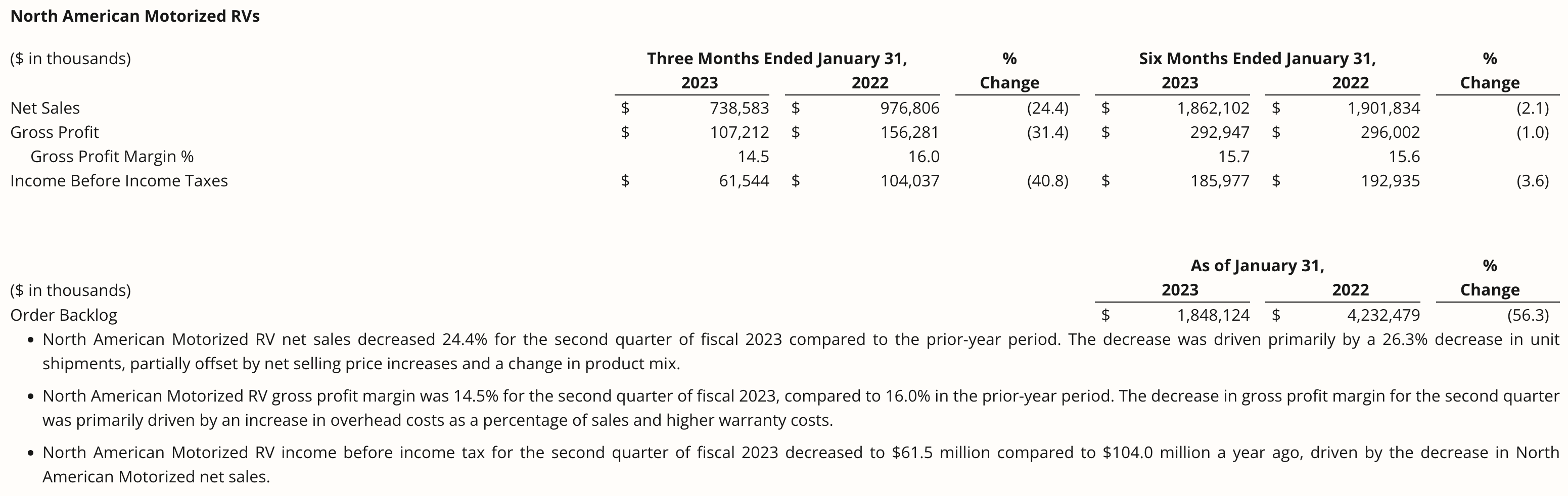

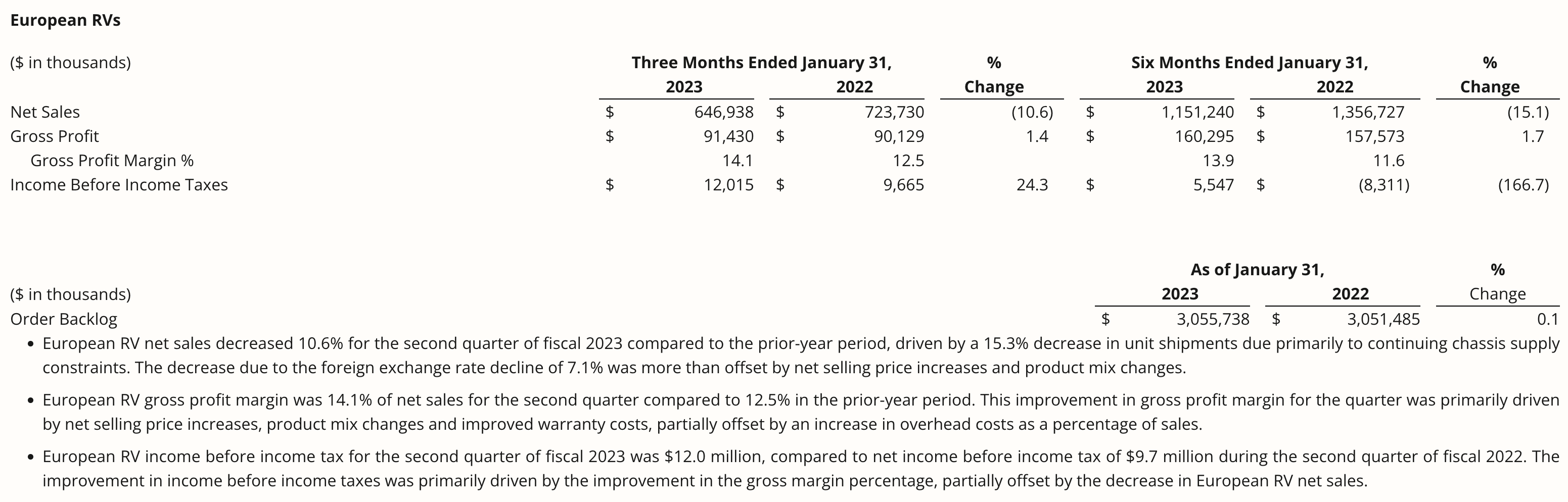

Our consolidated results were driven by the results of our individual segments as noted below.

Segment Results

Todd Woelfer

Management Commentary

“Our proven variable cost model and solid through-cycle execution allowed us to generate positive results despite net sales decreasing 39% on a 52% reduction in unit shipments compared to the record prior-year period. We remained committed to our disciplined approach to operations that prioritizes profitability while maintaining market-leading positions across each of THOR’s product categories. This commitment, combined with solid execution across each of our business segments, positions THOR to be a more financially resilient company and to deliver profitability that exceeds previous down-cycle periods,” said Todd Woelfer, senior vice president and chief operating officer.

“In North America, through reduced production rates and extended holiday shutdowns, our teams successfully balanced wholesale shipments with retail demand in the second quarter despite the significant retail pullback, keeping dealer inventory levels essentially flat compared to Oct. 31, 2022 levels,” he continued. “Our production discipline continues to be greatly valued among our dealer partners as we work to protect the long-term interests, and profitability, of our customers. In addition, we undertook strategic pricing actions in the quarter aimed at moving finished goods inventory related to calendar 2022 production of certain towable models, and we enacted strong cost controls under our variable cost model.

“In Europe, we sequentially increased motorized production volumes, aided by the improving chassis availability. We remain encouraged by the improvement in chassis deliveries and we expect to further ramp up production of motorized units in the second half of fiscal 2023 as we look to replenish dealer inventory levels to more normalized levels,” said Woelfer.

Colleen Zuhl

“We also remain focused on maintaining a strong balance sheet,” said Colleen Zuhl, senior vice president and chief financial officer. “We ended our fiscal second quarter with total liquidity of $1.2 billion, including cash and cash equivalents totaling $281.6 million and approximately $915.0 million of availability under our ABL. Net cash provided by operating activities for the first half of fiscal 2023 totaled $185.3 million, including $91.3 million provided in the challenging second quarter, and was deployed in a balanced manner. During the quarter, cash generated from operations was of a similar level to that generated during our stronger first quarter, further manifesting the Company’s ability to execute in a challenging market.

“Year-to-date capital deployment included $101.0 million of capital expenditures, $48.2 million of dividend payments, $27.4 million of overall debt reduction and $25.4 million of share repurchases,” she continued. “Subsequent to the end of the fiscal second quarter, we further paid down $15.0 million on our U.S. Term Loan B and $15.0 million on our ABL, demonstrating our commitment to maintaining a strong balance sheet despite the softer quarter. Looking forward, given the historical seasonality of our cash flow and expected reductions of net working capital, we expect to generate strong net cash flow from operations in the second half of fiscal 2023, which will allow us to maintain our balanced capital allocation strategy focused on enhancing long-term shareholder value.”

Outlook

“While macroeconomic uncertainties continue to exist in the segments and geographies we serve, we have high confidence in our operating teams, flexible business model and execution strategy. Our first half of fiscal 2023 performance reinforces our discipline to remain focused on what we can control. Looking ahead to the second half of fiscal 2023, we intend to maintain that same discipline to navigate this challenging near-term environment while positioning THOR to be an even stronger company when the market recovers,” added Martin.

Fiscal 2023 Guidance

While positive sentiment and strong underlying interest for the RV lifestyle remain undeterred, we expect near-term demand will continue to be influenced by current macroeconomic conditions. Given the impact of the softer market during our second quarter and our expectation that macroeconomic pressures will persist through the balance of our fiscal year, we are revising our full-year guidance. Our revised guidance anticipates that higher interest rates, elevated prices, and a full North American dealer inventory will result in slower product pull through for the balance of our fiscal year. Nevertheless, our teams have consistently responded to dynamic market conditions as we aim to optimize our business to expected demand conditions. Our teams are executing at a high level, and we are well-positioned to deliver on our revised fiscal 2023 outlook.

For fiscal 2023, the company’s updated full-year guidance now includes:

- Consolidated net sales in the range of $10.5 billion to $11.5 billion (previously $11.5 billion to $12.5 billion)

- Consolidated gross profit margin in the range of 13.4% to 14.2% (previously 14.2% to 14.9%)

- Diluted earnings per share in the range of $5.50 to $6.50 (previously $7.40 to $8.70)

Supplemental Earnings Release Materials

THOR Industries has provided a comprehensive question and answer document, as well as a PowerPoint presentation, relating to its quarterly results and other topics.

To view these materials, go to http://ir.thorindustries.com.

Source: https://rvbusiness.com/thor-industries-reports-2-35b-in-net-sales-for-q2-fiscal-2023/