How Tariffs Could Impact the RV Industry

President Trump’s decision to implement tariffs on Mexico, Canada, and China has dominated the news cycle in recent days, bringing a lot of fear, uncertainty, and doubt along with it. Some of that concern comes from a fundamental lack of understanding of what tariffs are and the impact they can have on the economy, especially should a broader trade war break out between the US and its allies and adversaries alike. So what do these tariffs mean for the country as a whole and the RV industry more specifically? Read on to find out.

Photo Credit: welcomia/Getty

What is a Tariff?

In the simplest of terms, a tariff is a tax placed on goods being imported into a country. Often, they are implemented as a means to raise funds for the government of the nation levying the tax or as a way to protect domestic manufacturers and merchants from foreign competitors. And contrary to popular belief, the exporting country does not end up paying the increased price. Typically, a tariff results in the cost of goods going up, with the increase usually getting passed along to consumers.

In other words, if a 25% tax is levied on a product that costs $10, the price of that product increases by $2.50. More often than not, that means those goods will now sell for $12.50, although some manufacturers may find creative ways to keep costs down to try to minimize the impact on customers. The government collecting the tariff may also elect to exempt some goods from the taxes, allowing them to continue being sold at their original price.

In case you dozed off during your history classes back in junior high and high school, tariffs are not new. They’ve been around for centuries and have always been a way to generate revenue and/or punish other nations for trade inequalities between countries. Imposing tariffs almost always results in reciprocal taxes being levied by the other country, often leading to an increasingly escalating trade war that pushes prices up, weakens the economy, and results in unemployment, inflation, and scarcity of goods.

Low-level tariffs are a fact of life, with almost every country in the world imposing minor fees on imported goods. But in an age when global economies are more interdependent than ever before, high import taxes have largely fallen out of favor. That’s because implementing them usually results in as much harm at home as it does abroad. To the point that most modern politicians don’t usually consider using them as an actual tactic to achieve their economic policy goals.

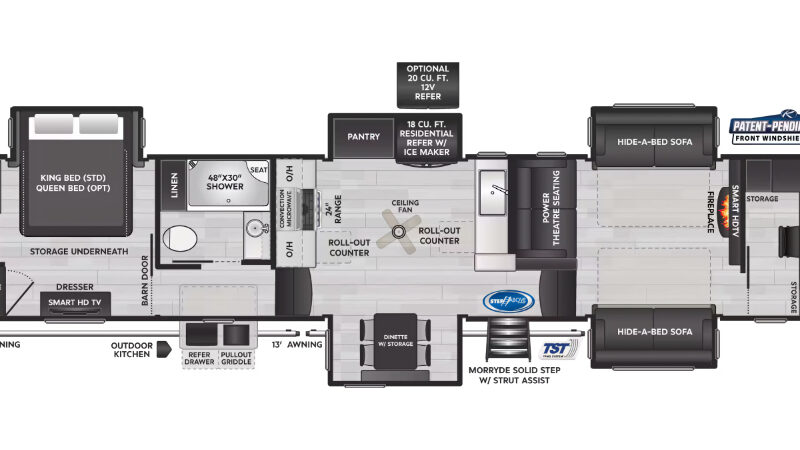

Photo Credit: Camping World/Keystone

Why is President Trump Implementing Tariffs?

If high tariffs are generally bad for the economy, why is President Trump implementing them? That’s a good question, because most economists agree that they are a bad idea. But the president sees tariffs as a way to pressure Canada, Mexico, and China into complying with his policy goals. For instance, Trump is using these import taxes as economic leverage to get Canada and Mexico to beef up security along their shared borders with the US. The hope is to cut down on illegal migrants crossing into the country, while also minimizing the inflow of illicit drugs and the outflow of illegal guns.

President Trump also hopes to use tariffs as a way to force some companies to bring manufacturing back to the US, including automakers, computer chip manufacturers, industrial goods, and more. That process can take years to accomplish, if it is even possible at all. With major manufacturing having moved largely abroad across a number of major industries, rebuilding factories and retraining labor is a challenging and expensive prospect. Even if the tariffs do convince some companies to resume manufacturing domestically, it’ll likely take years before that becomes a reality.

Photo Credit: Lucy Hewett

How Will Tariffs Impact the RV Industry?

America’s RV industry remains a vibrant and important part of the economy, with most of the manufacturing taking place right here in the US. That should help protect it against these tariffs to a degree, but not completely. Remember above when we mentioned an increasingly interdependent international economy? That extends to RV manufacturers, too. And while most of them do build their rigs in the country, they also import parts that are made in other parts of the world—most notably Canada, Mexico, and China. If those parts are hit with tariffs, it could cause prices to go up, resulting in higher sticker prices for RVs, too. Remember, these increased costs almost always get passed on to consumers.

Keep in mind, there are some RV manufacturers—like Northern Lite, Pleasure Way, and Leisure Travel Vans—who are based in Canada. Pricing for those models being shipped to the US could go up dramatically based on the imposed tariffs. The same could happen for US manufacturers shipping their vehicles to Canada and Mexico, should those nations implement retaliatory tariffs of their own. Increased import taxes could result in a 10%-25% increase in prices depending on how the situation plays out in the coming weeks.

As noted above, high tariffs can have a dramatic impact on the economy resulting in higher prices, stagnating growth, layoffs, and other issues. Those challenges could definitely leak into the RV industry, which often faces headwinds when the overall economy slows down. That could lead to a loss of jobs, temporary plant closures, reduced manufacturing, reduced inventories, and other difficulties. Considering the industry is just now getting back on its feet post-COVID, most manufacturers and dealerships would prefer to not have more barriers to their success put into place.

RVing In The Mountains In Class C Motorhome Landscape At Sunset in Jasper, AB, Canada

Tariffs Delayed

After announcing new tariffs for Mexico, Canada, and China going into effect on February 1, 2025, it does appear that some of those new regulations have been temporarily averted. President Trump had phone conversations with Canadian Prime Minister Justin Trudeau and Mexican President Claudia Sheinbaum that resulted in those leaders coming to an understanding on shared goals. This led to the tariffs on both countries—as well as their reciprocating tariffs—being postponed for 30 days. This has helped reduce tensions between the nations and has had a stabilizing effect on world markets that were in disarray over fears of a prolonged global trade war.

The downside is, the threat of tariffs still looms. President Trump continues to use them as a weapon against neighboring countries and allies—he says he’ll impose them on the European Union, too—as a way to force them to comply with his policies. But what happens if they can no longer appease those demands? There is a real possibility that the tariffs will still go into place, disrupting trade and sending ripples across the world’s economy. This is especially true in regards to returning manufacturing to the US and closing trade gaps between the countries. Those are issues that won’t easily be solved in the near term, if at all.

It should also be noted that the new 10% tariffs against China continue to be in effect and have resulted in a 10%-15% increase in taxes on US crude oil, liquid natural gas, coal, cars, and other goods. Those are likely to have an impact on the US economy in the weeks ahead, unless they can be renegotiated in a timely fashion, as well. And with the potential for more tariffs against other countries looming on the horizon, there will still be some challenging days on the horizon.

Photo Credit: Cavan Images/Getty

Cautiously Optimistic

For now, it is safe to say the RV industry is taking a cautiously optimistic stance on the impact of tariffs. The 30-day delay provides hope that trade disputes can be managed and overcome, keeping the flow of goods between the US, Canada, and Mexico moving. It is in everyone’s best interest that the three nations cooperate with one another, and hopefully that will continue to be the case in March when the tariff discussion will likely resume.

This is a hot-button issue at the moment, with the situation changing quickly. We’ll continue to update this story with further developments as things are warranted. Stay tuned.

The post How Tariffs Could Impact the RV Industry appeared first on RV.com.

Source: https://www.rv.com/rv/how-tariffs-could-impact-the-rv-industry/