Camping World Reports Q3 2023 Financial Performance – RVBusiness – Breaking RV Industry News

LINCOLNSHIRE, Ill. – Camping World Holdings, Inc. (NYSE: CWH), America’s Recreation Dealer, today reported results for the third quarter ended Sept. 30, 2023.

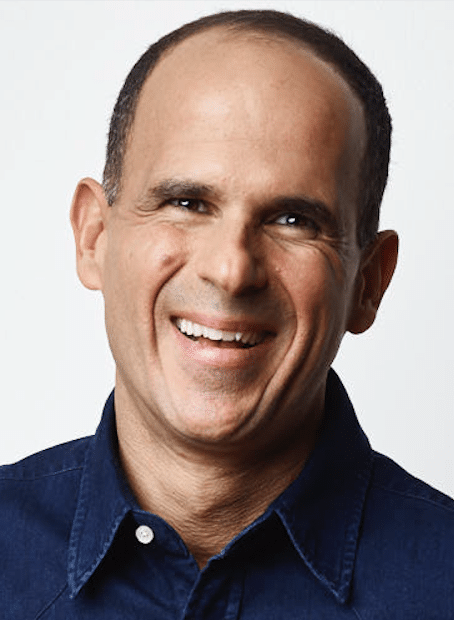

Marcus Lemonis

Marcus Lemonis, Chairman and Chief Executive Officer of Camping World Holdings, Inc. stated, “We are laser focused on the final stages of cleansing our inventory going into 2024. These actions have come with near-term gross margin compression, but we believe now is the moment to put the finishing touches on our industry-leading inventory position and prepare the business for the next up-cycle. In 2024, we expect total company revenue, same store unit sales, total gross margin, and earnings to increase year over year.”

Third Quarter-over-Quarter Operating Highlights

- Revenue was $1.7 billion for the third quarter, a decrease of $126.1 million, or 6.8%.

- Used vehicle revenue was a record $590.2 million for the third quarter, an increase of $64.2 million, or 12.2%, and used vehicle unit sales were a record 17,125 units, an increase of 2,665 units, or 18.4%.

- New vehicle revenue was $679.2 million for the third quarter, a decline of $154.9 million, or 18.6%, and new vehicle unit sales were 15,205 units, a decrease of 2,411 units, or 13.7%.

- Average selling price of new and used vehicles declined 5.7% and 5.2%, respectively, during the third quarter. As the procurement prices of model year 2024 new vehicles declined compared to model years 2022 and 2023, the Company actively discounted certain used vehicles during the third quarter to reduce inventory levels of aged used vehicles.

- Products, service and other revenue was $235.6 million for the third quarter, a decline of $33.3 million, or 12.4%. The decrease was driven largely by lower demand and lower stocking levels of lifestyle, activities, design, and home products, as well as declines in our direct to manufacturer RV furniture revenues due to RV manufacturer production slowdowns and discounting related to our Active Sports Restructuring.

- Same store used vehicle unit sales increased 10.9% for the third quarter, and same store new vehicle unit sales decreased 21.5%.

- Gross profit was $523.1 million, a decrease of $70.6 million, or 11.9%. Total gross margin was 30.2%, a decrease of 175 basis points. The decrease in gross profit and gross margin was driven largely by the decrease in average selling price of new and used vehicles discussed above. The decrease in finance and insurance, net gross profit was partially offset by improved retention on finance and insurance products, which drove favorable adjustments to reserves in the third quarter of 2023. Good Sam Services and Plans gross profit and gross margin was favorably impacted by finalizing contract negotiations to exit an arrangement with a service partner in the quarter.

- Selling, general and administrative expenses were $415.3 million, a decrease of $3.8 million, or 0.9%, primarily as a result of our efforts to reduce expenses. In the quarter, the company closed two underperforming retail stores and one distribution center, whose leases were successfully terminated. These cost reductions were partially offset by additional employee compensation and facility costs resulting from the 8.3% increase in store location count to 209 at September 30, 2023 from 193 at September 30, 2022.

- Subsequent to Sept. 30, 2023, the company made the decision to consolidate or close seven underperforming dealership locations in order to redeploy working capital to higher returning investments.

- Floor plan interest expense was $19.8 million, an increase of $10.3 million, or 108.9%, and other interest expense, net was $35.2 million, an increase of $14.7 million, or 71.7%. These increases were primarily as a result of the rise in interest rates.

- Net income was $30.9 million, a decrease of $72.1 million, or 70.0%, driven primarily by the pretax $71.7 million decrease in new and used vehicle gross profit, the $14.7 million increase in other interest expense, net, and the $10.3 million increase in floor plan interest, which was partially offset by the $3.8 million decrease in selling, general, and administrative expenses and lower income tax expense from net reductions of pretax income.

- Diluted earnings per share of Class A common stock was $0.32 in 2023 versus diluted earnings per share of Class A common stock of $0.97 in 2022. Adjusted earnings per share – diluted of Class A common stock was $0.39 in 2023 versus adjusted earnings per share – diluted of Class A common stock of $1.07 in 2022.

- Adjusted EBITDA was $95.0 million, a decrease of $78.4 million, or 45.2%, driven primarily by the $71.7 million decrease in new and used vehicle gross profit and the $10.3 million increase in floor plan interest, which was partially offset by the $3.8 million decrease in selling, general, and administrative expenses.

Earnings Conference Call and Webcast Information

A conference call to discuss the company’s third quarter 2023 financial results is scheduled for Nov. 2, 2023, at 7:30 am Central Time. Investors and analysts can participate on the conference call by dialing 1-877-407-9039 (international callers please dial 1-201-689-8470) and using conference ID# 13741006. Interested parties can also listen to a live webcast or replay of the conference call by logging on to the Investor Relations section on the company’s website at http://investor.campingworld.com. The replay of the conference call webcast will be available on the investor relations website for approximately 90 days.

About Camping World Holdings Inc.

Camping World Holdings, Inc., headquartered in Lincolnshire, Ill., (together with its subsidiaries) is America’s largest retailer of RVs and related products and services. Our vision is to build a long-term legacy business that makes RVing fun and easy, and our Camping World and Good Sam brands have been serving RV consumers since 1966. We strive to build long-term value for our customers, employees, and shareholders by combining a unique and comprehensive assortment of RV products and services with a national network of RV dealerships, service centers and customer support centers along with the industry’s most extensive online presence and a highly trained and knowledgeable team of associates serving our customers, the RV lifestyle, and the communities in which we operate. We also believe that our Good Sam organization and family of programs and services uniquely enable us to connect with our customers as stewards of the RV enthusiast community and the RV lifestyle. With RV sales and service locations in 43 states, Camping World has grown to become the prime destination for everything RV.

For more information, visit www.CampingWorld.com.

Source: https://rvbusiness.com/camping-world-reports-q3-2023-financial-performance/