Economic Activity in Services Sector Contracted in May – RVBusiness – Breaking RV Industry News

TEMPE, Ariz. — Economic activity in the services sector contracted in May, the first time since June 2024, say the nation’s purchasing and supply executives in the latest Services ISM Report On Business, a report by the Institute for Supply Management (ISM). The Services PMI indicated slight contraction at 49.9%, below the 50% breakeven point for only the fourth time in 60 months since recovery from the coronavirus pandemic-induced recession began in June 2020.

“In May, the Services PMI registered 49.9%, 1.7 percentage points lower than the April figure of 51.6%,” stated Steve Miller, CPSM, CSCP, chair of the ISM Services Business Survey Committee. “The Business Activity Index was ‘unchanged’ in May, registering 50%, 3.7 percentage points lower than the 53.7% recorded in April. This is the index’s first month out of expansion territory since May 2020. The New Orders Index dropped into contraction territory in May, recording a reading of 46.4%, a decrease of 5.9 percentage points from the April figure of 52.3%. The Employment Index returned to expansion after two months in contraction; the reading of 50.7% is 1.7 percentage points higher than the 49% recorded in April and is the second straight month-over-month gain.

The Supplier Deliveries Index registered 52.5%, 1.2 percentage points higher than the 51.3% recorded in April, the release continued. This is the sixth consecutive month that the index has been in expansion territory, indicating slower supplier delivery performance. (Supplier Deliveries is the only ISM Report On Business index that is inversed; a reading of above 50% indicates slower deliveries, which is typical as the economy improves and customer demand increases.)

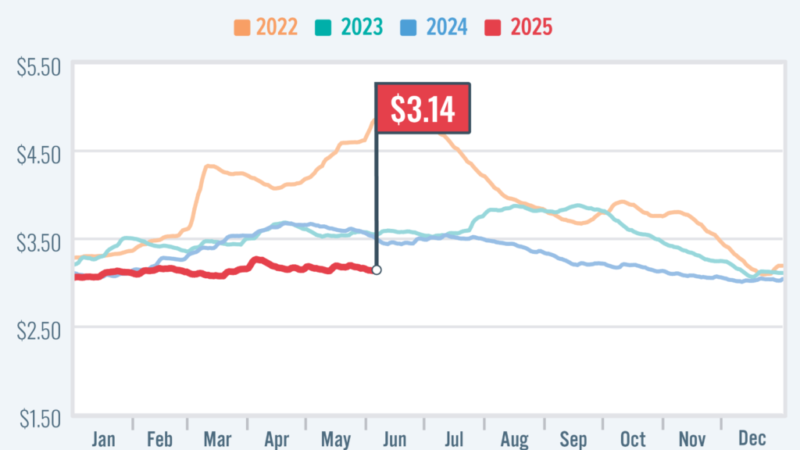

The Prices Index registered 68.7% in May, a 3.6-percentage point increase from April’s reading of 65.1%; the index has elevated 7.8 percentage points in the last two months to reach its highest level since November 2022 (69.4%). This is the first time the index has recorded this high of a two-month increase since a 9.2-percentage point gain in February and March 2021. The May reading is also its sixth in a row above 60%.

The Inventories Index returned to contraction territory in May, registering 49.7%, a decrease of 3.7 percentage points from April’s figure of 53.4%. This is the second time the index has contracted in 2025. The Inventory Sentiment Index expanded for the 25th consecutive month, registering 62.9%, up 6.8 percentage points from April’s figure of 56.1% and its highest reading since July 2024 (63.2%). The Backlog of Orders Index registered 43.4% in May, a 4.6-percentage point decrease from the April figure of 48%, indicating contraction for the ninth time in the last 10 months and its lowest reading since August 2023 (41.8%).

Ten industries reported growth in May, down one from the 11 industries reported in April. The Services PMI has contracted in only four of the last 60 months dating back to June 2020. The May reading of 49.9% is 2.4 percentage points below the 12-month average reading of 52.3%.

“May’s PMI level is not indicative of a severe contraction, but rather uncertainty that is being expressed broadly among ISM Services Business Survey panelists,” Miller continued. “The average reading of 50.8 % over the last three months still indicates expansion in that time period, but it is a notable shift of 2 percentage points below its average of 52.8% over the previous nine months. The New Orders Index moved into contraction territory for the first time in nearly a year. Tariff impacts are likely elevating prices paid by services sector companies, with the Prices Index hitting its highest level since November 2022, when the Bureau of Labor Statistics’ CPI indicated that prices had increased 7.1 percent as compared to November 2021. Respondents continued to report difficulty in forecasting and planning due to longer-term tariff uncertainty and frequently cited efforts to delay or minimize ordering until impacts become clearer.”

What respondents are saying

“Business activity is increasing due to demand for data centers, commercial growth and infrastructure. Residential growth remains flat.” [Utilities]

“Tariff variability has thrown residential construction supply chains into chaos. Many items are still manufactured in southeast Asia, and suppliers are beginning to test the waters for increases. Major heating, ventilation and air conditioning equipment manufacturers are passing on their cost increases due to higher refrigerant and steel commodity prices. Planning is difficult for community projects that could be scheduled for the next 22 to 30 months.” [Construction]

“Steady, with some signs of growth and opportunity.” [Finance & Insurance]

“Federal budget cuts are affecting purchasing decisions.” [Health Care & Social Assistance]

“Tariffs remain a challenge, as it is not clear what duties apply. The best plan is still to delay decisions to purchase where possible.” [Information]

“Due to the tariffs, we’ve had had small price increases on our international raw materials, and some suppliers are holding back inventory to cover uncertainties. We’ve seen some slowdown in the production of new wells, but there has been an increase in restimulation of existing wells.” [Mining]

“Life science startups continue to push forward on clinical trials and market launches. The level of investment grew this month. The impacts of tariffs are being watched but are not driving changes in strategic plans.” [Professional, Scientific & Technical Services]

“The projects are slowly starting to be issued, albeit with a great deal of market uncertainty.” [Public Administration]

“Business is strong. Consumer concerns over tariffs may be driving some demand.” [Retail Trade]

“Tariffs have increased the cost of doing business. It’s too early to tell what the lasting impact of this will be. We have tried to budget for the increase, but it has been a moving target. Overall, we are seeing a leveling off in business activity; time will tell if this is temporary or long lasting.” [Transportation & Warehousing]